Narratives are currently in beta

Key Takeaways

- The acquisition and exclusive site-building agreement with Millicom are key to increased scale and substantial revenue enhancement in Central America.

- Strategic refinancing affords capital flexibility, enabling impactful strategic investments that improve earnings and cash flow stability.

- International market challenges, increased competition, and dependence on 5G upgrades pose risks to revenue stability and earnings forecasts for SBA Communications.

Catalysts

About SBA Communications- A leading independent owner and operator of wireless communications infrastructure including towers, buildings, rooftops, distributed antenna systems (DAS) and small cells.

- Increased domestic carrier activity, with a shift towards new lease colocation rather than amendments to existing leases, suggests potential for future revenue growth as domestic network demand rises.

- The acquisition of over 7,000 sites from Millicom International in Central America is expected to increase scale, enhance customer relationships, and generate significant site leasing revenue, influencing overall earnings positively.

- The exclusive agreement to build up to 2,500 new sites for Millicom could significantly bolster future revenue streams and expand SBA's asset base over the next 7 years.

- International growth prospects are promising with expected 5G upgrades and increasing wireless broadband consumption, which could lead to organic revenue and earnings growth in international markets.

- Strategic refinancing and balance sheet management efforts, including favorable interest rate swaps, provide capital flexibility for strategic investments like Millicom acquisition, which can positively impact earnings and cash flow stability.

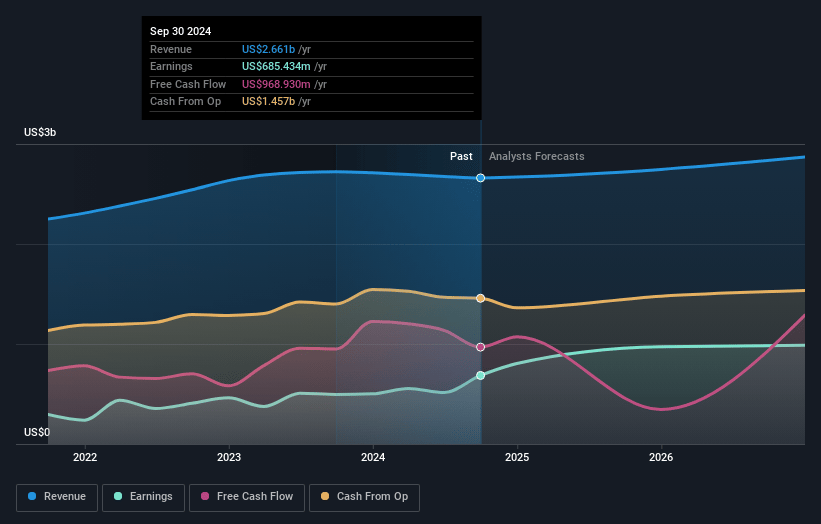

SBA Communications Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming SBA Communications's revenue will grow by 5.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 25.8% today to 34.3% in 3 years time.

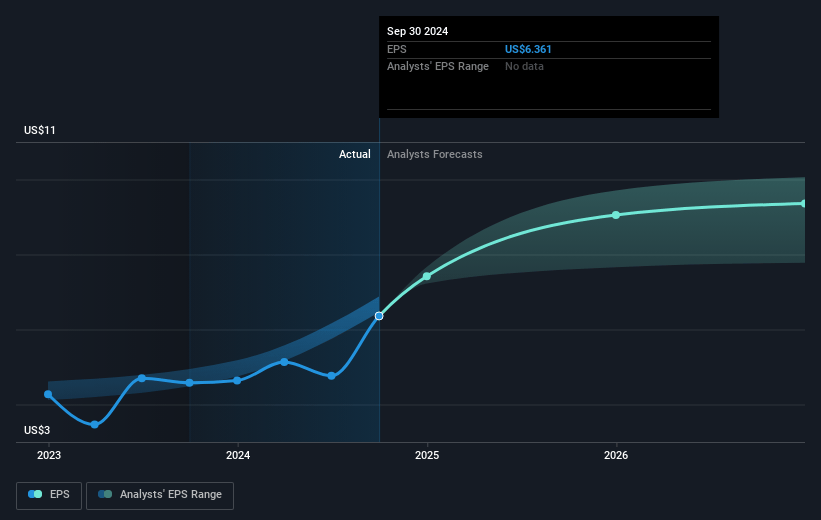

- Analysts expect earnings to reach $1.1 billion (and earnings per share of $10.11) by about December 2027, up from $685.4 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $847.2 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 30.9x on those 2027 earnings, down from 31.8x today. This future PE is greater than the current PE for the US Specialized REITs industry at 24.8x.

- Analysts expect the number of shares outstanding to decline by 0.63% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.72%, as per the Simply Wall St company report.

SBA Communications Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- There are challenges in navigating customer consolidations and network rationalizations internationally, which could affect revenue stability.

- Increased competition and the presence of over 30 independent tower companies in markets like the Philippines could hinder market share growth and revenue potential.

- The large number of independent tower companies and sub-1% market share in markets like the Philippines suggest potential overvaluation risks, which could impact earnings.

- The reliance on ongoing 5G upgrades and incremental equipment deployment for future leasing revenue involves market timing and execution risks, potentially affecting future revenue streams.

- The anticipated impacts of foreign currency fluctuations and potential international market entry or exit decisions may bring uncertainties in revenue and earnings forecasts.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $258.12 for SBA Communications based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $300.0, and the most bearish reporting a price target of just $225.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $3.1 billion, earnings will come to $1.1 billion, and it would be trading on a PE ratio of 30.9x, assuming you use a discount rate of 6.7%.

- Given the current share price of $202.56, the analyst's price target of $258.12 is 21.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives