Key Takeaways

- Expansion through active development and redevelopment initiatives drives significant earnings growth with high-quality retail spaces and attractive yields.

- Strong leasing activity and capital allocation strategies enhance shareholder value and sustain revenue growth with robust tenant demand and disciplined financial management.

- Reliance on tenant demand and development projects introduces risks, while competition and market uncertainties could affect revenue and earnings.

Catalysts

About Regency Centers- Regency Centers is a preeminent national owner, operator, and developer of shopping centers located in suburban trade areas with compelling demographics.

- Regency Centers is actively expanding its development pipeline, with close to $500 million of projects in process and a successful shadow pipeline for future growth, expected to drive significant future earnings growth due to high demand and limited supply of high-quality retail spaces. This will positively impact revenues and earnings.

- Strong leasing activity, with record high leased rates and rent spreads, indicate robust tenant demand, leading to potential further increases in base rent and same-property NOI, directly boosting future revenue and earnings.

- The company’s strategic focus on redevelopment and ground-up development projects with attractive yields, exceeding 10%, provides a clear path for accretive growth, enhancing margins and long-term earnings potential.

- Minimal new supply in the retail sector positions Regency to capitalize on higher rental rates and improved occupancy, thus supporting sustained revenue and NOI growth in the long term.

- Regency’s disciplined capital allocation, including opportunistic acquisitions and share repurchases, financed by a strong balance sheet, allows the company to enhance shareholder value, drive EPS growth, and maintain its liquidity position.

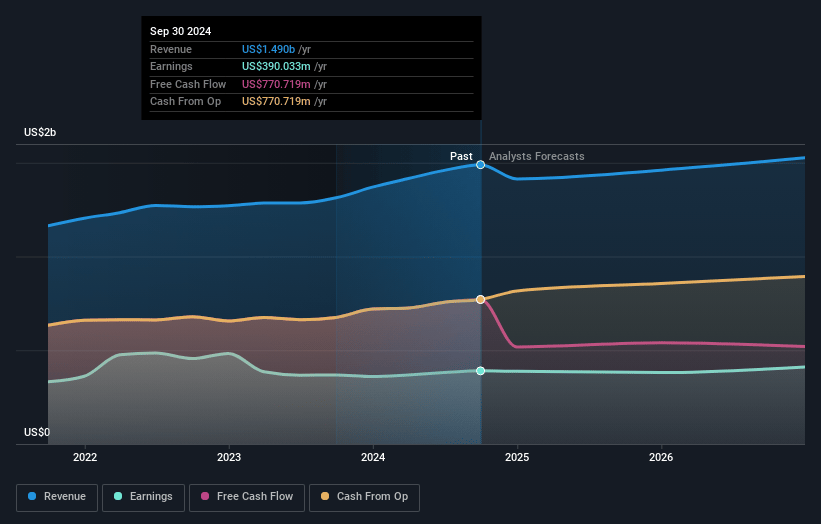

Regency Centers Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Regency Centers's revenue will grow by 1.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 25.7% today to 31.4% in 3 years time.

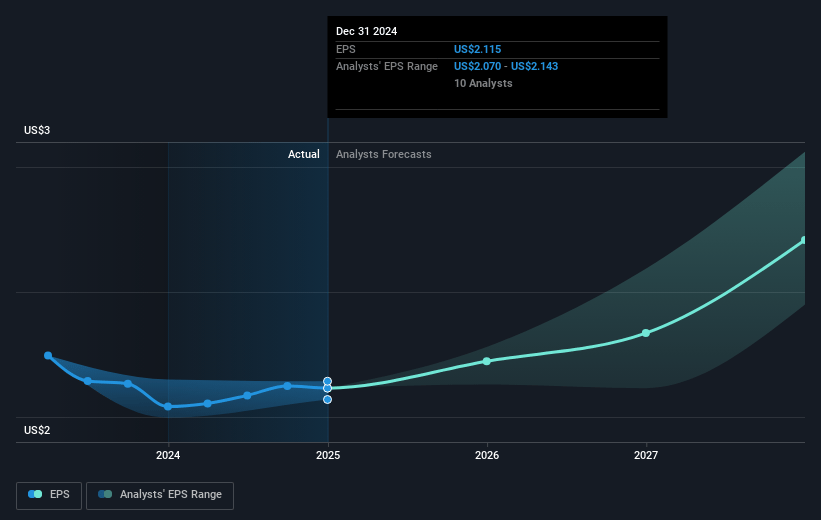

- Analysts expect earnings to reach $499.7 million (and earnings per share of $2.71) by about March 2028, up from $386.7 million today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as $560.6 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 34.2x on those 2028 earnings, up from 33.4x today. This future PE is greater than the current PE for the US Retail REITs industry at 32.4x.

- Analysts expect the number of shares outstanding to decline by 1.87% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.71%, as per the Simply Wall St company report.

Regency Centers Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Regency Centers' forward-looking statements are subject to risks and uncertainties, including market conditions that could differ materially from expectations, potentially impacting future revenue and earnings.

- The financial performance heavily relies on strong tenant demand and base rent growth; any slowdown in consumer spending or retail bankruptcies could adversely affect revenue and same-property NOI.

- Credit loss forecasts remain a potential concern, particularly with recent retail bankruptcies, which could affect net margins if tenant credit risk materializes.

- While development and redevelopment activities are expected to provide growth, reliance on hitting target starts and completions introduces execution risk, which could impact earnings if not managed effectively.

- The increasing competition within the grocery-anchored retail space, coupled with rate uncertainties, could compress yield spreads on developments and acquisitions, impacting future revenue and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $79.895 for Regency Centers based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.6 billion, earnings will come to $499.7 million, and it would be trading on a PE ratio of 34.2x, assuming you use a discount rate of 7.7%.

- Given the current share price of $71.42, the analyst price target of $79.89 is 10.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.