Narratives are currently in beta

Key Takeaways

- Expansion of the Waldo sawmill and improvements in lumber prices are set to boost the Wood Products segment's revenue and earnings potential.

- Real Estate and Natural Climate Solutions initiatives aim to drive steady revenues and long-term earnings, with share repurchases enhancing EPS.

- Weak lumber pricing, cautious buyer sentiment, and market challenges threaten PotlatchDeltic's financial stability, potentially impacting margins, revenues, and future earnings.

Catalysts

About PotlatchDeltic- PotlatchDeltic Corporation (Nasdaq: PCH) is a leading Real Estate Investment Trust (REIT) that owns nearly 2.2 million acres of timberlands in Alabama, Arkansas, Georgia, Idaho, Louisiana, Mississippi and South Carolina.

- The modernization and expansion of the Waldo sawmill is expected to increase capacity by 85 million board feet, improve recovery rates by approximately 6%, and decrease processing costs by about 30%, leading to an estimated $25 million in incremental EBITDA annually, positively impacting earnings.

- Improvements in lumber prices due to capacity curtailments and a more balanced supply/demand dynamic are anticipated to benefit the Wood Products segment, which should enhance revenue potential.

- The Real Estate segment's focus on selling rural land at significant premiums and the strong demand for properties are expected to drive steady revenues, positively impacting net margins.

- Natural Climate Solutions initiatives, especially solar agreements covering over 35,000 acres with a net present value exceeding $400 million, present potential for future revenue streams and enhance long-term earnings.

- Capital allocation strategy focused on share repurchases with $90 million remaining under the buyback program is expected to enhance earnings per share (EPS) as the stock is deemed undervalued compared to net asset value.

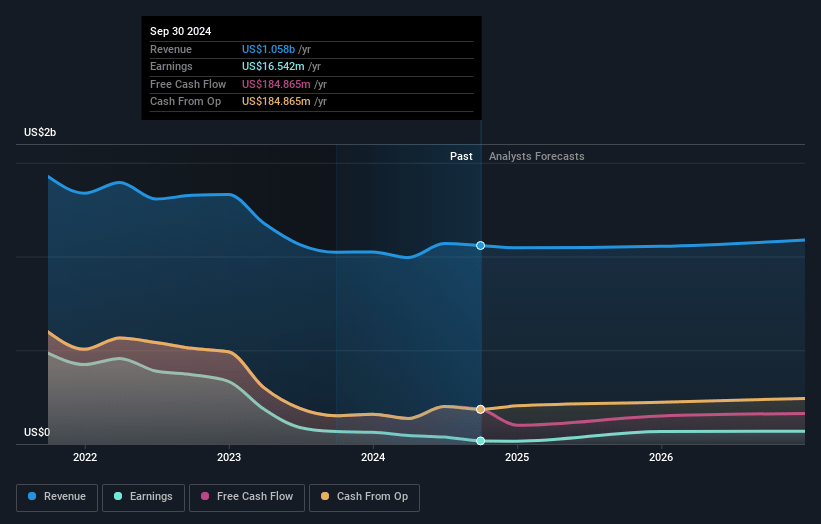

PotlatchDeltic Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming PotlatchDeltic's revenue will decrease by -1.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.1% today to 8.1% in 3 years time.

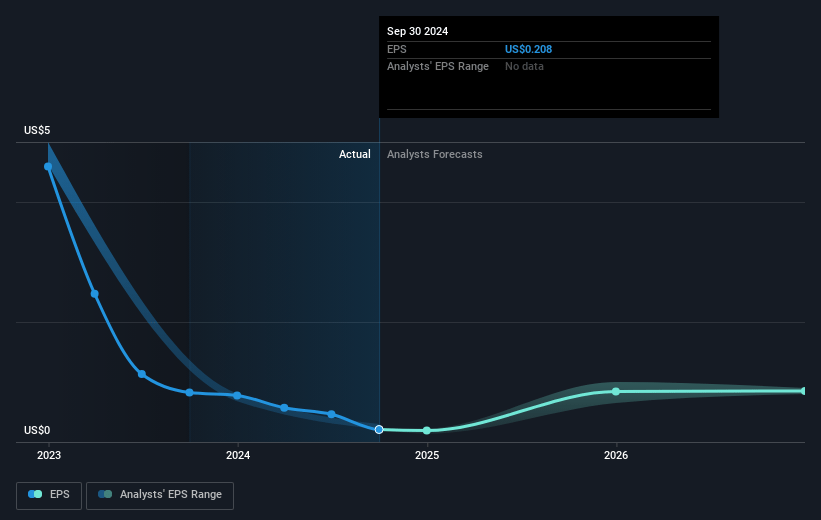

- Analysts expect earnings to reach $83.2 million (and earnings per share of $1.05) by about January 2028, up from $21.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 56.8x on those 2028 earnings, down from 152.9x today. This future PE is greater than the current PE for the US Specialized REITs industry at 25.3x.

- Analysts expect the number of shares outstanding to grow by 0.23% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.28%, as per the Simply Wall St company report.

PotlatchDeltic Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Weak lumber pricing and cautious buyer sentiment in the Wood Products segment have led to financial losses, which could continue to impact net margins if prices don't stabilize or improve significantly.

- A challenging interest rate environment continues to depress the housing market and construction activity, which could limit future revenues from lumber sales.

- The planned variability in harvest volumes and recent land sales can reduce Timberland revenue and potentially decrease earnings.

- Delays and uncertainties in project developments, particularly in Natural Climate Solutions like forest carbon offsets and CCS, pose risks to future financial contributions from these initiatives.

- Fluctuations in log costs and the potential impact of changes in Canadian lumber duties or tariffs could create uncertainty in raw material costs, affecting profit margins in the Wood Products business.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $49.86 for PotlatchDeltic based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $55.0, and the most bearish reporting a price target of just $44.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.0 billion, earnings will come to $83.2 million, and it would be trading on a PE ratio of 56.8x, assuming you use a discount rate of 6.3%.

- Given the current share price of $42.51, the analyst's price target of $49.86 is 14.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives