Narratives are currently in beta

Key Takeaways

- Investments in hurricane resiliency and transformational renovations aim to improve net margins and future revenue growth through reduced repair costs and higher rates.

- A focus on group bookings, diversified revenue streams, and share repurchases indicates potential revenue growth, financial stability, and increased shareholder value.

- Natural disasters and rising expenses, coupled with reliance on leisure bookings, could pressure Host Hotels' revenue, margins, and strategic flexibility amid market uncertainties.

Catalysts

About Host Hotels & Resorts- An S&P 500 company and is the largest lodging real estate investment trust and one of the largest owners of luxury and upper-upscale hotels.

- Host Hotels & Resorts is prioritizing investments in hurricane resiliency measures, such as at The Ritz-Carlton Naples, which minimized disruption and allowed for a fast reopening. This could lead to reduced future repair costs, maintaining stable revenue streams after weather events, thereby potentially improving net margins.

- The company's strong focus on group business is highlighted with a 5% increase in group revenue pace for 2024 compared to the previous year. This suggests potential revenue growth and increased stability due to the inherently more predictable and higher-margin nature of group bookings.

- Host Hotels & Resorts is leveraging significant out-of-room spending trends, with total RevPAR growth outpacing traditional RevPAR growth. This focus on diversified revenue sources, including food, beverage, and other offerings, could bolster overall revenue and improve net margins by capturing more affluent consumer spending.

- The ongoing investments in transformational renovations are showing strong RevPAR index share gains, exceeding targets. This suggests potential future revenue growth and improved financial performance as upgraded properties attract more guests and command higher rates.

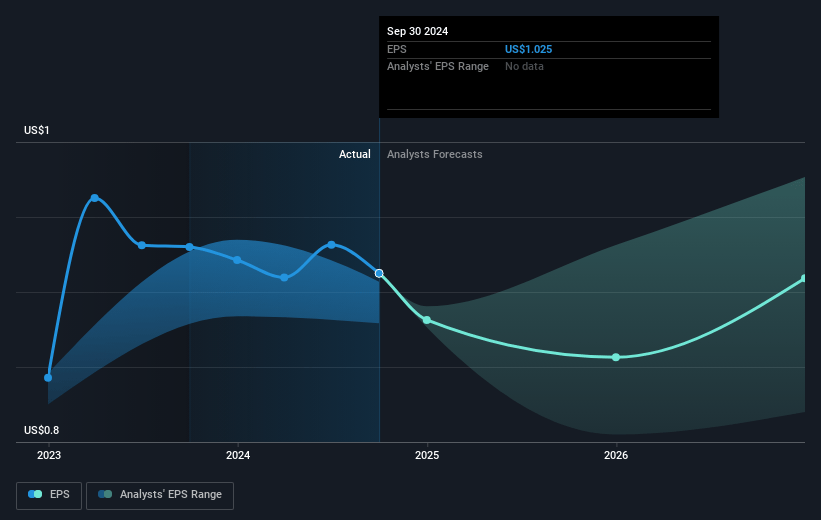

- Continued share repurchases, totaling $315 million since 2022, highlight a focus on increasing shareholder value and suggest future EPS growth due to reducing the number of shares outstanding.

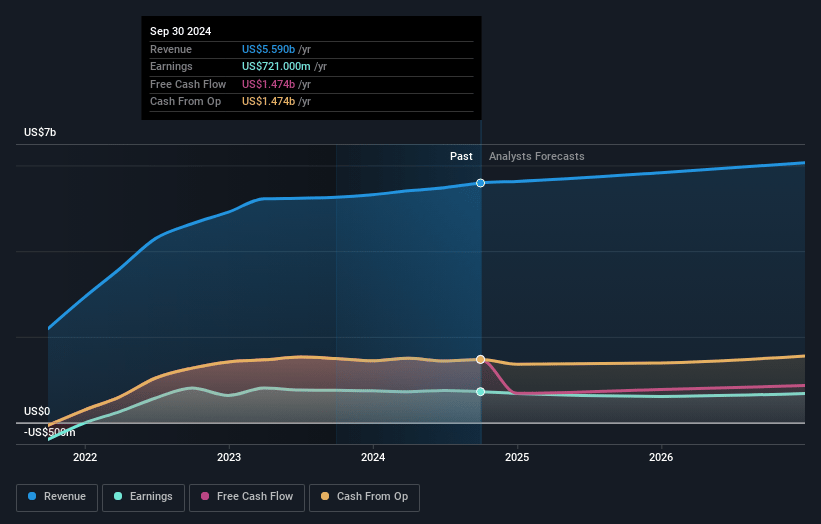

Host Hotels & Resorts Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Host Hotels & Resorts's revenue will grow by 5.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 12.9% today to 13.0% in 3 years time.

- Analysts expect earnings to reach $840.0 million (and earnings per share of $1.21) by about December 2027, up from $721.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.0x on those 2027 earnings, up from 17.7x today. This future PE is greater than the current PE for the US Hotel and Resort REITs industry at 18.4x.

- Analysts expect the number of shares outstanding to decline by 0.34% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.62%, as per the Simply Wall St company report.

Host Hotels & Resorts Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Host Hotels & Resorts is facing potential financial impacts from natural disasters, such as the damage from Hurricanes Helene and Milton, which led to the closure of properties. This could affect revenue due to the loss of operational days and increased costs from remediation and reconstruction.

- The ongoing recovery from the Maui wildfires presents a risk, as it significantly impacted RevPAR and will likely take time to fully recover, thereby impacting the company's revenue and earnings.

- The rise in expenses, particularly wages and benefits, and a decrease in comparable hotel EBITDA margin indicate pressure on net margins that could affect profitability.

- The reliance on leisure and group bookings for revenue growth may pose a risk if macroeconomic conditions change or if competition increases, potentially impacting overall market share and revenue.

- Uncertainty in the real estate transaction market and the potential need for heavy capital expenditures on non-core assets could affect future earnings and strategic flexibility, impacting the company's financial health.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $20.47 for Host Hotels & Resorts based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $23.0, and the most bearish reporting a price target of just $16.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $6.5 billion, earnings will come to $840.0 million, and it would be trading on a PE ratio of 21.0x, assuming you use a discount rate of 7.6%.

- Given the current share price of $18.22, the analyst's price target of $20.47 is 11.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives