Key Takeaways

- Investments in technology and strategic acquisitions position the company to capture market share and enhance productivity as transaction activity accelerates.

- Demographic shifts and migration trends are expected to expand commercial real estate demand, supporting sustainable revenue and earnings growth.

- Heavy reliance on transaction-based revenue and rising competition, combined with adverse credit conditions, are pressuring margins, earnings, and long-term market strength.

Catalysts

About Marcus & Millichap- An investment brokerage company, provides real estate investment brokerage and financing services to sellers and buyers of commercial real estate in the United States and Canada.

- The anticipated large-scale transfer of wealth from baby boomers to younger generations is likely to drive a significant uptick in commercial real estate transactions as assets are rebalanced, which should increase Marcus & Millichap's brokerage revenue and transaction fee income over the coming years.

- Continued urbanization, suburban revitalization, and strong in-migration to growth markets like Texas, Florida, and Georgia are expected to create durable demand for a diverse range of commercial property types, expanding the company's addressable market and supporting both top-line revenue growth and earnings.

- Ongoing investments in technology-including analytics, AI-driven client targeting, and virtual deal management-are expected to boost sales force productivity and deal velocity, allowing the company to handle higher transaction volumes with lower incremental costs, thereby expanding net margins when deal flow recovers.

- Expansion of capital markets and financing services, particularly as transaction size and institutional investor activity increase, will diversify and stabilize revenue streams, driving more recurring fee-based income and improving earnings resiliency.

- The company's pro-active recruiting of experienced professionals and targeted strategic acquisitions are positioning MMI to gain market share and capitalize on heightened transaction activity when markets normalize, leading to greater operating leverage and potential for outsized earnings growth.

Marcus & Millichap Future Earnings and Revenue Growth

Assumptions

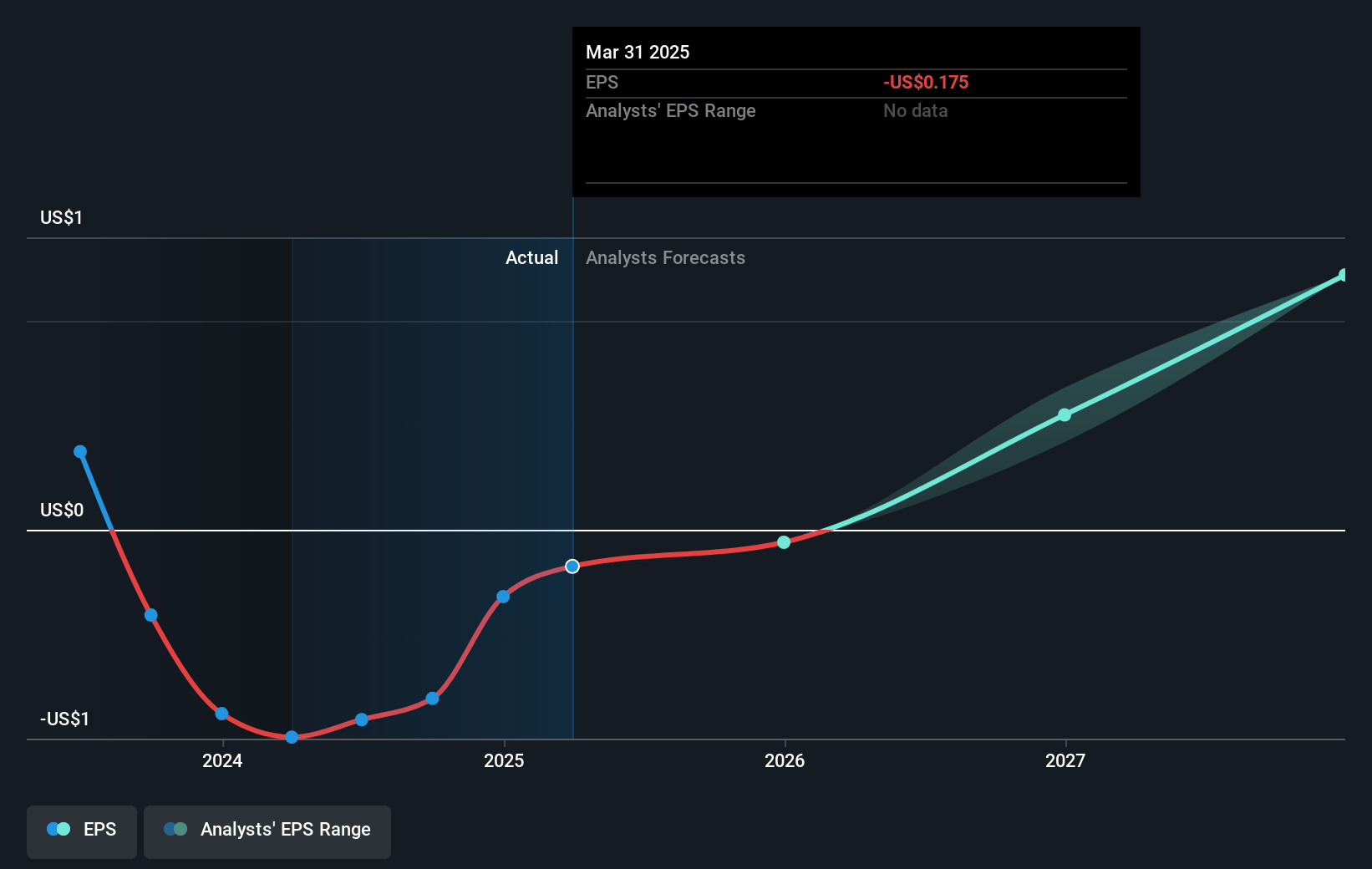

How have these above catalysts been quantified?- Analysts are assuming Marcus & Millichap's revenue will grow by 18.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from -1.0% today to 5.5% in 3 years time.

- Analysts expect earnings to reach $64.4 million (and earnings per share of $1.08) by about July 2028, up from $-6.8 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 22.8x on those 2028 earnings, up from -175.6x today. This future PE is lower than the current PE for the US Real Estate industry at 31.8x.

- Analysts expect the number of shares outstanding to grow by 0.64% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.83%, as per the Simply Wall St company report.

Marcus & Millichap Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Marcus & Millichap's heavy reliance on transaction-based revenue-approximately 85% of total revenue is from real estate brokerage commissions-means its earnings and profitability are highly exposed to market cycles and downturns in transaction volumes, which can lead to significant volatility in revenues and net margins during prolonged market disruptions.

- The persistence of high and volatile interest rates, combined with tight lending standards from banks and credit unions, continues to negatively impact deal flow and lengthen transaction timelines, particularly for the private client and microcap segments; prolonged adverse credit conditions threaten to further depress revenue growth and operational leverage.

- Strategic investments in technology, talent retention, and market expansion, while potentially accretive long-term, are currently increasing operating expenses and placing downward pressure on near-term margins and net earnings, underscored by recurring net losses and negative EBITDA despite recent revenue growth.

- Ongoing market disruptions-such as the bid-ask spread, slow price corrections, and investor caution driven by uncertainty over trade, tariffs, and future interest rate policy-are reducing overall business development capacity and could delay a return to robust transaction volumes, extending the period of earnings weakness.

- Larger institutional investors have become a more significant revenue driver for the company (notably in the middle market segment), but increasing industry consolidation and the potential for technology-forward, better-capitalized competitors to gain share present long-run threats to Marcus & Millichap's market position, placing future revenue and margin expansion at risk.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $30.0 for Marcus & Millichap based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.2 billion, earnings will come to $64.4 million, and it would be trading on a PE ratio of 22.8x, assuming you use a discount rate of 7.8%.

- Given the current share price of $30.63, the analyst price target of $30.0 is 2.1% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.