Key Takeaways

- Strong real estate demand in high-growth regions and a robust development pipeline support recurring income, higher margins, and future earnings growth.

- Diversification into new sectors and disciplined capital strategy aim to reduce risk, strengthen financial flexibility, and enhance long-term returns.

- Heavy capital commitments, market cyclicality, and unproven diversification efforts create cash flow pressures, high risk, and limited value creation for shareholders.

Catalysts

About Howard Hughes Holdings- Develops and operates master planned communities (MPCs) in the United States.

- Sustained demand for residential and commercial real estate in master-planned communities located in the Sun Belt and other high-growth, lower-cost regions underpins strong land sales, higher pricing, and robust operating income—trends highly visible in recent performance and likely to continue boosting revenue and margins as population migration persists.

- The company’s ongoing development pipeline—including significant future condo revenues, entitlement expansions (e.g., in Ward Village, Hawai'i), and several major new projects in Texas—sets up a multi-year runway for monetizing existing land holdings, which should increase gross margins, bring earnings growth, and eventually produce excess cash flow for reinvestment.

- Elevated interest in live-work-play suburban environments, fueled by remote/hybrid work and urban flight, continues to drive strong lease-up and occupancy rates across office, multifamily, and retail assets within HHH’s portfolio, supporting recurring income streams and reducing earnings volatility.

- The transformation into a diversified holding company, with a $900 million equity investment and a strategy to acquire durable growth businesses outside of real estate (potentially including insurance), positions HHH to lower its overall risk profile, improve access to capital, and enhance long-term earnings power, which could support margin stability and accelerate growth.

- Continued focus on capital recycling, operating asset NOI growth, and a path toward investment-grade credit status (aided by new equity capital and future cash generation) increases the likelihood of lower cost of capital and the ability to unlock higher long-term returns on capital, with a positive impact on net margins and enterprise value.

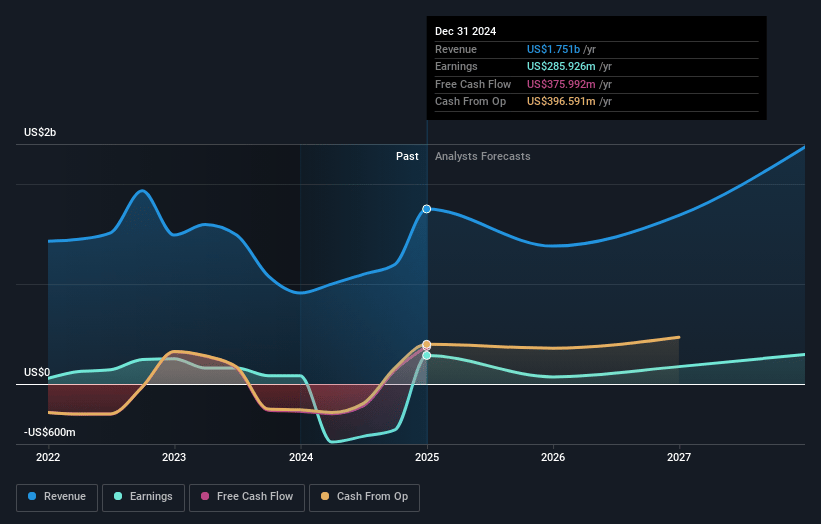

Howard Hughes Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Howard Hughes Holdings's revenue will grow by 3.1% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 17.7% today to 10.3% in 3 years time.

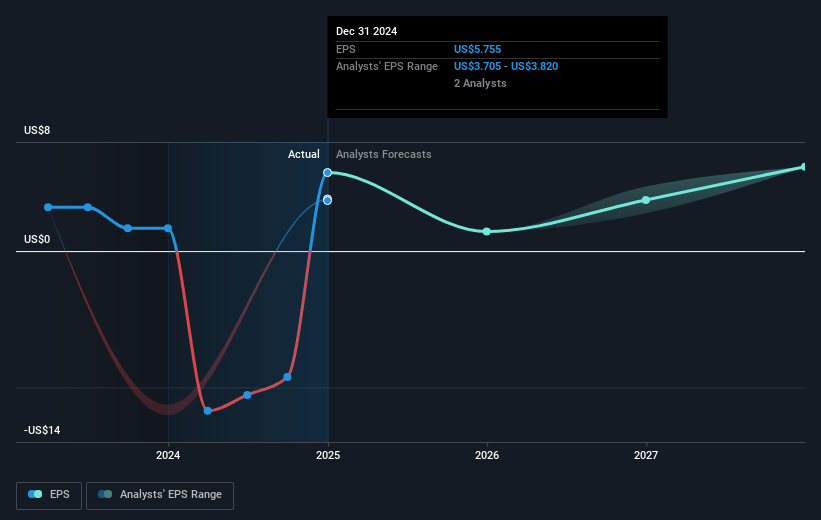

- Analysts expect earnings to reach $202.4 million (and earnings per share of $5.15) by about July 2028, down from $317.9 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 32.1x on those 2028 earnings, up from 13.1x today. This future PE is greater than the current PE for the US Real Estate industry at 31.0x.

- Analysts expect the number of shares outstanding to grow by 0.35% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.08%, as per the Simply Wall St company report.

Howard Hughes Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy, ongoing capital commitments to master planned communities (MPCs) and other real estate developments may continue to generate lumpy and sometimes negative cash flow, especially as returns from new projects and condominium developments are realized over long timeframes; this could constrain free cash flow, impacting debt repayment, funding for new initiatives, and ultimately net earnings.

- Howard Hughes’ business model has struggled historically to generate returns on capital above its cost of capital as a pure-play real estate firm, according to management’s own admissions; continued weak market valuation, high perceived risk, and non-investment-grade status could restrict access to low-cost capital and hamper efforts to create long-term shareholder value, pressuring share price appreciation.

- The company remains significantly exposed to cyclical trends in real estate values and macroeconomic headwinds; any prolonged weakness in the national or MPC markets (like higher interest rates, a cooling housing market, or less robust migration) could decrease demand for land/home sales and lower revenue growth and margins.

- Efforts to diversify into new business areas (such as building an insurance business and acquiring “durable growth companies”) introduce significant execution risk, unproven portfolio synergies, and potential for capital misallocation; a lack of track record in non-real-estate operating businesses could lead to suboptimal investment returns and increased volatility in earnings.

- Concentration of assets in a few key geographic markets and large, long-term development projects leaves the company highly susceptible to regional downturns, climate events, regulatory shifts, or project-specific delays, which can adversely impact stabilized occupancy, operating income, and the predictability of long-term revenue streams.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $80.333 for Howard Hughes Holdings based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.0 billion, earnings will come to $202.4 million, and it would be trading on a PE ratio of 32.1x, assuming you use a discount rate of 11.1%.

- Given the current share price of $70.55, the analyst price target of $80.33 is 12.2% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.