Key Takeaways

- Rising demand for complex, integrated real estate services and sustainability consulting is strengthening the company’s recurring revenue streams and supporting higher margins.

- Strategic focus on technology, talent, and operational efficiency is fueling client retention, market share gains, and sustained earnings growth.

- Exposure to secular office demand decline, digital disruption, debt reliance, mature market sluggishness, and tenant-favoring lease trends threaten revenue stability and long-term earnings growth.

Catalysts

About Cushman & Wakefield- Provides commercial real estate services under the Cushman & Wakefield brand in the Americas, Europe, Middle East, Africa, and Asia Pacific.

- Accelerating global urbanization and population growth is driving a sustained increase in demand for commercial real estate services, which is already translating into a strong and growing pipeline of leasing, capital markets, and outsourcing deals for the company, supporting multi-year revenue growth and higher long-term contract volumes.

- The continued complexity and globalization of supply chains is increasing demand for integrated property, facilities, and project management services, leading to the expansion of recurring, annuity-like revenue streams for Cushman & Wakefield and supporting higher net margins.

- The rising importance of environmental and sustainability requirements means clients are seeking more guidance on green building solutions, which positions the company to capture higher-margin consulting and project management fees as ESG standards become mainstream in global real estate, positively impacting both revenue mix and margins.

- Increasing adoption of technology and data analytics across the industry is enabling Cushman & Wakefield to offer differentiated, higher-value solutions and operational efficiency, resulting in greater client retention, higher win rates, and sustained net margin improvement.

- The company’s strategic investments in talent and organic growth, together with a proven ability to deliver ahead of targets and a materially strengthened balance sheet, are positioning it to disproportionately benefit from a cyclical rebound in global capital flows, supporting outsized earnings growth and significant market share expansion.

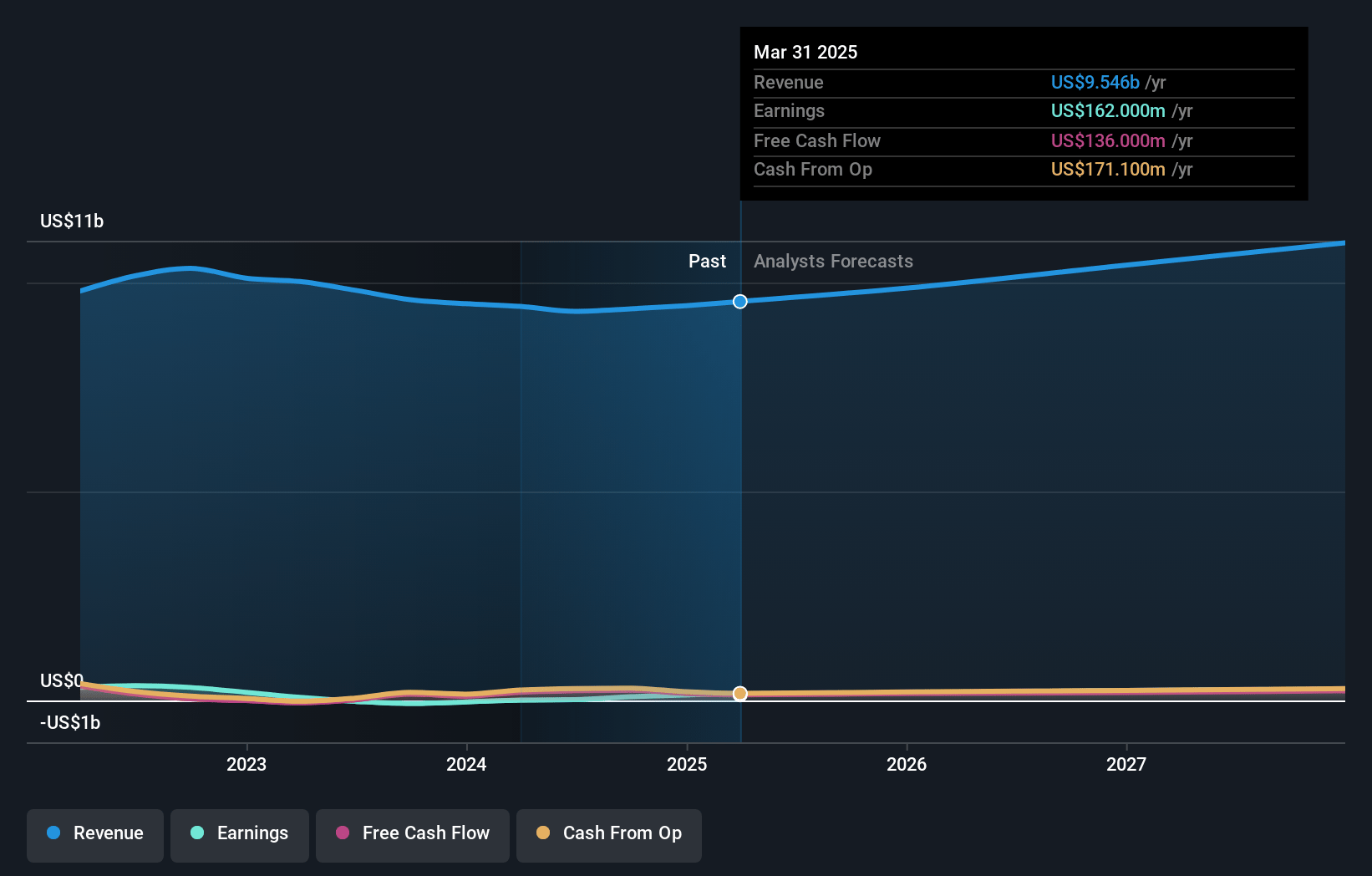

Cushman & Wakefield Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Cushman & Wakefield compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Cushman & Wakefield's revenue will grow by 5.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 1.7% today to 3.5% in 3 years time.

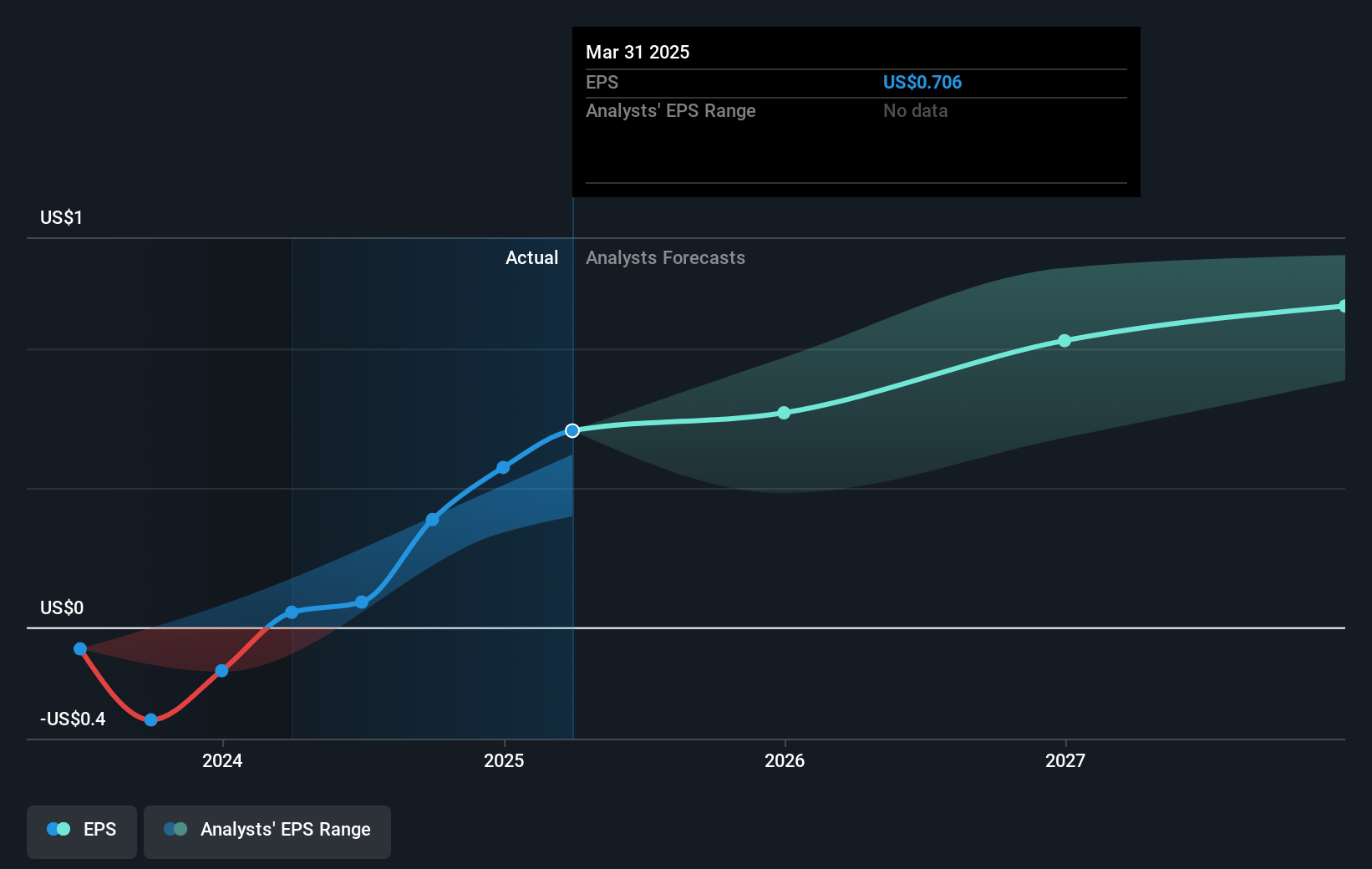

- The bullish analysts expect earnings to reach $394.0 million (and earnings per share of $1.8) by about May 2028, up from $162.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 14.0x on those 2028 earnings, which is the same as it is today today. This future PE is lower than the current PE for the US Real Estate industry at 25.2x.

- Analysts expect the number of shares outstanding to grow by 0.98% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.01%, as per the Simply Wall St company report.

Cushman & Wakefield Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The persistent shift toward remote and hybrid work models poses a significant threat to demand for large office space, and while management cited healthy pipeline activity, their leasing business remains exposed to secular headwinds that may reduce future brokerage and commission revenues.

- Accelerated adoption of property technology and digital platforms could disintermediate Cushman & Wakefield’s traditional service offerings; there was little discussion in the text about technology investments beyond operational agility, suggesting a risk of margin compression and competitive erosion impacting long-term earnings growth.

- The company’s net leverage remains elevated at 3.9 times EBITDA, and although there has been progress with repayments, heavy reliance on debt financing increases vulnerability to rising interest rates or credit tightening, which could put future net margins under pressure and increase insolvency risk.

- Cushman & Wakefield’s revenue profile is highly reliant on mature urban markets such as EMEA, where the text acknowledges a weaker macro environment and slow recovery; continued demographic stagnation in these regions could suppress occupancy rates and rental levels, directly impacting topline revenue.

- The ongoing industry trend of increased tenant bargaining power and shorter lease durations threatens the stability and predictability of Cushman & Wakefield’s fee streams, potentially leading to greater revenue volatility and reduced long-term earnings visibility.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Cushman & Wakefield is $17.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Cushman & Wakefield's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $17.0, and the most bearish reporting a price target of just $9.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $11.1 billion, earnings will come to $394.0 million, and it would be trading on a PE ratio of 14.0x, assuming you use a discount rate of 11.0%.

- Given the current share price of $9.84, the bullish analyst price target of $17.0 is 42.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.