Last Update 09 Apr 25

Key Takeaways

- Strategic collaborations and successful CMS partnerships can enhance market adoption and pricing stability, boosting net margins and profitability.

- Expanding clinical trials and NASDAQ uplisting may increase revenue, earnings, and shareholder value through broader market access and investor reach.

- Increased operating expenses, regulatory risks, and dependence on key partners and clinical trials pose revenue, profitability, and growth challenges for BioStem Technologies.

Catalysts

About BioStem Technologies- A life sciences corporation, focuses on discovering, developing, and producing pharmaceutical and regenerative medicine products and services.

- The upcoming nationwide launch of VENDAJE AC in Q4 2024, with established reimbursement across all MAC regions, is expected to contribute significantly to revenue growth.

- The IRB approval and subsequent enrollment in clinical trials for diabetic foot ulcers provide potential for clinical data that could broaden market access and payer coverage, positively impacting future revenue and earnings.

- Uplisting to NASDAQ and transitioning to fully reporting status could enhance visibility, broaden investor reach, and increase access to capital, potentially influencing stock price and shareholder value.

- Strategic collaborations with CMS and industry leaders to shape Medicare reimbursement policies can drive pricing stability and market adoption, potentially improving net margins and profitability.

- Positive retrospective study results reinforcing the clinical superiority of BioRetain technology may support expanded payer coverage and drive higher revenue through increased market penetration.

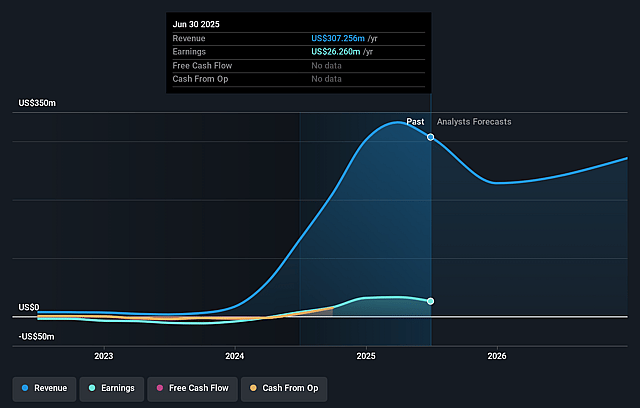

BioStem Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming BioStem Technologies's revenue will grow by 27.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.5% today to 11.7% in 3 years time.

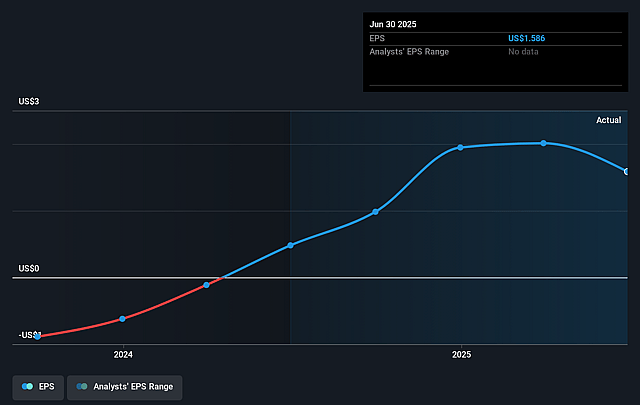

- Analysts expect earnings to reach $50.4 million (and earnings per share of $2.15) by about April 2028, up from $15.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.1x on those 2028 earnings, up from 8.0x today. This future PE is lower than the current PE for the US Pharmaceuticals industry at 15.1x.

- Analysts expect the number of shares outstanding to grow by 1.8% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.21%, as per the Simply Wall St company report.

BioStem Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The proposed Local Coverage Determination (LCD) for undescended products, including BioStem's, by CMS could potentially limit access for Medicare beneficiaries and impact payer reimbursement, thereby affecting future revenue streams.

- A significant increase in operating expenses due to workforce expansion, higher service fees for distributors, and share-based compensation might compress net margins and impact overall profitability if revenue growth does not keep pace.

- Dependence on pivotal clinical trial outcomes for broadening market access and payer coverage introduces risk, as unfavorable trial results could negatively impact future earnings and growth prospects.

- Reliance on Venture Medical as a key commercialization partner means any disruption or renegotiation in this partnership could affect sales distribution channels and revenue generation.

- The ongoing process of uplisting to NASDAQ and filing with the SEC may expose the company to increased regulatory risks and associated costs, influencing net margins and financial stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $32.5 for BioStem Technologies based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $432.1 million, earnings will come to $50.4 million, and it would be trading on a PE ratio of 13.1x, assuming you use a discount rate of 6.2%.

- Given the current share price of $7.56, the analyst price target of $32.5 is 76.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on BioStem Technologies?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.