Key Takeaways

- Strategic M&A and innovation drive revenue growth and market share, enhancing long-term profitability through synergies and advanced technologies.

- Operational efficiencies via generative AI and shareholder return strategies bolster net margins and support sustainable EPS growth.

- Revenue growth and earnings could be affected by pandemic-related revenue decline, policy changes, forex issues, and acquisition risks impacting operational efficiency.

Catalysts

About Thermo Fisher Scientific- Provides life sciences solutions, analytical instruments, specialty diagnostics, and laboratory products and biopharma services in the North America, Europe, Asia-Pacific, and internationally.

- Thermo Fisher Scientific's Accelerator Drug Development solution, which combines their CDMO and CRO capabilities, is expected to enhance customer return on R&D investments, driving revenue growth and potentially increasing net margins through higher efficiency.

- Increased innovation with new product launches, such as Thermo Scientific Stellar mass spectrometer and Iliad scanning transmission electron microscope, supports revenue growth by capturing market share and fulfilling customer needs for advanced technologies.

- Strategic M&A activities, including the acquisition of Olink, expand Thermo Fisher's capabilities in high-growth areas like proteomics, thereby augmenting long-term revenue streams and enhancing profit through synergies.

- The application of Thermo Fisher's PPI Business System, which includes adopting generative AI for operational efficiency, is set to improve productivity and customer satisfaction, contributing to higher net margins and solid EPS growth.

- The ongoing return of capital to shareholders, including $4.6 billion in buybacks and dividends in 2024, reflects a strategy to enhance EPS through share reduction, underpinning the catalysts for future earnings growth.

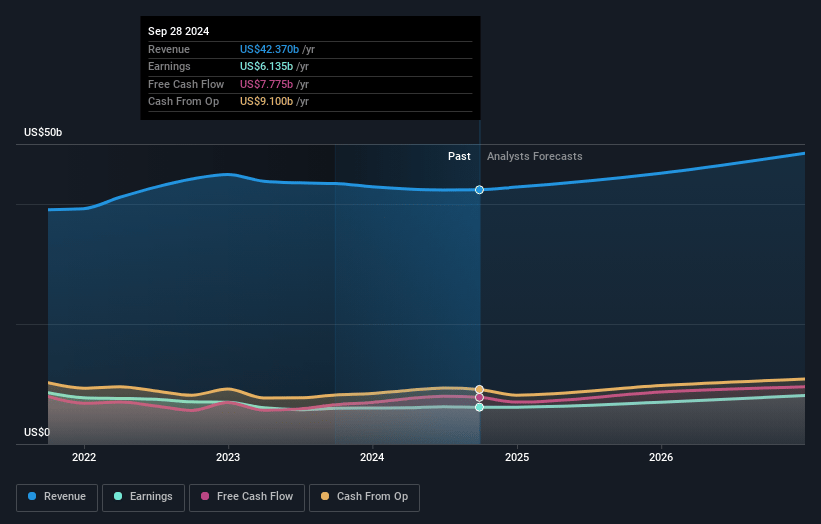

Thermo Fisher Scientific Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Thermo Fisher Scientific's revenue will grow by 5.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 14.8% today to 17.9% in 3 years time.

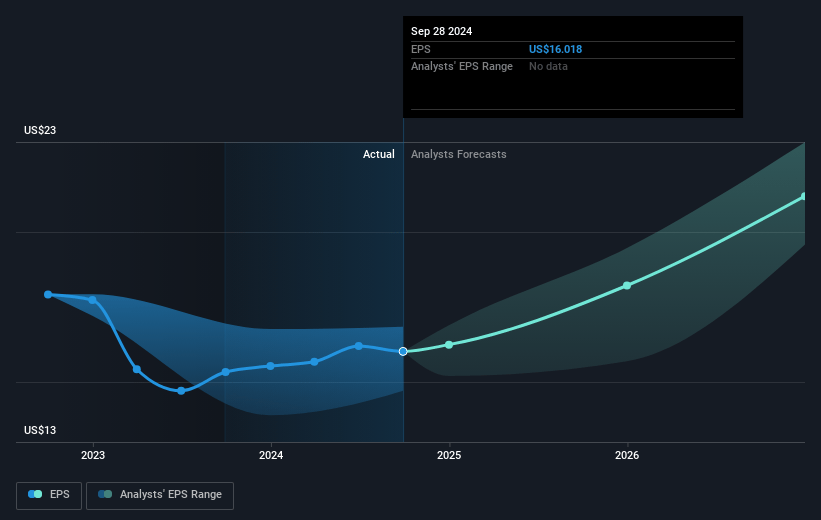

- Analysts expect earnings to reach $9.0 billion (and earnings per share of $25.32) by about March 2028, up from $6.3 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 32.8x on those 2028 earnings, up from 31.7x today. This future PE is lower than the current PE for the US Life Sciences industry at 42.5x.

- Analysts expect the number of shares outstanding to decline by 1.17% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.99%, as per the Simply Wall St company report.

Thermo Fisher Scientific Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Continued run-off of pandemic-related revenue, including a headwind in clinical research, could impact revenue growth and overall earnings.

- The company anticipates a low, flat growth rate in organic revenue in Q1, largely due to timing issues and fewer selling days, which may temporarily affect earnings.

- Potential adverse policy changes, such as government funding instability (like NIH funding discussions), and export controls could create uncertainty impacting future revenues and margins.

- Foreign exchange rate fluctuations, with an anticipated 1.5% headwind on revenue, could negatively affect total revenue and operating margins.

- Integration and strategic execution risks related to recent acquisitions, such as Olink, could impact operational efficiency and net margins if not managed effectively.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $661.022 for Thermo Fisher Scientific based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $767.0, and the most bearish reporting a price target of just $570.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $50.3 billion, earnings will come to $9.0 billion, and it would be trading on a PE ratio of 32.8x, assuming you use a discount rate of 7.0%.

- Given the current share price of $531.71, the analyst price target of $661.02 is 19.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

UN

Unike

Community Contributor

The demand for personalized medicine will keep Thermo Fisher Scientific thriving

Catalysts Most Immediate Catalysts (1–2 Years) Resilient Demand for Life Sciences & Diagnostics – TMO is a key supplier for biotech, pharma, and research institutions, ensuring steady demand despite economic cycles. Cost Synergies from PPD Acquisition – The 2021 acquisition of PPD (clinical research services) is expected to enhance revenue synergies and margin expansion.

View narrativeUS$540.27

FV

4.8% undervalued intrinsic discount7.00%

Revenue growth p.a.

0users have liked this narrative

0users have commented on this narrative

4users have followed this narrative

2 days ago author updated this narrative