Key Takeaways

- Expansion of QIAstat platform and new FDA clearances aim to boost revenue with U.S. launch of QIAstat Rise for high-throughput applications.

- Enhancements in digital PCR and automated sample preparation systems target growth in oncology, infectious diseases, and liquid biopsy markets.

- Discontinuation of NeuMoDx, weak instrument sales, EU tariffs, and conversion to SaaS may temporarily reduce revenues and affect margins.

Catalysts

About Qiagen- Offers sample to insight solutions that transform biological materials into molecular insights.

- Expansion of the QIAstat Diagnostics platform and new FDA clearances are expected to drive future revenue growth, particularly as QIAstat Rise system launches in the U.S. market for high-throughput applications.

- The QuantiFERON TB test, which has experienced strong growth, continues to show promise for future revenue increases as only about 40% of the global latent TB testing market has been converted to blood-based testing.

- Advances in digital PCR technology with the QIAcuity system, including the recent launch of QIAcuity Diagnostic, are aimed at expanding into oncology and infectious disease applications, potentially increasing future revenues and earnings.

- Planned launches of new automated sample preparation systems over the next 24 months could drive mid-term revenue growth in high-growth areas like liquid biopsy and minimal residual disease analysis.

- Achieving significant operational efficiencies, such as improved margins from discontinuing NeuMoDx and increasing digital sales channels, is expected to enhance net margins and boost earnings.

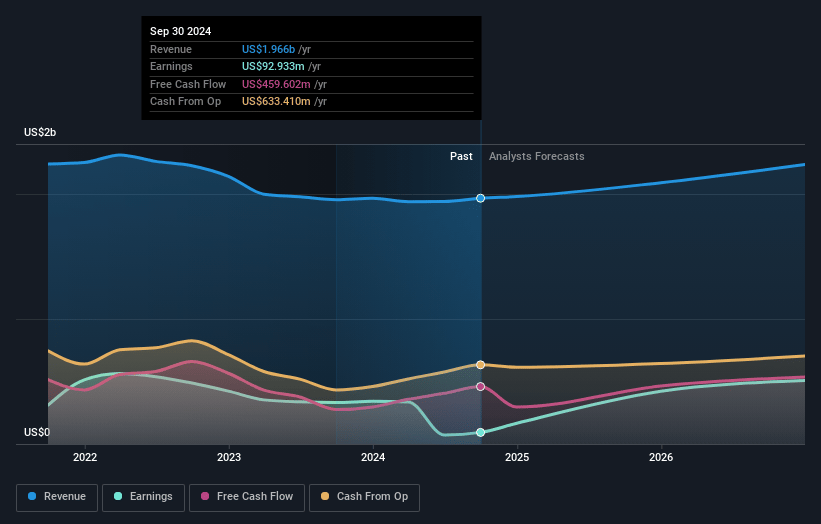

Qiagen Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Qiagen's revenue will grow by 6.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.2% today to 23.6% in 3 years time.

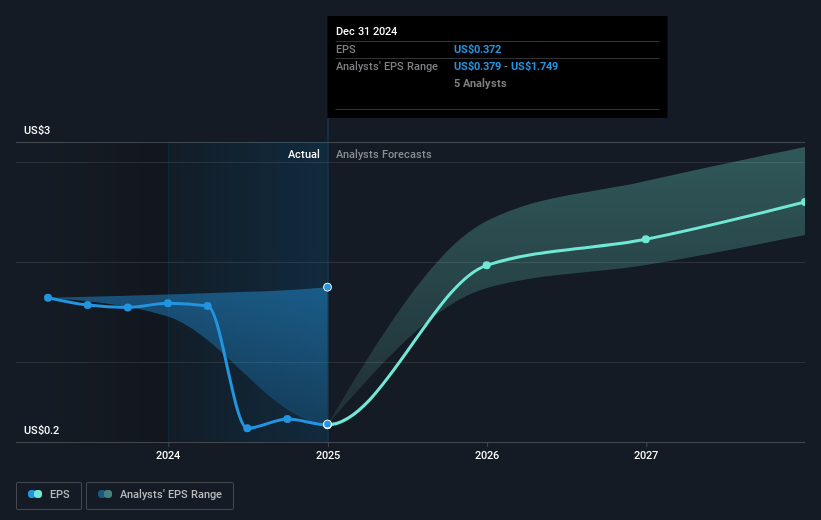

- Analysts expect earnings to reach $559.2 million (and earnings per share of $2.6) by about March 2028, up from $83.6 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $677 million in earnings, and the most bearish expecting $497 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 25.7x on those 2028 earnings, down from 102.8x today. This future PE is lower than the current PE for the GB Life Sciences industry at 42.5x.

- Analysts expect the number of shares outstanding to grow by 3.06% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.97%, as per the Simply Wall St company report.

Qiagen Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The decision to discontinue NeuMoDx may lead to reduced revenues and potential short-term operational disruptions as the company phases out associated systems.

- Weak instrument sales in the Sample technologies segment and cautious spending by customers on new instruments could impact the company's ability to achieve higher revenues through increased instrument sales.

- Exposure to potential EU import tariffs and geopolitical uncertainties in key markets like China could adversely affect revenue and margins.

- Transitioning QIAGEN Digital Insight (QDI) to a SaaS model might result in short-term revenue dips as it works through converting existing contracts.

- An increase in the adjusted tax rate and fluctuations in interest income are anticipated to present headwinds, potentially impacting net margins and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $49.697 for Qiagen based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $55.0, and the most bearish reporting a price target of just $42.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.4 billion, earnings will come to $559.2 million, and it would be trading on a PE ratio of 25.7x, assuming you use a discount rate of 7.0%.

- Given the current share price of $39.75, the analyst price target of $49.7 is 20.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives