Last Update07 May 25Fair value Increased 0.21%

Key Takeaways

- A robust late-stage pipeline, strategic acquisitions, and innovation in biologics and AI-driven R&D position Pfizer for long-term growth in key therapeutic areas.

- Enhanced global market access and operational efficiencies, including cost savings and digital transformation, are expanding Pfizer's revenue base and improving profitability.

- Exposure to patent expirations, regulatory pressures, pipeline risks, biosimilar competition, and shifting macroeconomic conditions threatens sustained revenue, margins, and earnings stability.

Catalysts

About Pfizer- Pfizer Inc. discovers, develops, manufactures, markets, distributes, and sells biopharmaceutical products in the United States and internationally.

- Pfizer’s broad, late-stage pipeline across oncology, vaccines, and internal medicine is on track for multiple regulatory milestones and pivotal readouts in 2025 and 2026, putting the company in position to launch new blockbuster therapies addressing high unmet needs in age-related and chronic diseases—supporting a long-term acceleration of revenue growth as global demand increases with the aging population.

- Enhanced global commercial execution and expanded market access, especially in emerging markets and with recently launched products like Vyndaqel, Nurtec, and oncology assets, is driving strong volume growth; this leverages rising healthcare expenditure and improving international access to medicines, which can structurally expand Pfizer’s addressable revenue base over time.

- Focused investment in next-generation biologics, mRNA platforms, and AI-driven R&D is substantially improving research efficiency, pipeline productivity, and speed to market for new products. This sustained innovation cycle positions Pfizer to capture share in high-growth therapeutic areas and underpins bullish earnings projections even as legacy products lose exclusivity.

- Strategic acquisitions—most notably Seagen—alongside disciplined internal pipeline prioritization, are replenishing the late-stage portfolio in higher-margin categories such as oncology, vaccines, and rare diseases. This diversification and shift toward specialty pharma is expected to drive margin expansion and long-term net income growth.

- Ongoing multi-year cost-realignment and manufacturing optimization programs, expected to deliver about $7.7 billion in savings by 2027, are already resulting in higher gross and operating margins. Coupled with digital transformation and AI-enabled efficiencies, these initiatives improve net profitability and create operating leverage, supporting earnings per share growth even in periods of slower top-line expansion.

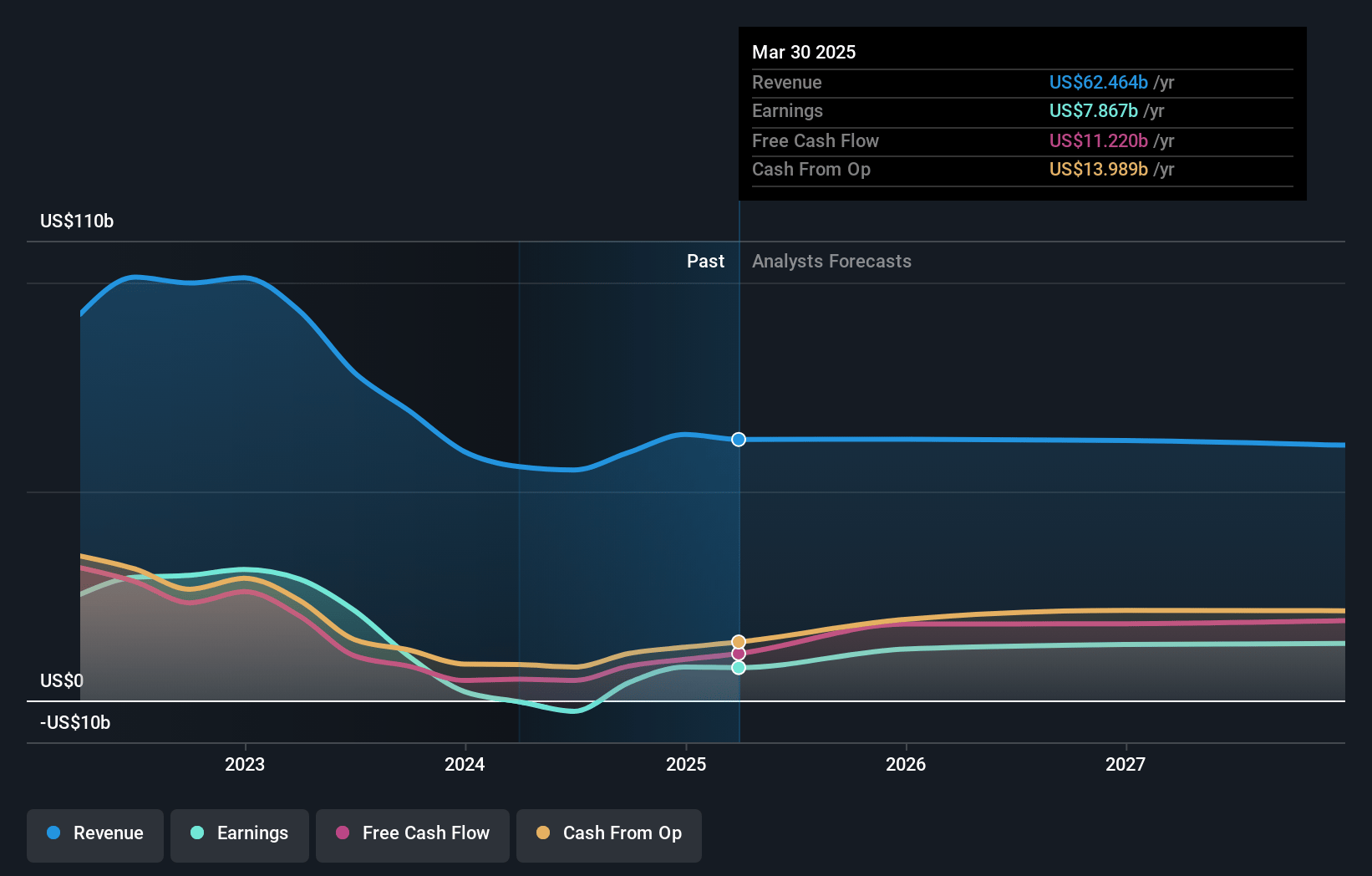

Pfizer Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Pfizer compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Pfizer's revenue will grow by 1.6% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 12.6% today to 25.8% in 3 years time.

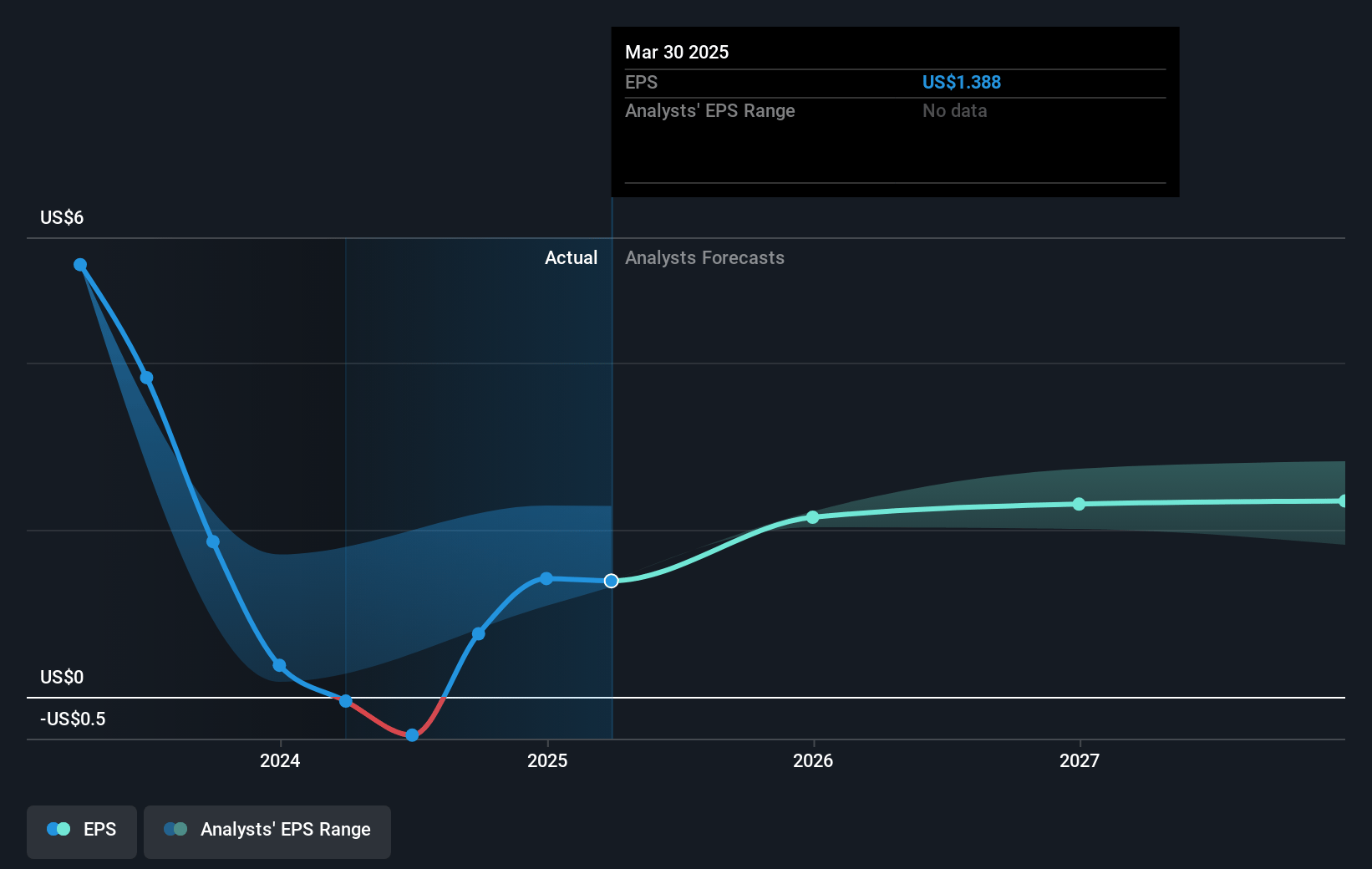

- The bullish analysts expect earnings to reach $16.9 billion (and earnings per share of $3.01) by about May 2028, up from $7.9 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 15.7x on those 2028 earnings, down from 16.5x today. This future PE is lower than the current PE for the US Pharmaceuticals industry at 16.8x.

- Analysts expect the number of shares outstanding to grow by 0.33% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.21%, as per the Simply Wall St company report.

Pfizer Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Loss of exclusivity for key blockbuster drugs beginning in 2026, peaking in 2028, is expected to cause significant declines in top-line revenue as generics and biosimilars enter the market and erode Pfizer’s pricing power in its established product portfolio.

- Increasing global healthcare cost pressures and U.S. regulatory reforms such as the IRA Medicare Part D redesign have already led to notable revenue declines, with Pfizer absorbing a $650 million negative impact in the first quarter of 2025 alone, which signals continued revenue headwinds and margin pressure.

- Substantial reliance on new product launches and pipeline assets to replace revenues from expiring patents increases risk, especially as late-stage pipeline attrition (such as the discontinuation of danuglipron in obesity) could leave earnings vulnerable if R&D investments do not yield enough approvals or commercial successes.

- Growing competition from both innovative biotech disruptors and expanded uptake of generics and biosimilars, particularly outside the U.S., poses sustained threats to both market share and gross margins, as illustrated by new entrants already impacting the Vyndaqel franchise’s growth trajectory.

- Ongoing macroeconomic and geopolitical risks, including potential sector-specific tariffs, increased regulatory scrutiny, and trade uncertainties, could raise compliance costs, disrupt supply chains, and negatively impact net margins and overall earnings, especially if policies shift unfavorably for the sector in key markets.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Pfizer is $38.61, which represents two standard deviations above the consensus price target of $29.25. This valuation is based on what can be assumed as the expectations of Pfizer's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $42.0, and the most bearish reporting a price target of just $23.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $65.5 billion, earnings will come to $16.9 billion, and it would be trading on a PE ratio of 15.7x, assuming you use a discount rate of 6.2%.

- Given the current share price of $22.88, the bullish analyst price target of $38.61 is 40.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.