Key Takeaways

- The expansion of manufacturing capability and a strong pipeline position Eli Lilly for potential revenue growth through increased demand and new product launches.

- Strategic acquisitions and collaborations, alongside shareholder-focused initiatives like share repurchases, indicate confidence in driving future revenue and earnings growth.

- Challenges such as pricing pressure, increased R&D costs, competition, currency fluctuations, and supply chain issues may hinder Eli Lilly's revenue and margin growth.

Catalysts

About Eli Lilly- Eli Lilly and Company discovers, develops, and markets human pharmaceuticals in the United States, Europe, China, Japan, and internationally.

- Eli Lilly's investments in expanding manufacturing capacity in Indiana, Wisconsin, and Ireland, totaling more than $23 billion since 2020, are expected to address growing demand for its medicines, directly impacting future revenue growth.

- The company's strong pipeline progress, including positive Phase III results for imlunestrant, insulin efsitora alfa, and tirzepatide trials, as well as new Phase III programs for lepodisiran, remternetug, and olomorasib, positions Eli Lilly for potential future revenue growth from new product launches.

- The acquisition of Morphic Therapeutics and collaboration with OpenAI to innovate in novel antimicrobials signal strategic pipeline complementations that could enhance future revenue potential and help increase earnings.

- Eli Lilly's announced $15 billion share repurchase program and consecutive quarterly dividend increases demonstrate confidence in its cash flow generation capabilities, potentially improving earnings per share growth through capital return to shareholders.

- The international expansion plans for Mounjaro, combined with the projected robust growth in the incretin market and sustained uptake in U.S. sales, are anticipated to significantly boost revenue and earnings growth in 2025 and beyond.

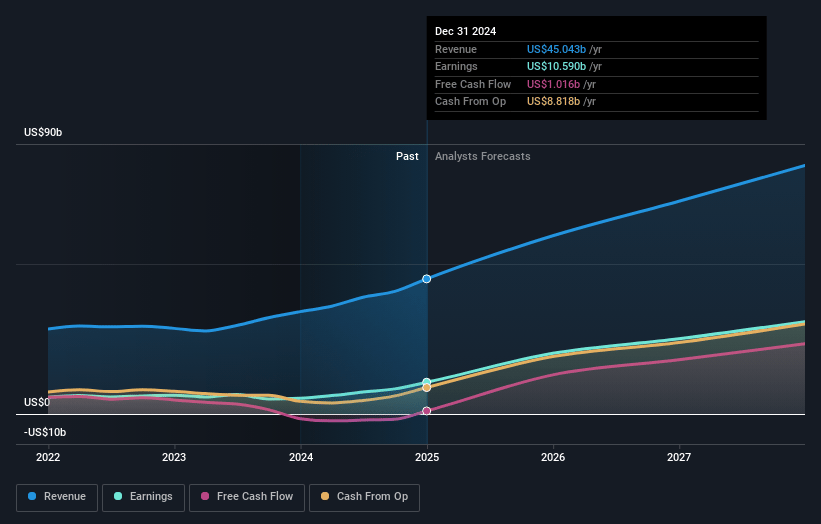

Eli Lilly Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Eli Lilly's revenue will grow by 22.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 23.5% today to 37.2% in 3 years time.

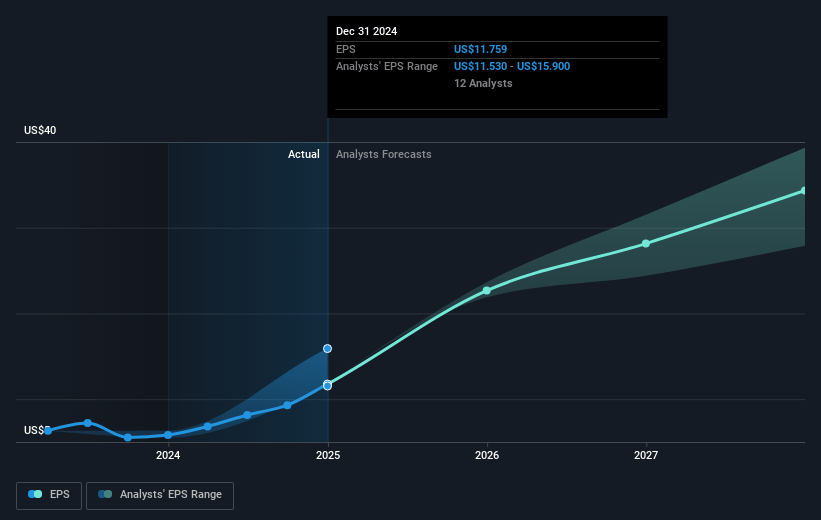

- Analysts expect earnings to reach $30.8 billion (and earnings per share of $34.35) by about March 2028, up from $10.6 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $35.6 billion in earnings, and the most bearish expecting $25.2 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 35.0x on those 2028 earnings, down from 69.8x today. This future PE is greater than the current PE for the US Pharmaceuticals industry at 16.3x.

- Analysts expect the number of shares outstanding to decline by 0.25% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.21%, as per the Simply Wall St company report.

Eli Lilly Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company faces potential pricing pressure as they anticipate a decline in net prices by mid

- to high single digits in percentage terms, including U.S. Part D changes, which could impact revenue growth.

- The increasing R&D expenses, which rose by 18% in 2024 due to investment in early and late-stage portfolios, could negatively affect net margins if the pipeline products do not meet expectations.

- Issues related to the launch and uptake of new drugs, such as potential competition and market adoption barriers, especially for newer treatments like Kisunla and Ebglyss, present a risk to projected revenues.

- The anticipated foreign exchange headwinds, as the dollar strengthens compared to other currencies, could negatively impact earnings by reducing the value of international revenues.

- Manufacturing and supply chain challenges, including the need for significant investment to expand production capacity, pose a risk to efficiently meeting global demand, which might depress revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $1010.472 for Eli Lilly based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $1190.0, and the most bearish reporting a price target of just $620.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $82.8 billion, earnings will come to $30.8 billion, and it would be trading on a PE ratio of 35.0x, assuming you use a discount rate of 6.2%.

- Given the current share price of $822.51, the analyst price target of $1010.47 is 18.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.