Key Takeaways

- Eli Lilly is poised for growth with new trial data, product approvals, and strategic expansion in oncology and immunology.

- Substantial investments in manufacturing and R&D strengthen production, supply chain, and future revenue prospects despite short-term charges.

- Revenue growth driven by key products faces risks from pricing declines, competition, and potential regulatory delays, with U.S. investments straining cash flow and margins.

Catalysts

About Eli Lilly- Eli Lilly and Company discovers, develops, and markets human pharmaceuticals in the United States, Europe, China, Japan, and internationally.

- The anticipated release of Phase III trial data for orforglipron, aimed at treating type 2 diabetes and obesity, presents an opportunity for revenue growth, supported by the potential scalability of manufacturing a once-daily oral medication. Potential regulatory submissions for obesity-related indications could further solidify possible new revenue streams by the end of 2025.

- Eli Lilly’s strategic focus on expanding its product pipeline, evidenced by new approvals and ongoing global trials, suggests planned increases in revenue and market share, particularly in high-demand therapy areas such as oncology and immunology (e.g., the European approval of Jaypirca for CLL and Omvoh for Crohn's disease).

- Significant manufacturing investment, over $50 billion since 2020, with commitments to build new facilities, including three active pharmaceutical ingredient facilities in the U.S., should help optimize production efficiency, improve gross margins, and ensure better supply chain resilience for growth.

- Increased investment in research and development and early-stage assets reflect a commitment to drive future applications of current and new therapies. These investments are intended to support revenue growth and bolster future earnings potential despite short-term acquired IPR&D charges impacting Q1 earnings negatively.

- The strength of current key products, which drove a significant portion of Eli Lilly’s 45% revenue growth year-over-year, positions the company positively for maintaining and increasing earnings through expansion in existing markets and the enhancement of product offerings.

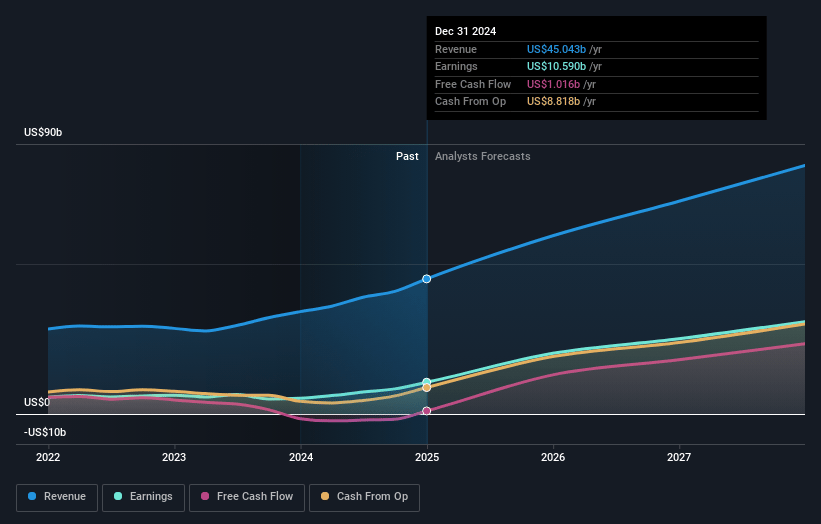

Eli Lilly Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Eli Lilly's revenue will grow by 20.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 22.7% today to 37.2% in 3 years time.

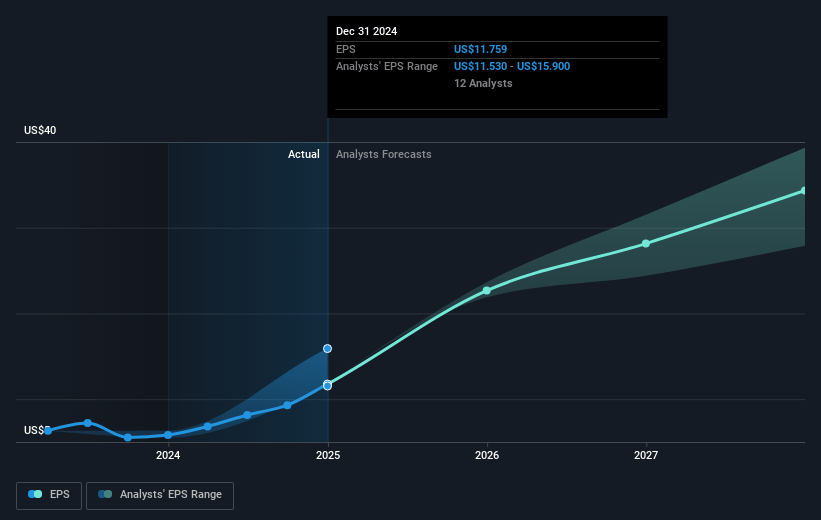

- Analysts expect earnings to reach $31.7 billion (and earnings per share of $35.8) by about May 2028, up from $11.1 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $25.2 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 33.0x on those 2028 earnings, down from 62.7x today. This future PE is greater than the current PE for the US Pharmaceuticals industry at 16.8x.

- Analysts expect the number of shares outstanding to decline by 0.3% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.21%, as per the Simply Wall St company report.

Eli Lilly Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company is concerned that announced tariffs, although currently not significantly affecting their 2025 financial outlook, could lead to financial setbacks if expansions in other geographies or retaliatory tariffs occur, thereby negatively impacting their revenues and net margins.

- A significant portion of Lilly's revenue growth has come from key products like Mounjaro and Zepbound, but there's a noted concern over declining prices, especially in the U.S. market, risking future revenue stability and net earnings.

- Competition and PBM (Pharmacy Benefit Manager) dynamics, particularly with Zepbound and Wegovy, could lead to pricing pressures and result in reduced net pricing, impacting revenue and margins.

- The company's decision to invest heavily in manufacturing facilities in the U.S. could initially strain cash flow and increase operational costs, potentially impacting net margins.

- The potential requirement of additional confirmatory clinical trials for tirzepatide in heart failure, leading to withdrawal of U.S. application, indicates delays which could affect expected revenue growth timelines and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $981.625 for Eli Lilly based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $1190.0, and the most bearish reporting a price target of just $650.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $85.1 billion, earnings will come to $31.7 billion, and it would be trading on a PE ratio of 33.0x, assuming you use a discount rate of 6.2%.

- Given the current share price of $775.12, the analyst price target of $981.63 is 21.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.