Key Takeaways

- Adopting New Approach Methods aligns with FDA goals, positioning Charles River as a preclinical drug development leader, potentially driving future revenue growth.

- Strategic restructuring and investments in innovative testing could expand operating margins and enhance earnings through cost savings and portfolio expansion.

- Shift towards New Approach Methods, reduced government funding, and strategic restructuring could challenge Charles River's traditional revenue streams and profitability.

Catalysts

About Charles River Laboratories International- Charles River Laboratories International, Inc.

- Charles River Laboratories is advancing the adoption of New Approach Methods (NAMs), which aligns with the FDA's goals to reduce animal testing. This positions the company as a leader in preclinical drug development, potentially driving future revenue growth through the increased use of innovative, non-animal testing methods.

- Strategic investments in NAMs and alternative methods, such as organoid platforms and AI-driven technologies, aim to expand Charles River's portfolio and capabilities. This could enhance net margins by reducing the reliance on traditional, more costly animal testing.

- The company's restructuring initiatives have realized cost savings, with a goal to deliver annualized savings of over $175 million in 2025. This is expected to protect and potentially expand operating margins.

- Charles River's improved DSA bookings and reduced cancellation rates from clients indicate stabilization in demand, boosting confidence in future earnings performance.

- The ongoing strategic review, with input from new Board members and Elliott Investment Management, could identify further opportunities for shareholder value creation, potentially through cost optimization or strategic divestitures, impacting EPS positively.

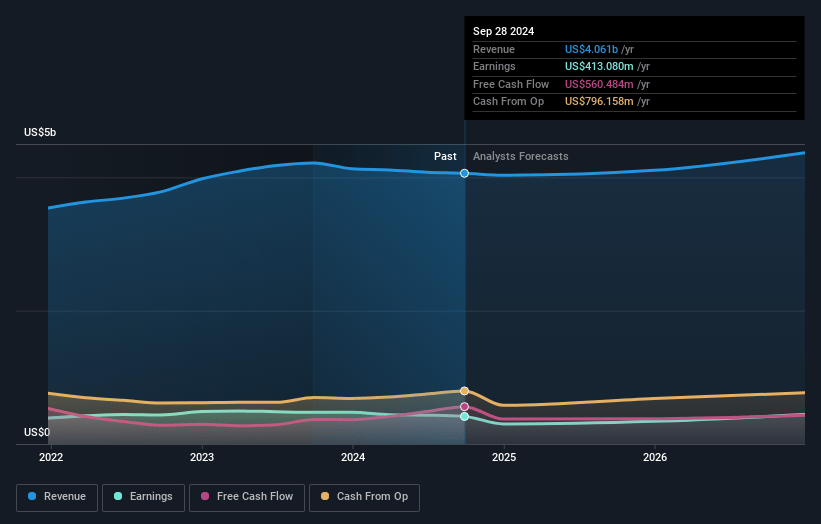

Charles River Laboratories International Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Charles River Laboratories International's revenue will decrease by 0.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 0.3% today to 8.0% in 3 years time.

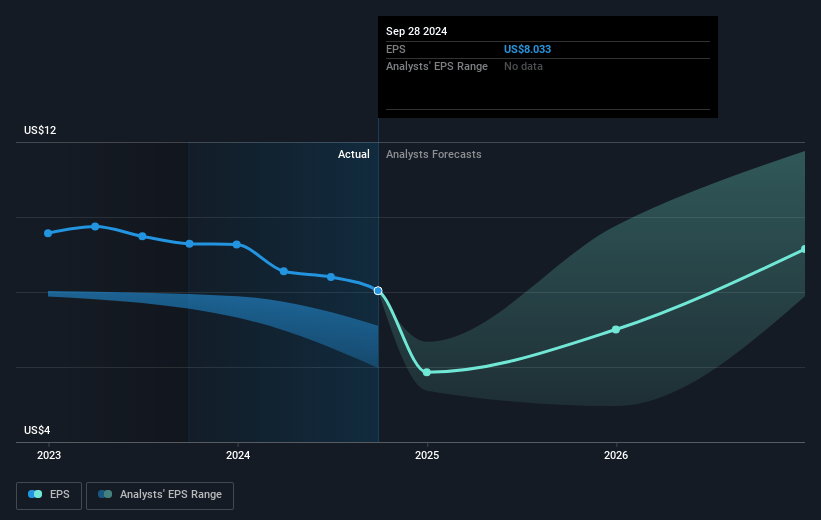

- Analysts expect earnings to reach $327.3 million (and earnings per share of $6.7) by about May 2028, up from $10.3 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $416 million in earnings, and the most bearish expecting $174.3 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 27.8x on those 2028 earnings, down from 550.5x today. This future PE is lower than the current PE for the US Life Sciences industry at 36.1x.

- Analysts expect the number of shares outstanding to decline by 0.72% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.63%, as per the Simply Wall St company report.

Charles River Laboratories International Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The FDA's initiative to emphasize New Approach Methods (NAMs) may lead to a gradual decline in the demand for traditional animal models, potentially impacting revenue from segments that rely on these models.

- Reductions in NIH and government funding could negatively impact future revenue, especially as North American academic and government institutions account for a significant portion of Charles River's revenue.

- Concerns over weakened funding for biotech, particularly small and early-stage companies, could reduce demand and affect future revenue growth within certain client segments.

- Weakness in the discovery phase work and anticipated market constraints, such as tariffs and economic pressures, could impact revenue and profit margins in specific segments.

- The strategic review with Elliot Investment Management may lead to restructuring or divestitures, which could impact Charles River's revenue or profitability if certain segments underperform or require significant investment.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $151.944 for Charles River Laboratories International based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $215.0, and the most bearish reporting a price target of just $70.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $4.1 billion, earnings will come to $327.3 million, and it would be trading on a PE ratio of 27.8x, assuming you use a discount rate of 7.6%.

- Given the current share price of $115.41, the analyst price target of $151.94 is 24.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.