Key Takeaways

- Strong positioning in biopharma and advanced therapies, coupled with innovation and digital expansion, is driving sustained share gains and margin growth.

- Operational efficiency initiatives, cost transformation, and optimization of the capital structure are supporting improved earnings, free cash flow, and long-term profitability.

- Overreliance on large biopharma clients, high debt from acquisitions, commoditization, trade risks, and digital disruption threaten Avantor’s revenue stability, margins, and market position.

Catalysts

About Avantor- Engages in the provision of mission-critical products and services to customers in the biopharma, healthcare, education and government, advanced technologies, and applied materials industries in the Americas, Europe, Asia, the Middle East, and Africa.

- Avantor is well positioned to benefit from rising global demand for biopharmaceuticals and advanced medical treatments that result from an aging population and the growing prevalence of chronic diseases, setting the stage for sustained organic revenue growth in its lab consumables, reagents, and production chemicals businesses.

- Increasing investment in precision medicine, gene therapy, and cell therapy is fueling higher requirements for specialized, high-quality materials, with Avantor’s strong presence and innovation engine in bioprocessing and bioscience production paving the way for continued share gains, content expansion per therapy, and double-digit growth in its highest-margin segments, ultimately driving both revenue and operating margin expansion.

- Ongoing investments in global supply chain optimization, automation, and capacity expansion—including the completion of new state-of-the-art manufacturing facilities—are expected to increase operational efficiency, support faster delivery, and enhance supply chain resiliency, directly contributing to improved EBITDA margins and sustainable earnings growth.

- The company’s accelerated cost transformation initiative, which is exceeding original targets, is on track to deliver over $300 million in structural cost savings by the end of 2026, resulting in a significant boost to EBITDA margins and free cash flow generation, thus improving net earnings and enabling disciplined capital allocation.

- Avantor’s strategy of adding differentiated proprietary products and expanding digital and e-commerce solutions increases customer stickiness and recurring revenue, while strategic deleveraging and the eventual resumption of targeted M&A are set to optimize the capital structure, drive working capital efficiency, and unlock further net margin expansion over the long-term.

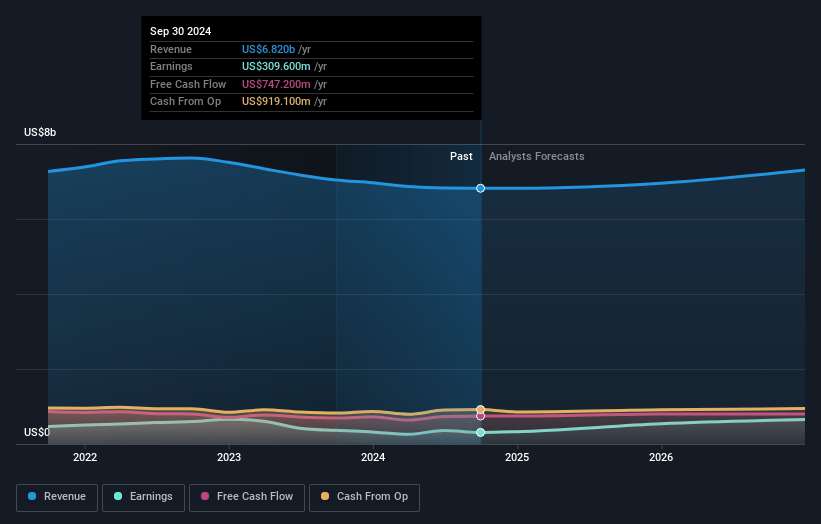

Avantor Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Avantor compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Avantor's revenue will grow by 3.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 10.5% today to 10.1% in 3 years time.

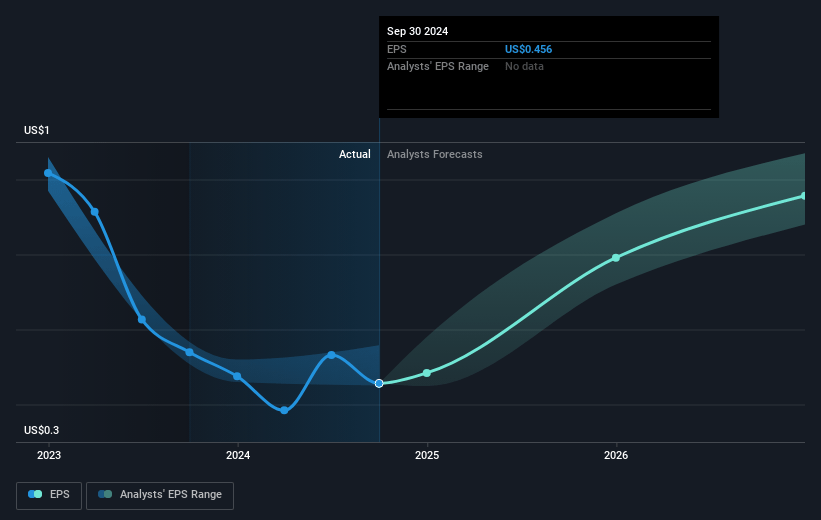

- The bullish analysts expect earnings to reach $754.5 million (and earnings per share of $1.1) by about April 2028, up from $711.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 32.7x on those 2028 earnings, up from 14.6x today. This future PE is lower than the current PE for the US Life Sciences industry at 36.5x.

- Analysts expect the number of shares outstanding to grow by 0.24% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.59%, as per the Simply Wall St company report.

Avantor Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Avantor's high customer concentration, especially its dependence on large biopharma accounts, poses a long-term risk of revenue volatility and downward pricing pressure, which would negatively impact revenue stability and profit margins.

- Elevated leverage from previous acquisitions, while being addressed through deleveraging, still exposes the company to greater vulnerability if interest rates rise or there is an economic downturn, increasing debt servicing costs and reducing net margins and earnings.

- The commoditization of Avantor’s core products threatens its ability to differentiate and sustain premium pricing, leading to ongoing margin erosion and potential declines in profitability over the long term.

- Intensifying global trade tensions, protectionist measures, and the risk of supply chain disruptions could hinder Avantor’s access to raw materials and its ability to serve international markets, potentially raising operational costs and reducing margins.

- Rapid advances in automation and digital procurement may enable customers to bypass intermediaries like Avantor, putting pressure on its value proposition, reducing pricing power, and potentially leading to sustained loss of market share and top-line revenue.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Avantor is $28.85, which represents two standard deviations above the consensus price target of $22.35. This valuation is based on what can be assumed as the expectations of Avantor's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $30.0, and the most bearish reporting a price target of just $18.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $7.5 billion, earnings will come to $754.5 million, and it would be trading on a PE ratio of 32.7x, assuming you use a discount rate of 7.6%.

- Given the current share price of $15.28, the bullish analyst price target of $28.85 is 47.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NYSE:AVTR. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives