Narratives are currently in beta

Key Takeaways

- Divesting clinical services and cost-saving initiatives are set to enhance margins, shift focus to high-growth areas, and reduce debt.

- Commitment to innovation and bioprocessing segment growth suggest a positive outlook for future revenue and earnings.

- Reliance on bioprocessing growth poses risks, as disruptions or underperformance could materially impact revenue amid a cautious biopharma spending environment.

Catalysts

About Avantor- Engages in the provision of mission-critical products and services to customers in the biopharma, healthcare, education and government, advanced technologies, and applied materials industries in the Americas, Europe, Asia, the Middle East, and Africa.

- The divestiture of Avantor's clinical services assets is expected to provide $500 million in cash to pay down debt and focus on higher growth, lower capital needs areas, positively impacting revenue growth and earnings.

- Avantor's ongoing cost transformation initiatives, aiming for $150 million in savings by the end of the year, are expected to improve margins and earnings through significant SG&A savings.

- The new Bridgewater Innovation Center and expansion of the Magnetic Mixing Systems portfolio demonstrate Avantor's commitment to innovation, which can drive future revenue growth.

- Rising order momentum in the bioprocessing segment suggests expected mid

- to high single-digit growth in Q4, potentially increasing future revenue and earnings.

- Strong free cash flow generation and debt repayment efforts are expected to reduce leverage, potentially improving net margins and investor confidence in long-term earnings growth.

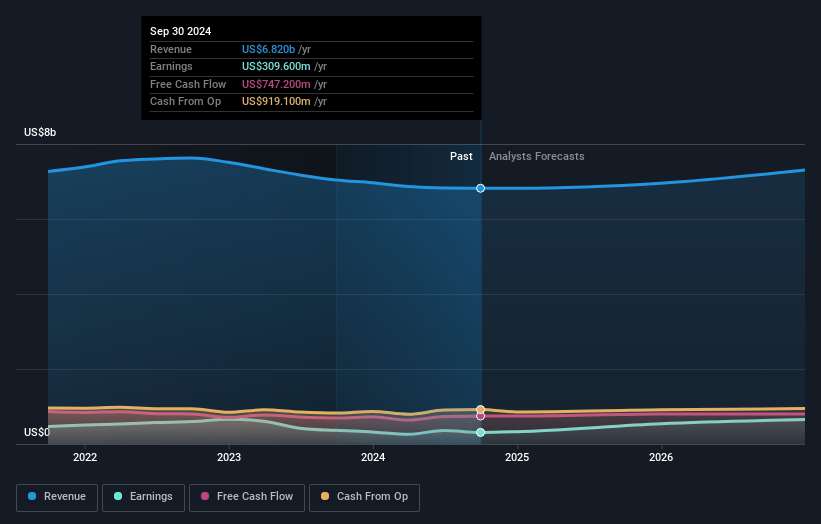

Avantor Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Avantor's revenue will grow by 3.6% annually over the next 3 years.

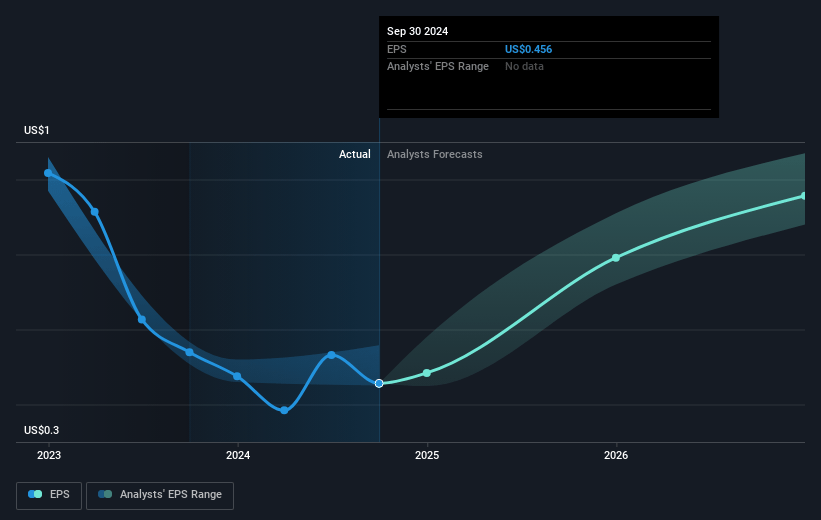

- Analysts assume that profit margins will increase from 4.5% today to 11.2% in 3 years time.

- Analysts expect earnings to reach $850.0 million (and earnings per share of $1.25) by about November 2027, up from $309.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 26.8x on those 2027 earnings, down from 43.4x today. This future PE is lower than the current PE for the US Life Sciences industry at 41.6x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.04%, as per the Simply Wall St company report.

Avantor Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The organic revenue decline of 0.7% year-over-year, despite overall growth, indicates potential challenges in maintaining steady revenue streams, which could impact future earnings and overall financial stability.

- Declines in the advanced technology sales in the US and pressure within the semiconductor industry highlight vulnerabilities in certain segments, potentially affecting revenue and net margins.

- The business's reliance on bioprocessing for growth is notable, but as expectations are set for mid

- to high single-digit growth, any disruptions or underperformance in this segment could materially impact revenue and earnings.

- The divestiture of clinical services, while strategically focused, reduces annual revenue projections by approximately $200 million, affecting short-term revenue and potentially impacting net margins due to loss of the business's scale.

- The cautious spending environment in the biopharma and healthcare sectors, influenced by economic conditions and budget constraints, poses risks to overall revenue growth, as these areas are significant contributors to Avantor’s income.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $27.31 for Avantor based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $33.0, and the most bearish reporting a price target of just $24.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $7.6 billion, earnings will come to $850.0 million, and it would be trading on a PE ratio of 26.8x, assuming you use a discount rate of 7.0%.

- Given the current share price of $19.72, the analyst's price target of $27.31 is 27.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives