Key Takeaways

- Advancing innovative treatments like WVE-007 and WVE-006 could drive revenue growth by addressing current therapy limitations and capturing market share in obesity and AATD.

- Strategic RNA editing developments and promising clinical trials position Wave Life Sciences to expand its market presence and achieve long-term revenue growth in metabolic and liver diseases.

- High R&D expenses and uncertain clinical outcomes pose risks to financial stability and market capture, amid profitability concerns from sustained net losses.

Catalysts

About Wave Life Sciences- A clinical-stage biotechnology company, designs, develops, and commercializes ribonucleic acid (RNA) medicines through PRISM, a discovery and drug development platform.

- The advancement of WVE-007, a GalNAc-siRNA for obesity, to the clinic is expected to provide a competitive edge in obesity treatment by addressing limitations of current GLP-1 therapies, which could drive future revenue growth through new market penetration.

- The development of WVE-006 for alpha-1 antitrypsin deficiency (AATD), with promising RNA editing potential and an easier delivery method compared to existing treatments, could significantly increase revenues if it successfully captures market share as the first treatment addressing the root cause of AATD.

- The progress in the Duchenne muscular dystrophy (DMD) pipeline, particularly WVE-N531's potential as a best-in-class therapeutic, may lead to increased earnings if regulatory approval is achieved and it captures share from existing therapies requiring more frequent dosing.

- The SELECT-HD trial results for WVE-003 in Huntington's disease, demonstrating allele-selective targeting, could position the drug favorably for approval and market adoption, which would positively impact revenue growth if it becomes a leading therapy in a currently underserved market.

- The potential strategic partnerships and advancements in the RNA editing pipeline, such as the PNPLA3 and LDLR programs, are expected to contribute to long-term revenue growth as these programs address large patient populations with high unmet needs in metabolic and liver diseases.

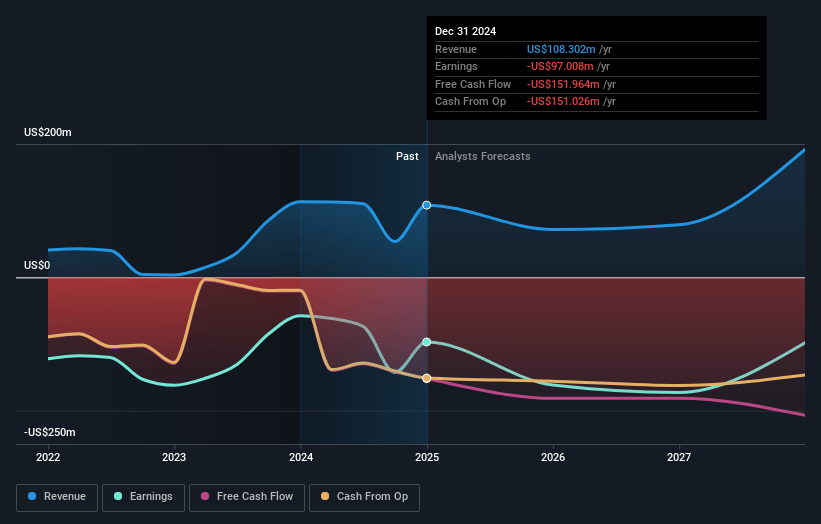

Wave Life Sciences Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Wave Life Sciences's revenue will grow by 21.0% annually over the next 3 years.

- Analysts are not forecasting that Wave Life Sciences will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Wave Life Sciences's profit margin will increase from -89.6% to the average US Pharmaceuticals industry of 20.5% in 3 years.

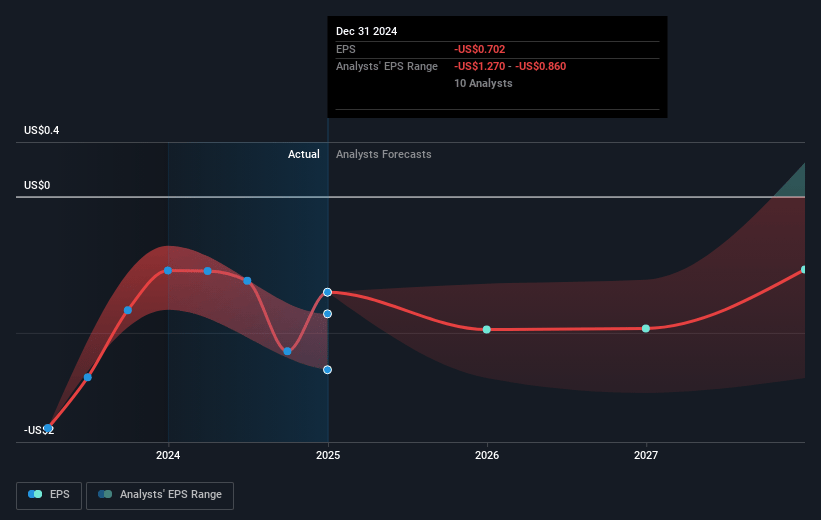

- If Wave Life Sciences's profit margin were to converge on the industry average, you could expect earnings to reach $39.2 million (and earnings per share of $0.21) by about March 2028, up from $-97.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $61 million in earnings, and the most bearish expecting $-239.1 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 131.6x on those 2028 earnings, up from -15.2x today. This future PE is greater than the current PE for the US Pharmaceuticals industry at 17.0x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.21%, as per the Simply Wall St company report.

Wave Life Sciences Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The competitive landscape in the obesity treatment market, with GLP-1 medications becoming standard and offering established efficacy, could challenge WVE-007's ability to capture significant market share and, therefore, impact future revenue growth for Wave Life Sciences.

- Clinical trials for products targeting obesity (WVE-007) and inherited disorders (WVE-006) are ongoing, and the outcomes are uncertain. If these products fail to demonstrate expected efficacy or face safety issues, it could negatively affect projected earnings and financial stability.

- Wave Life Sciences is incurring significant research and development expenses, which have increased over the past year. This trend could further pressure net margins if the company cannot offset these costs with revenue from successful product commercialization.

- The company faces execution risks related to the commercialization and regulatory pathways for its pipeline, particularly if the FDA or other regulatory bodies demand additional data or studies for approval, which may delay product launches and affect projected revenues and profits.

- Despite an increase in net cash, Wave Life Sciences still reported a net loss for the full year of 2024, highlighting an ongoing concern regarding profitability. Continued financial losses without a clear path to break-even can exert pressure on the company’s stock price and investor confidence.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $22.909 for Wave Life Sciences based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $36.0, and the most bearish reporting a price target of just $14.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $191.7 million, earnings will come to $39.2 million, and it would be trading on a PE ratio of 131.6x, assuming you use a discount rate of 6.2%.

- Given the current share price of $9.59, the analyst price target of $22.91 is 58.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.