Last Update07 May 25Fair value Decreased 1.05%

AnalystHighTarget has decreased revenue growth from 15.0% to 13.5%.

Read more...Key Takeaways

- Expansion into emerging market indications and continued innovation in organ manufacturing strengthen future growth prospects and market leadership.

- Strategic R&D reinvestment, disciplined pipeline expansion, and productivity focus support durable margins and rapid new product adoption.

- Heavy reliance on a narrow drug portfolio, regulatory and competitive risks, and growing pressure from policy and ESG concerns threaten revenue, margins, and future growth.

Catalysts

About United Therapeutics- A biotechnology company, engages in the development and commercialization of products to address the unmet medical needs of patients with chronic and life-threatening diseases in the United States and internationally.

- United Therapeutics’ commercial portfolio, led by Tyvaso and Tyvaso DPI, is set to benefit from a rising prevalence of pulmonary arterial hypertension and related chronic conditions as the global population ages, supporting both sustained volume growth and the expansion of the company’s addressable market in the coming years, which should drive continued double-digit revenue growth.

- The potential to expand Tyvaso’s use into larger market indications such as idiopathic pulmonary fibrosis, pending data from the TETON studies, represents a major near-term catalyst that could unlock significant new high-value revenue streams and extend the lifespan of their pulmonary hypertension franchise, positively affecting both top-line growth and market leadership.

- Breakthrough innovation in organ manufacturing and xenotransplantation—exemplified by upcoming clinical trials for 3D-printed and genetically engineered organs including UKidney and UHeart—positions United Therapeutics to capture large, first-mover opportunities in regenerative medicine as demographics and healthcare demands shift, offering the potential for transformative, high-margin revenue engines in the long term.

- The company’s strategic reinvestment in R&D and capital expenditures, combined with acquisitions and licensing of promising pipeline assets, demonstrates a disciplined approach to pipeline expansion while maintaining strict cost controls and industry-leading productivity per employee, which should support durable high net margins and EPS growth over the next decade.

- United Therapeutics is well-positioned to benefit from increased worldwide healthcare investment in personalized, advanced therapies—and favorable regulatory tailwinds for rare diseases—which together should increase the pace of new product adoption and support rapid revenue and earnings growth as the company brings next-generation treatments to market.

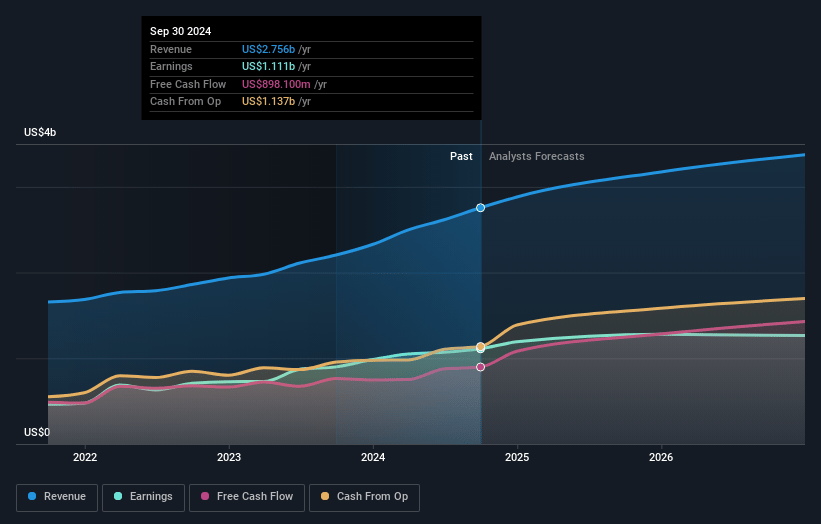

United Therapeutics Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on United Therapeutics compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming United Therapeutics's revenue will grow by 13.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 40.4% today to 45.3% in 3 years time.

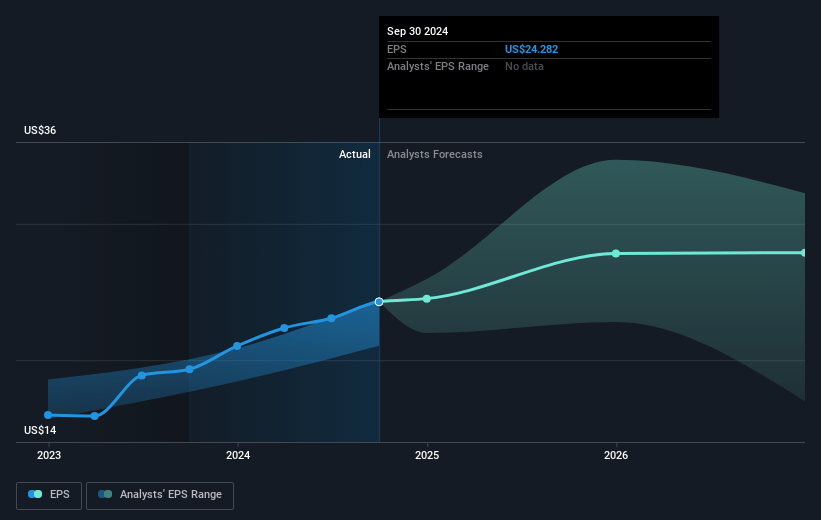

- The bullish analysts expect earnings to reach $2.0 billion (and earnings per share of $39.1) by about May 2028, up from $1.2 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 15.4x on those 2028 earnings, up from 11.0x today. This future PE is lower than the current PE for the US Biotechs industry at 18.3x.

- Analysts expect the number of shares outstanding to grow by 1.69% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.21%, as per the Simply Wall St company report.

United Therapeutics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- United Therapeutics continues to rely heavily on a concentrated portfolio of treprostinil-based pulmonary arterial hypertension therapies, making it highly vulnerable to future generic competition and therapeutic displacement when key patents expire, which could sharply erode revenue and earnings growth.

- Elevated research and development and capital expenditures targeting advanced platforms like xenotransplantation and organ manufacturing, while promising, present significant risks of clinical trial failure or regulatory delays—as evident from learnings and complications in ongoing studies—which could stall pipeline diversification and put sustained pressure on net margins.

- Intensifying competition in the pulmonary hypertension space, including new therapies such as Insmed’s TPIP and generic entrants, may erode United Therapeutics’ pricing power and market share, presenting risks to both revenue and long-term profitability.

- The evolving healthcare policy landscape, with ongoing Medicare Part D redesign, global drug pricing reform, and a push for lower specialty drug reimbursement, risks compressing future top-line growth and could force margin contraction if U.S. profit pools are eroded.

- Growing investor and societal focus on ESG issues, especially around access and affordability for rare disease therapies, may prompt more restrictive payer dynamics or regulatory scrutiny, negatively impacting future sales potential and brand perception, with potential downstream effects on revenue and long-term earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for United Therapeutics is $543.18, which represents two standard deviations above the consensus price target of $388.18. This valuation is based on what can be assumed as the expectations of United Therapeutics's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $600.0, and the most bearish reporting a price target of just $314.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $4.4 billion, earnings will come to $2.0 billion, and it would be trading on a PE ratio of 15.4x, assuming you use a discount rate of 6.2%.

- Given the current share price of $295.02, the bullish analyst price target of $543.18 is 45.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives