Key Takeaways

- Strong revenue growth driven by treprostinil products and potential expansion from new organ programs and market entries.

- Strategic investments and share buybacks enhance operational efficiency and shareholder value, supporting long-term growth.

- The company's dependence on continual innovation and existing product reliance, amid regulatory and competitive pressures, presents significant risks to revenue and margins.

Catalysts

About United Therapeutics- A biotechnology company, engages in the development and commercialization of products to address the unmet medical needs of patients with chronic and life-threatening diseases in the United States and internationally.

- United Therapeutics continues to experience strong revenue growth from its treprostinil products, with Tyvaso DPI positioned for sustained long-term growth due to its convenience and market exclusivity, which should positively impact revenue and earnings.

- The company's pipeline is robust, with 5 registration phase studies underway and anticipated FDA submissions for new organ programs (UTHYMOKIDNEY and UHeart), potentially expanding future revenue streams and driving growth.

- In terms of capital allocation, United Therapeutics is investing in new manufacturing facilities and has completed acquisitions to enhance its organ development capabilities, which could improve operational efficiencies and long-term net margins.

- An accelerated share repurchase program was executed, returning $1 billion to shareholders, which could enhance earnings per share by reducing the number of shares outstanding.

- Future growth could also be fueled by entering new markets such as idiopathic pulmonary fibrosis, pending positive data from TETON studies, substantially increasing the addressable market and future revenue potential.

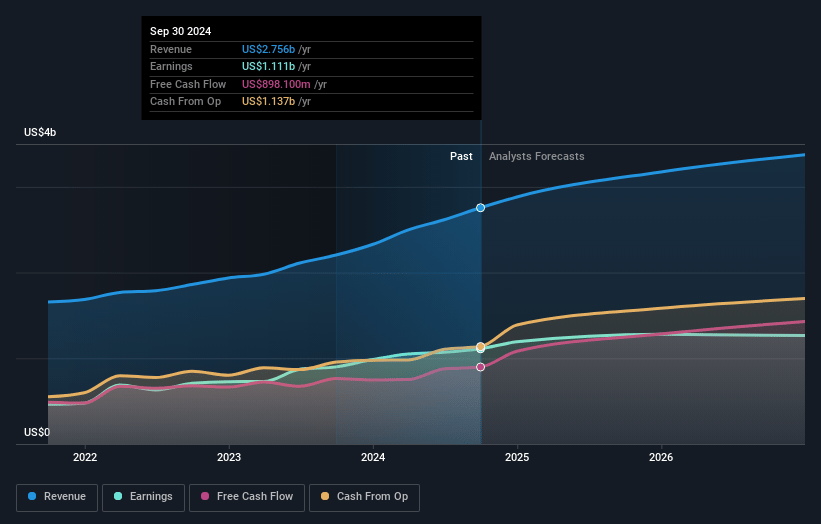

United Therapeutics Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming United Therapeutics's revenue will grow by 7.3% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 41.5% today to 40.8% in 3 years time.

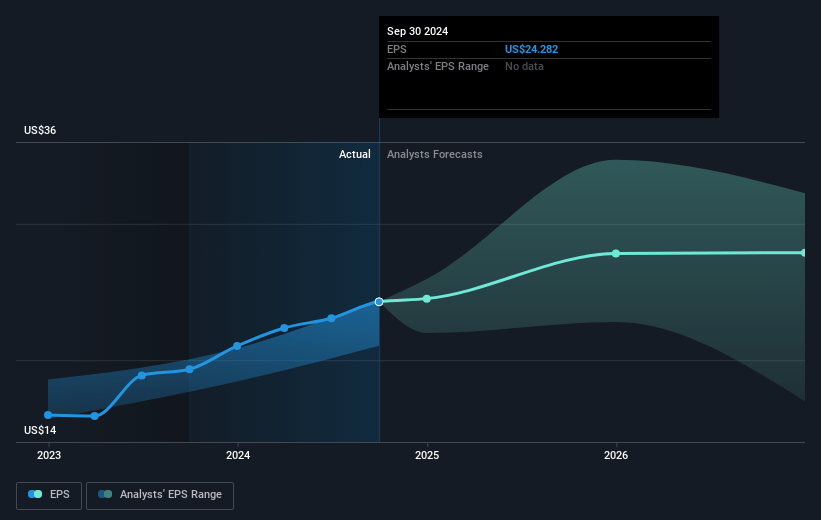

- Analysts expect earnings to reach $1.4 billion (and earnings per share of $28.97) by about April 2028, up from $1.2 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $2.0 billion in earnings, and the most bearish expecting $908.8 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.9x on those 2028 earnings, up from 11.3x today. This future PE is lower than the current PE for the US Biotechs industry at 20.4x.

- Analysts expect the number of shares outstanding to grow by 1.25% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.44%, as per the Simply Wall St company report.

United Therapeutics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The reliance on continuous pipeline innovation and the assumption that all clinical trials will progress as expected adds significant risk; any setbacks in their trials could materially impact future revenue projections.

- The company's substantial capital spending on internal R&D and manufacturing expansions could strain financial resources if expected revenues do not materialize, thereby affecting net margins.

- United Therapeutics' reliance on existing products like Tyvaso for revenue growth in an increasingly competitive market poses the risk that emerging competitors may capture market share, impacting future revenue streams.

- Regulatory uncertainties inherent in the biotech industry, like those involving the FDA, pose significant risks that could delay new product launches or expand market access, affecting earnings growth.

- Changes in healthcare policies, such as those affecting drug pricing and Medicare Part D redesigns, could pressure pricing power and profit margins if company missteps in navigating these policy shifts.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $388.015 for United Therapeutics based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $600.0, and the most bearish reporting a price target of just $314.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.6 billion, earnings will come to $1.4 billion, and it would be trading on a PE ratio of 14.9x, assuming you use a discount rate of 6.4%.

- Given the current share price of $300.76, the analyst price target of $388.02 is 22.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.