Narratives are currently in beta

Key Takeaways

- Strategic advancements in pulmonary health products and organ technologies could significantly boost revenue and open high-growth markets.

- Accelerated share repurchase programs may improve earnings per share, reflecting a focus on shareholder value.

- Success with Tyvaso and IPF developments is promising, but competition, litigation, and operational challenges could limit revenue growth and impact margins.

Catalysts

About United Therapeutics- A biotechnology company, engages in the development and commercialization of products to address the unmet medical needs of patients with chronic and life-threatening diseases in the United States and internationally.

- United Therapeutics is expecting significant revenue growth through the introduction of new indications for their existing product, Tyvaso, in idiopathic pulmonary fibrosis (IPF), supported by forthcoming clinical trial data expected in 2025. This expansion could drive double-digit revenue growth in the near to midterm with expanded market penetration.

- The company anticipates completing the ADVANCE OUTCOMES study for Ralinepag in pulmonary arterial hypertension (PAH) by 2026, which could lead to product approval and a new revenue stream, positively impacting their earnings growth trajectory.

- Regulatory advancements, such as the FDA action expected in 2025 on the Centralized Lung Evaluation System (CLES) and Ex Vivo Lung Perfusion technology, could open new avenues for revenue and increase operational efficiency, thereby potentially improving net margins.

- United Therapeutics is engaging in accelerated share repurchase programs, which are likely to boost earnings per share by reducing the share count, while demonstrating a commitment to returning capital to shareholders.

- The company's focus on innovative organ alternative technologies in its Revolution Wave, including the miroliverELAP safety study and UKidney, highlights their potential to open new high-growth market segments, thereby setting the stage for substantial long-term revenue growth.

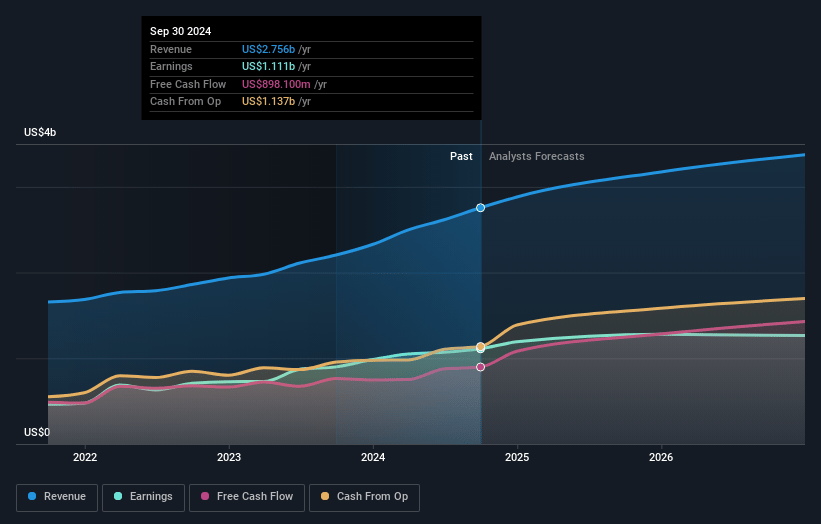

United Therapeutics Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming United Therapeutics's revenue will grow by 9.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 40.3% today to 40.7% in 3 years time.

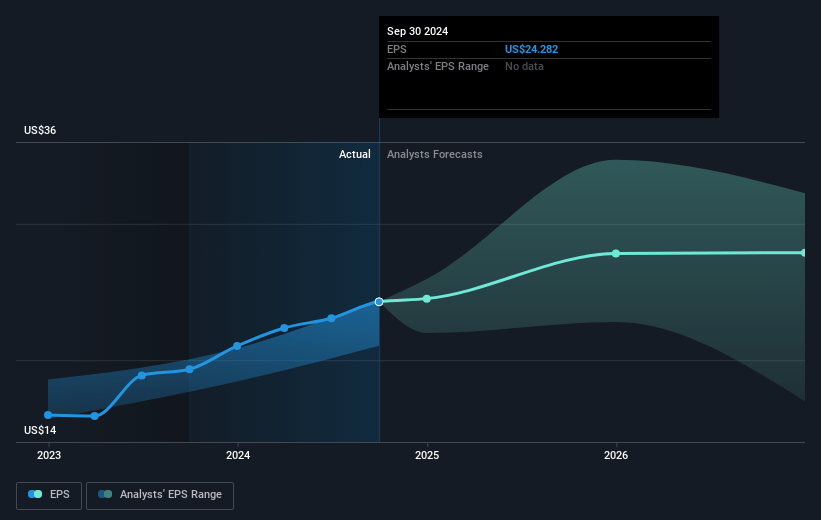

- Analysts expect earnings to reach $1.5 billion (and earnings per share of $30.05) by about November 2027, up from $1.1 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $371.1 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.0x on those 2027 earnings, down from 16.1x today. This future PE is about the same as the current PE for the US Biotechs industry at 15.0x.

- Analysts expect the number of shares outstanding to grow by 2.87% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.16%, as per the Simply Wall St company report.

United Therapeutics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The successful history with Tyvaso and anticipation for IPF developments are promising, but the existing competition and further market entry threats could limit revenue growth.

- The litigation accrual of $65.1 million as a result of the Sandoz case could potentially affect net margins if similar issues arise or if liabilities increase.

- The dependency on upcoming clinical trials and FDA approvals for the pipeline (like the TETON 2 study or Ralinepag) introduces uncertainty regarding future earnings and revenue streams.

- Despite efforts to support growth, potential operational challenges in expanding or scaling manufacturing facilities could impact future revenue if capacity doesn't meet demand.

- The initiation of new contracts, especially in Part D and response strategies for competitor threats, may cause fluctuations or limitations in net revenue due to changes in the gross-to-net trajectory.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $382.29 for United Therapeutics based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $600.0, and the most bearish reporting a price target of just $221.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $3.6 billion, earnings will come to $1.5 billion, and it would be trading on a PE ratio of 15.0x, assuming you use a discount rate of 6.2%.

- Given the current share price of $400.45, the analyst's price target of $382.29 is 4.7% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives