Key Takeaways

- BRIUMVI's international expansion and enhanced administration methods promise continued revenue growth and expanded market share.

- New indications and a subcutaneous formulation of BRIUMVI could diversify revenue and boost market penetration.

- Intensifying competition, regulatory challenges, and potential clinical setbacks could limit TG Therapeutics' market expansion and strain resources, impacting revenue and net margins.

Catalysts

About TG Therapeutics- A commercial stage biopharmaceutical company, focuses on the acquisition, development, and commercialization of novel treatments for B-cell mediated diseases in the United States and internationally.

- The launch and expansion of BRIUMVI's use internationally, with ongoing positive feedback and adoption in the EU and the UK, suggest continued revenue growth potential in 2025 and beyond.

- The further enhancement of BRIUMVI through trials like the ENHANCE study, showcasing improved administration methods (e.g., consolidating initial doses) and increased safety profiles, could lead to expanded market share and higher revenues.

- Developing a subcutaneous formulation of BRIUMVI, which is expected to start pivotal trials soon, could tap into a segment of the MS market seeking convenient at-home administration, potentially increasing revenue and market penetration.

- The exploration of additional indications for BRIUMVI, like myasthenia gravis, indicates a potential for revenue diversification and growth in autoimmune disease markets beyond MS.

- The extension of BRIUMVI's patent protection to 2042 provides long-term security and potential for sustained earnings from the exclusivity in the marketplace.

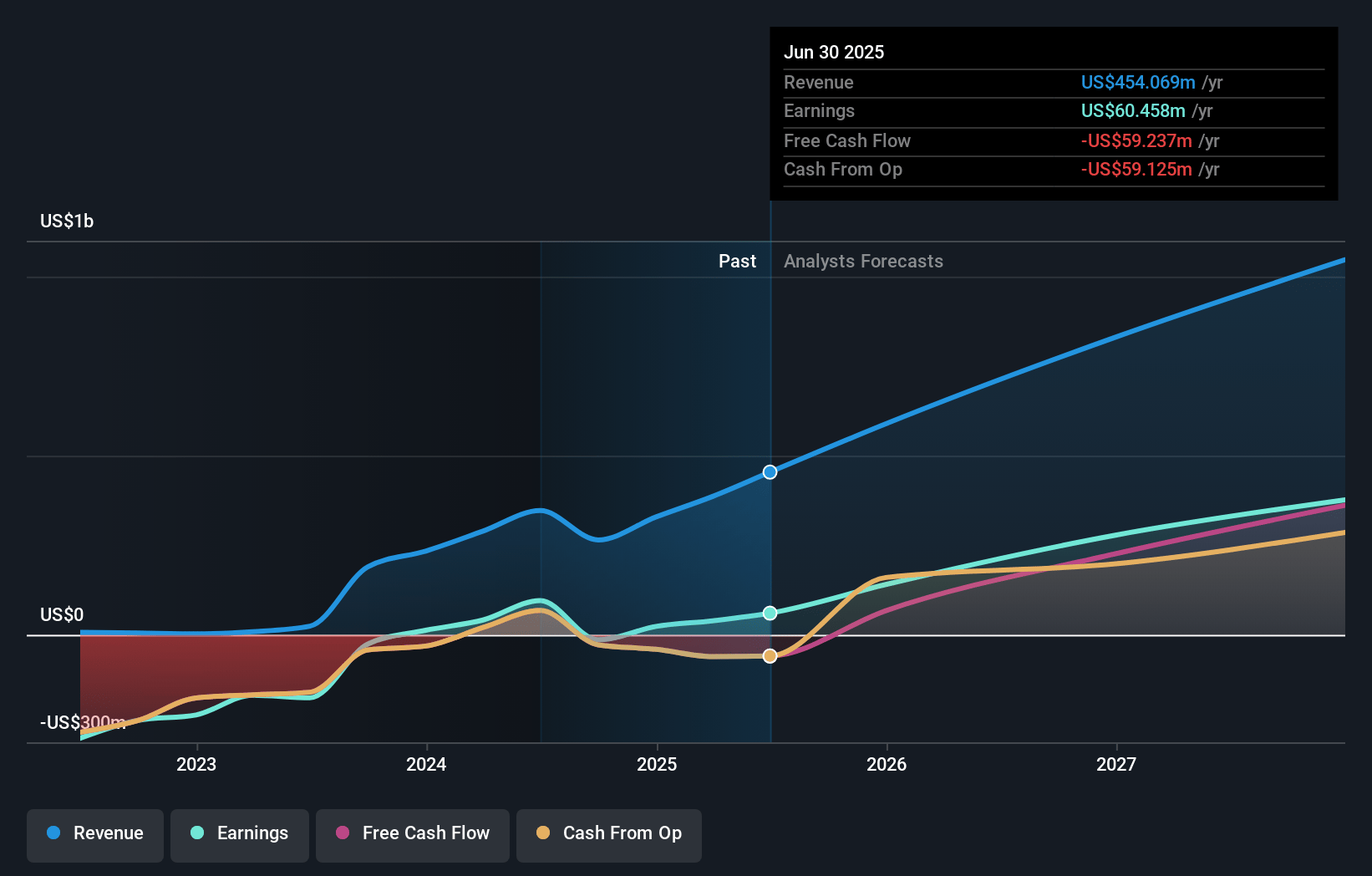

TG Therapeutics Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming TG Therapeutics's revenue will grow by 43.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.1% today to 42.1% in 3 years time.

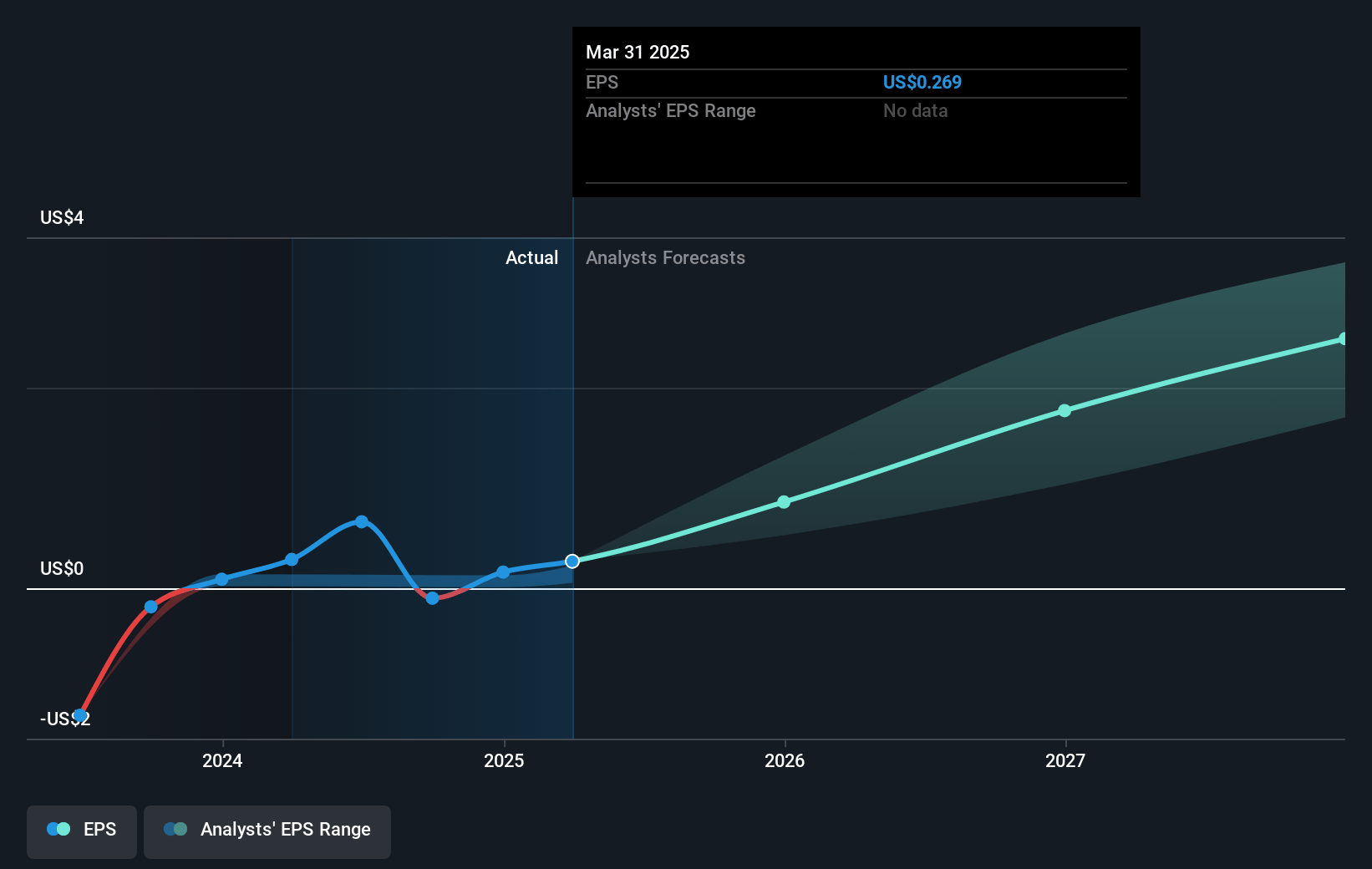

- Analysts expect earnings to reach $407.2 million (and earnings per share of $2.55) by about March 2028, up from $23.4 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $496.3 million in earnings, and the most bearish expecting $281.6 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.1x on those 2028 earnings, down from 247.7x today. This future PE is lower than the current PE for the US Biotechs industry at 19.6x.

- Analysts expect the number of shares outstanding to grow by 1.45% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.3%, as per the Simply Wall St company report.

TG Therapeutics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The competitive landscape for relapsing MS treatments is intensifying, with a new entrant already impacting the market, potentially limiting TG Therapeutics' ability to expand its market share and boost revenues significantly.

- The reliance on future pivotal trials for the subcutaneous version of BRIUMVI and other label expansions could introduce delays or unforeseen setbacks, impacting revenue growth projections.

- Any adverse data from clinical studies or unexpected safety concerns could negatively affect physician and patient confidence in BRIUMVI, which might impact demand and ultimately revenue.

- TG Therapeutics' entry into new therapeutic areas such as myasthenia gravis faces existing competition and may require substantial investment that could strain resources and affect net margins.

- Variability in international market acceptance and regulatory hurdles could affect the revenue contribution from ex-U.S. markets, thereby impacting overall financial performance.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $42.833 for TG Therapeutics based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $55.0, and the most bearish reporting a price target of just $10.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $967.0 million, earnings will come to $407.2 million, and it would be trading on a PE ratio of 19.1x, assuming you use a discount rate of 6.3%.

- Given the current share price of $39.88, the analyst price target of $42.83 is 6.9% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.