Key Takeaways

- Growth driven by expanding CNS patient pool, innovative product launches, and pipeline advancements supports higher revenue, margin expansion, and robust market positioning.

- Strong balance sheet and targeted acquisitions enable portfolio diversification, providing flexibility for inorganic growth and increased long-term shareholder value.

- Heavy reliance on a few core products, rising costs, and increased competitive, pricing, and regulatory pressures threaten Supernus’s revenue stability, margins, and long-term growth prospects.

Catalysts

About Supernus Pharmaceuticals- A biopharmaceutical company, develops and commercializes products for the treatment of central nervous system (CNS) diseases in the United States.

- Expanding patient pool for core products—Qelbree and GOCOVRI—driven by increased prevalence and diagnosis of CNS disorders, as well as broader healthcare access (especially among Medicare patients, as seen with GOCOVRI’s prescription growth), is likely to sustain robust top-line revenue growth.

- Commercial infrastructure and recent launch of ONAPGO position Supernus to capture further market share in Parkinson’s disease, benefiting from demographic aging and rising CNS disease burden, which should materially boost revenue and improve gross margins as fixed costs are leveraged.

- Deep pipeline progress—advancements in late-stage candidates like SPN-820 (major depressive disorder) and SPN-443 (next-gen ADHD/CNS disorders)—support future earnings and revenue growth through innovative, differentiated therapies with potentially larger addressable markets.

- Life cycle management and product differentiation (e.g., Qelbree’s strong adoption in untreated and switch patients, ONAPGO's novel delivery and add-on use) create defensive moats, supporting sustained net margin expansion as established products mature.

- Significant balance sheet strength and explicit focus on strategic acquisitions and partnerships provide optionality for inorganic growth, enabling portfolio diversification and long-term operating leverage, likely contributing to EPS growth and valuation re-rating.

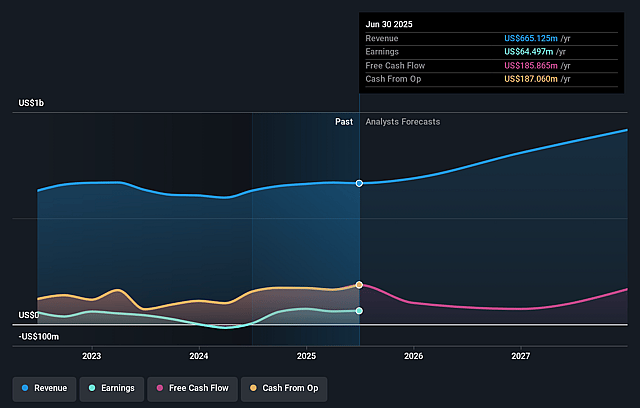

Supernus Pharmaceuticals Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Supernus Pharmaceuticals's revenue will grow by 7.8% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 9.3% today to 6.6% in 3 years time.

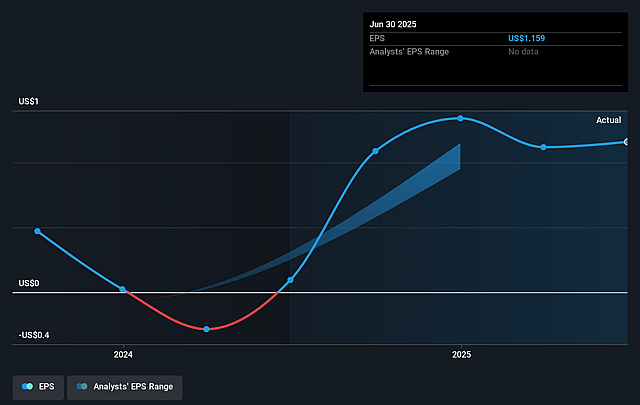

- Analysts expect earnings to reach $55.4 million (and earnings per share of $0.98) by about July 2028, down from $61.9 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 56.8x on those 2028 earnings, up from 33.8x today. This future PE is greater than the current PE for the US Pharmaceuticals industry at 17.6x.

- Analysts expect the number of shares outstanding to grow by 1.6% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.4%, as per the Simply Wall St company report.

Supernus Pharmaceuticals Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Supernus faces increasing pressure on drug pricing, with gross-to-net adjustments for Qelbree reaching 51–52% in Q1 and consensus expectations of net pricing potentially limited to small increases—this is likely to constrain long-term growth in revenue and net margins as payers exert more influence and healthcare systems adopt stricter value-based reimbursement.

- The company’s top-line remains heavily reliant on a small number of core products (Qelbree and GOCOVRI account for 67% of net sales), heightening vulnerability to market exclusivity loss, generic entry, and competitive pressures in the CNS space, which could drive revenue volatility and erode gross margins as flagship products mature.

- Despite a deep pipeline, Supernus has a mixed track record in clinical development: advancement of candidates like SPN-820 and SPN-443 faces uncertainty, with the timeline for key data readouts extending at least 1.5 years and historic challenges in differentiating efficacy endpoints. Any failure or delay risks R&D write-offs and undermines long-term earnings growth.

- SG&A and R&D expenses are rising in tandem with the launch of ONAPGO and pipeline development, leading to persistent GAAP operating losses (Q1 2025: −$10.3M), which, if sales growth slows or new products underperform, could compress net margins and limit the ability to fund future innovation or M&A.

- The CNS/specialty pharma sector is rapidly evolving thanks to gene, cell, and biologic therapies, and larger competitors like AbbVie aggressively launch alternative treatments. This trend may render traditional small-molecule drugs less competitive, shrinking Supernus’s addressable market and reducing both revenue potential and long-term earnings power.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $40.2 for Supernus Pharmaceuticals based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $45.0, and the most bearish reporting a price target of just $36.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $837.3 million, earnings will come to $55.4 million, and it would be trading on a PE ratio of 56.8x, assuming you use a discount rate of 6.4%.

- Given the current share price of $33.45, the analyst price target of $40.2 is 16.8% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.