Key Takeaways

- Addressing operational delays and administrative complexities in gene therapy could enhance revenue by quickly converting demand into treated patients.

- Expanding into LGMD and siRNA platforms diversifies revenue, potentially boosting earnings and financial stability.

- Safety concerns and administrative delays could impact ELEVIDYS demand and revenue growth, while high research costs pressure profitability amidst cautious market uptake.

Catalysts

About Sarepta Therapeutics- A commercial-stage biopharmaceutical company, focuses on the discovery and development of RNA-targeted therapeutics, gene therapies, and other genetic therapeutic modalities for the treatment of rare diseases.

- Sarepta's ELEVIDYS product has shown significant revenue growth, but due to operational delays and safety concerns, there is room for further patient and physician education which could drive revenue as confidence in the therapy is restored and more families choose to access the treatment.

- Administrative complexities in gene therapy, including longer start form to infusion times, can be improved, potentially streamlining processes and enhancing future revenue by more quickly translating demand into treated patients.

- Efforts to balance demand across affiliated treatment centers with additional capacity could improve the ability to treat more patients, advancing revenue growth as these centers become more effective and productive in patient throughput.

- The scheduled dissemination of additional safety and efficacy data for ELEVIDYS, and anticipated label updates for new patient populations, provides clear pathways to further demonstrate the therapy’s positive risk-benefit, likely enhancing long-term revenue drivers.

- Development and commercialization of other programs like the LGMD and siRNA platforms represent additional revenue streams. Expansion within these areas could drive significant future earnings and diversify Sarepta's product portfolio, positively impacting overall financial health.

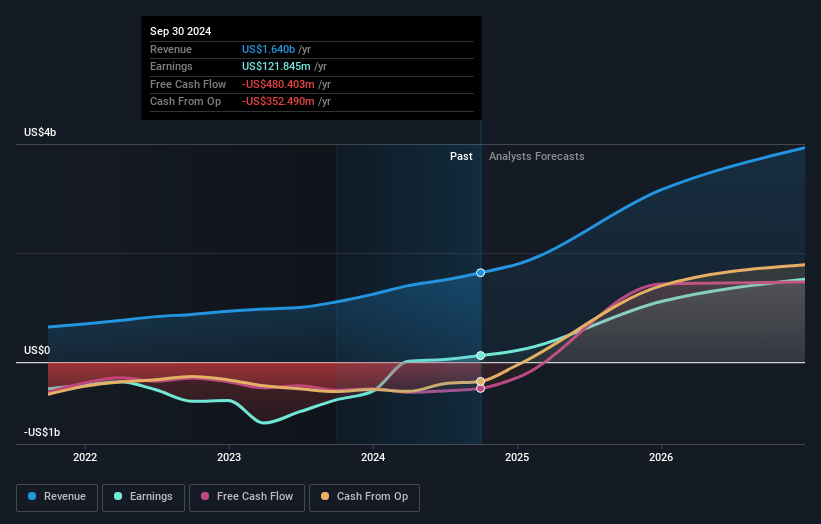

Sarepta Therapeutics Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Sarepta Therapeutics's revenue will grow by 28.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 12.4% today to 41.4% in 3 years time.

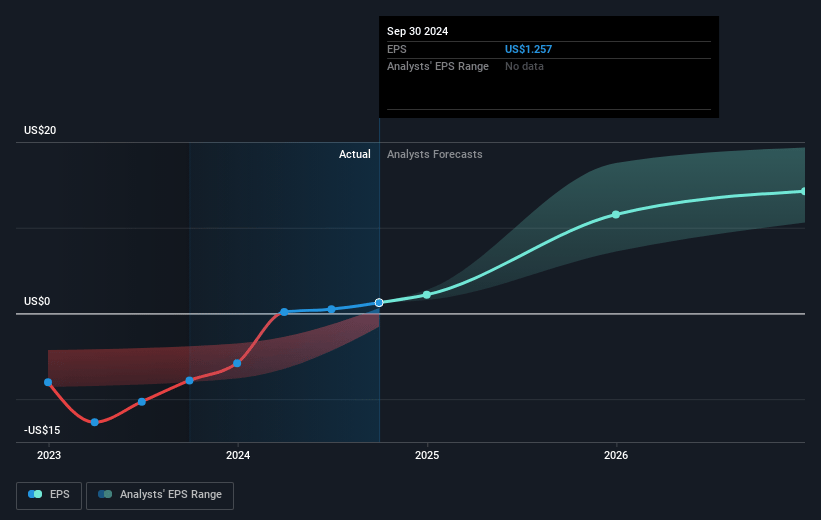

- Analysts expect earnings to reach $1.7 billion (and earnings per share of $13.56) by about May 2028, up from $235.2 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $2.3 billion in earnings, and the most bearish expecting $616.4 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.3x on those 2028 earnings, down from 19.5x today. This future PE is lower than the current PE for the US Biotechs industry at 18.3x.

- Analysts expect the number of shares outstanding to grow by 2.65% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.47%, as per the Simply Wall St company report.

Sarepta Therapeutics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The tragic event of a child's acute liver failure and death following ELEVIDYS infusion could lead to increased scrutiny, cautious patient uptake, and potential regulatory challenges, impacting revenue growth.

- Complex and prolonged administrative processes for gene therapy infusions, including issues like single-case agreements, can delay treatments and thus defer revenue recognition.

- The dependency on a few top sites with limited capacity, coupled with a significant backlog, creates bottlenecks in patient treatment, thereby affecting the timing of revenue realization.

- Safety concerns stemming from the recent patient death may affect physician and patient confidence, influencing demand for ELEVIDYS and potentially impacting earnings.

- High upfront costs for research and collaborations, evidenced by the significant expenses with Arrowhead, might pressure net margins and overall profitability in the face of slower than expected revenue recognition.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $147.332 for Sarepta Therapeutics based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $209.0, and the most bearish reporting a price target of just $70.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $4.0 billion, earnings will come to $1.7 billion, and it would be trading on a PE ratio of 11.3x, assuming you use a discount rate of 6.5%.

- Given the current share price of $46.75, the analyst price target of $147.33 is 68.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.