Narratives are currently in beta

Key Takeaways

- Expanding SRP-9003 and development of new treatments could diversify revenue and drive future growth through accelerated approvals.

- Transitioning ELEVIDYS manufacturing could enhance efficiency and margins, while addressing new patient groups may expand market reach.

- Discontinuation of SRP-5051 and potential regulatory delays may hinder innovation and pipeline growth, impacting revenue, market share, and profitability prospects.

Catalysts

About Sarepta Therapeutics- A commercial-stage biopharmaceutical company, focuses on the discovery and development of RNA-targeted therapeutics, gene therapies, and other genetic therapeutic modalities for the treatment of rare diseases.

- Sarepta Therapeutics plans to file a BLA in 2025 for SRP-9003 to treat limb-girdle muscular dystrophy Type 2E, which could lead to new revenue streams and drive future revenue growth.

- The commencement of trials for SRP-9004 and SRP-9005 for limb-girdle muscular dystrophy is expected in late 2024 and early 2025, respectively, with both programs intended to support accelerated approval, potentially increasing earnings through pipeline expansion.

- Sarepta's program to transition ELEVIDYS to suspension manufacturing, with positive interactions with the FDA, aims to enhance production efficiency, potentially improving net margins.

- The development of strategies to enable ELEVIDYS administration to patients with pre-existing anti-AAVrh74 antibodies and those under 4 years; success in these areas could expand the addressable market and boost revenue.

- Sarepta's healthy financial position, with projections to turn cash flow positive early in 2025, provides a foundation for investments in accelerating pipeline development, potentially enhancing long-term earnings.

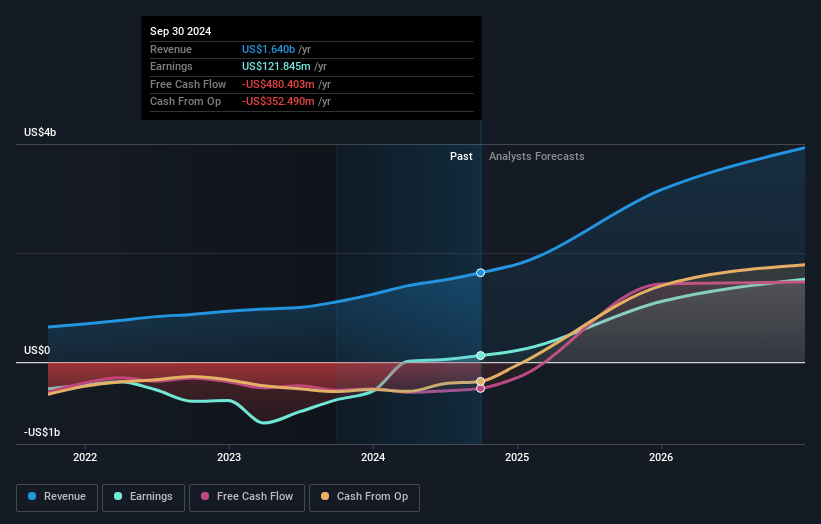

Sarepta Therapeutics Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Sarepta Therapeutics's revenue will grow by 37.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.4% today to 41.3% in 3 years time.

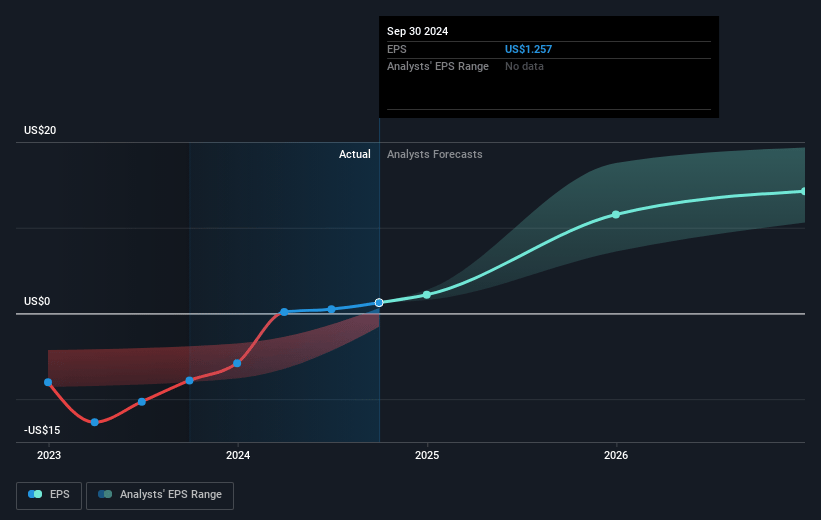

- Analysts expect earnings to reach $1.8 billion (and earnings per share of $15.83) by about November 2027, up from $121.8 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $2.0 billion in earnings, and the most bearish expecting $1.2 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.4x on those 2027 earnings, down from 89.6x today. This future PE is lower than the current PE for the US Biotechs industry at 16.1x.

- Analysts expect the number of shares outstanding to grow by 5.19% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.33%, as per the Simply Wall St company report.

Sarepta Therapeutics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The discontinuation of the SRP-5051 PPMO development program due to safety concerns and an inability to obtain regulatory approval could impact Sarepta's ability to innovate and expand its product offerings, potentially affecting future revenue streams.

- A potential delay or failure in obtaining approvals for limb-girdle muscular dystrophy programs could hinder future pipeline growth, affecting long-term revenue potential and market expansion.

- The financial impact of termination costs associated with manufacturing agreements, along with high R&D expenses, may pressure net margins and profitability if not offset by revenue gains.

- Competitive pressures and the evolving Duchenne therapy landscape, such as increased scrutiny from the FDA and competition, could affect Sarepta's ability to maintain market share and future earnings growth.

- Although ELEVIDYS sales are strong, its reliance on successful payer negotiations and site capacities suggests vulnerability to potential hurdles in reimbursement access and patient treatment that could impact revenue and earnings projections.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $189.86 for Sarepta Therapeutics based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $219.0, and the most bearish reporting a price target of just $147.12.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $4.3 billion, earnings will come to $1.8 billion, and it would be trading on a PE ratio of 14.4x, assuming you use a discount rate of 6.3%.

- Given the current share price of $114.32, the analyst's price target of $189.86 is 39.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives