Key Takeaways

- Evolve's successful launch is enhancing margins and creating new market opportunities, bolstering revenue growth.

- Cost reduction through strategy shifts and e-commerce partnerships boosts financial performance and paves the way for significant international expansion.

- Aggressive cost-reduction may not go as planned, with risks from reliance on large contracts, international regulatory delays, and potentially dilutive strategic financing.

Catalysts

About SenesTech- Engages in the development and commercialization of a technology for managing animal pest populations through fertility control.

- SenesTech's introduction of the Evolve soft bait fertility control solution has significantly boosted revenue and margins. Evolve's improved features and economical pricing are expanding distribution and creating new market opportunities, likely increasing revenue and gross margin.

- The company is targeting a substantial reduction in operating expenses by pausing new product development and bringing certain functions in-house, which should enhance net margins as operational costs are streamlined.

- Strong growth in e-commerce sales, driven by key partnerships with online retailers like Amazon and Walmart, is expected to continue, contributing significantly to future revenue increases.

- Strategic expansions into municipal and warehousing sectors, with new contracts in cities like New York and Baltimore and large warehousing companies, are anticipated to drive revenue growth as these sectors face unique challenges that SenesTech's products can address.

- International expansion through distribution agreements in multiple countries, along with increasing product approvals, positions SenesTech for significant future revenue growth from global markets.

SenesTech Future Earnings and Revenue Growth

Assumptions

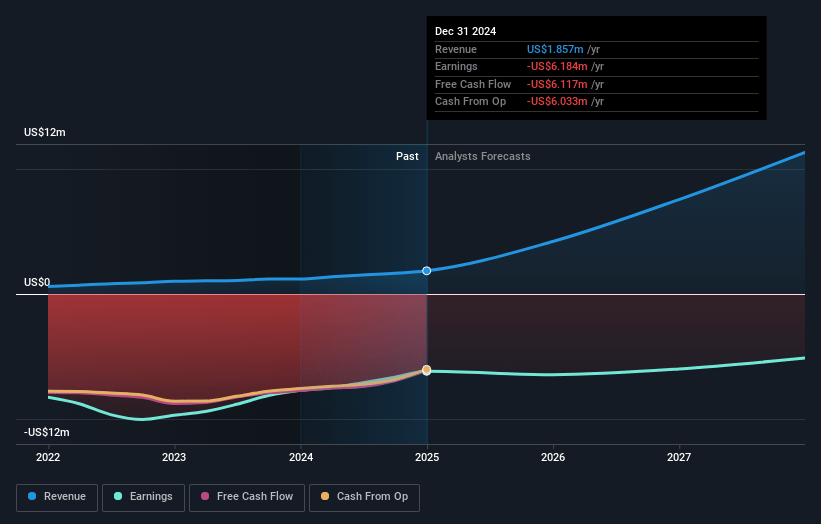

How have these above catalysts been quantified?- Analysts are assuming SenesTech's revenue will grow by 82.7% annually over the next 3 years.

- Analysts are not forecasting that SenesTech will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate SenesTech's profit margin will increase from -333.0% to the average US Pharmaceuticals industry of 20.0% in 3 years.

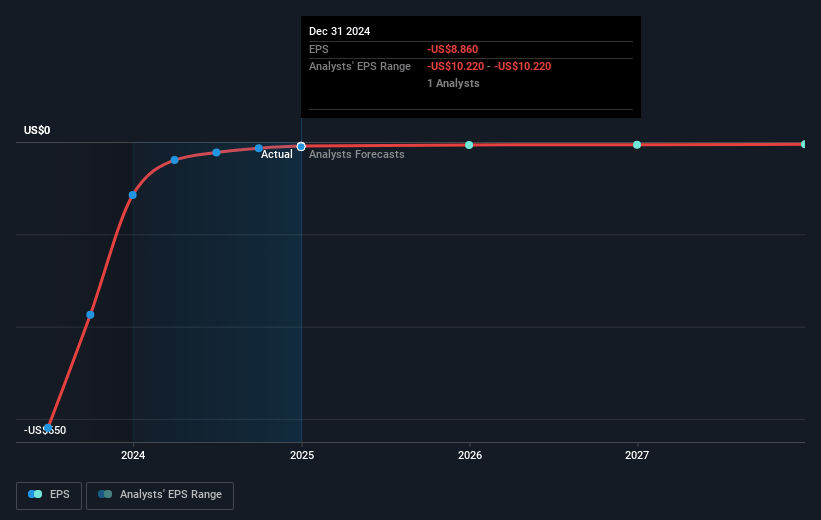

- If SenesTech's profit margin were to converge on the industry average, you could expect earnings to reach $2.3 million (and earnings per share of $1.14) by about May 2028, up from $-6.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.6x on those 2028 earnings, up from -0.6x today. This future PE is lower than the current PE for the US Pharmaceuticals industry at 17.2x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.21%, as per the Simply Wall St company report.

SenesTech Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- SenesTech is aiming for cash flow breakeven, requiring aggressive cost-reduction and efficiency strategies, which might not materialize as planned, potentially affecting net margins and earnings.

- The company's reliance on large contracts and their execution, like with New York City, poses a risk if these projects do not expand as expected, impacting revenue growth projections.

- International distribution is dependent on obtaining country-specific registrations, a process that can be lengthy and uncertain, potentially delaying expected revenue from these markets.

- New product launches and expansions into sectors like e-commerce and warehousing require significant upfront investments, and any failure to achieve anticipated market penetration could impede revenue and profitability.

- The company's strategic financing involves warrant repricing, which could be a concern if exercised under unfavorable terms, potentially diluting share value and impacting earnings per share.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $10.0 for SenesTech based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $11.3 million, earnings will come to $2.3 million, and it would be trading on a PE ratio of 10.6x, assuming you use a discount rate of 6.2%.

- Given the current share price of $2.28, the analyst price target of $10.0 is 77.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.