Narratives are currently in beta

Key Takeaways

- Strategic acquisitions of royalties on new therapies and synthetic royalty transactions are expected to drive revenue growth and enhance net margins.

- Effective capital allocation, including share buybacks, aims to boost earnings per share and shareholder value by leveraging market value discrepancies.

- Slowing growth in key assets and dependency on successful therapy launches amidst high debt create revenue challenges and potential margin impacts.

Catalysts

About Royalty Pharma- Operates as a buyer of biopharmaceutical royalties and a funder of innovations in the biopharmaceutical industry in the United States.

- The acquisition of royalties on newly FDA-approved therapies like Cobenfy, Voranigo, and Tremfya is expected to drive future revenue growth due to their market potential and therapeutic significance in schizophrenia, glioma, and ulcerative colitis respectively.

- The company's pipeline for acquiring new royalties is robust, with recent transactions on innovative therapies like Niktimvo, which are projected to impact revenue growth significantly, reflecting confidence in a sustained increase in Royalty Receipts.

- Synthetic royalty transactions are positioned as a growing opportunity in biopharma funding, indicating a strategic expansion that could enhance revenue streams and bolster net margins through innovative financial solutions.

- The business model's efficiency and substantial cash flow generation allow for reinvestment into high-quality royalties, facilitating potential earnings and revenue growth by capitalizing on strategic royalty acquisitions.

- A strong capital allocation strategy, including substantial shares buyback, is aimed at driving earnings per share growth, effectively using a disconnect between intrinsic value and stock price to enhance shareholder value.

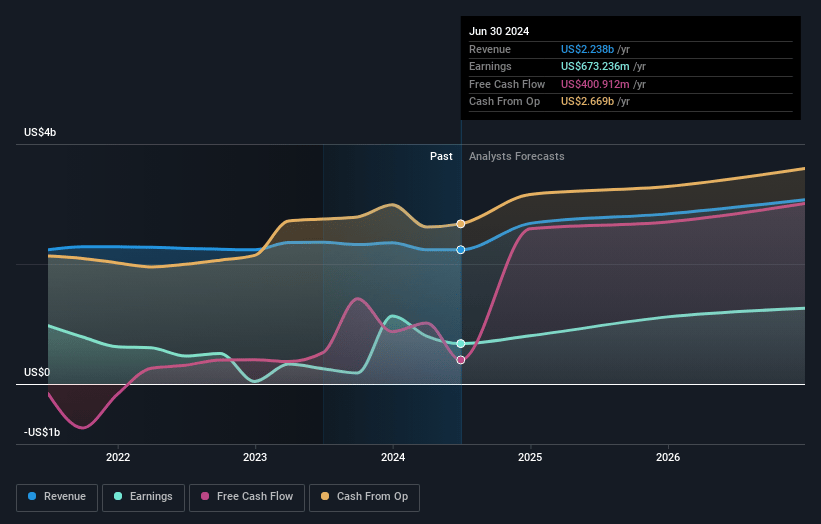

Royalty Pharma Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Royalty Pharma's revenue will grow by 7.3% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 50.5% today to 36.7% in 3 years time.

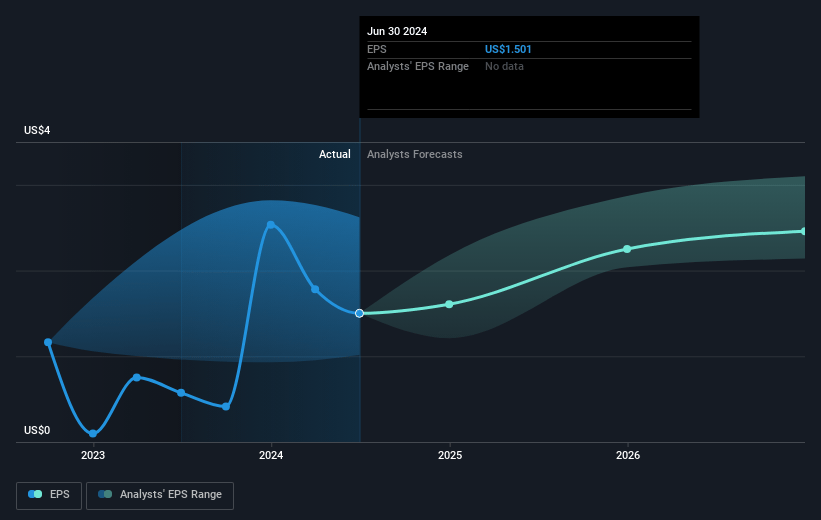

- Analysts expect earnings to reach $1.0 billion (and earnings per share of $2.25) by about November 2027, down from $1.1 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as $1.9 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.9x on those 2027 earnings, up from 10.1x today. This future PE is greater than the current PE for the US Pharmaceuticals industry at 19.9x.

- Analysts expect the number of shares outstanding to decline by 8.2% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.92%, as per the Simply Wall St company report.

Royalty Pharma Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The high base of comparison due to the $525 million in accelerated Biohaven payments in 2023 poses a challenge as these receipts are expected to decrease significantly in 2024, which could impact Portfolio Receipts and overall revenue.

- The company has a significant amount of outstanding debt, with $7.8 billion in investment-grade debt and a $1.5 billion increment raised, impacting net interest payments and potentially affecting net margins.

- There is a risk associated with synthetic royalty transactions as it represents an emerging funding modality, constituting only 3% of biopharma funding historically; this could impact long-term earnings if these investments do not perform as expected.

- Revenue growth largely hinges on successful product launches and market acceptance of new therapies like Niktimvo and their competitive positioning against established therapies, which creates uncertainty in achieving projected revenue growth.

- Key assets such as the cystic fibrosis franchise are starting to mature, leading to concerns about maintaining high growth rates; slower growth in these traditional revenue sources could negatively affect overall financial performance.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $41.53 for Royalty Pharma based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $51.0, and the most bearish reporting a price target of just $28.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $2.8 billion, earnings will come to $1.0 billion, and it would be trading on a PE ratio of 21.9x, assuming you use a discount rate of 5.9%.

- Given the current share price of $26.01, the analyst's price target of $41.53 is 37.4% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives