Key Takeaways

- The integration of Royalty Pharma's external manager will boost net margins through significant cost savings and eliminate management fees, enhancing shareholder value.

- Royalty Pharma's growing pipeline of new therapies and synthetic royalties could significantly drive future revenue growth and earnings, indicating strong market opportunities.

- Reliance on one-time payments and uncertain future acquisitions could threaten Royalty Pharma's consistent revenue growth and stability amidst risky financial strategies.

Catalysts

About Royalty Pharma- Operates as a buyer of biopharmaceutical royalties and a funder of innovation in the biopharmaceutical industry in the United States.

- Royalty Pharma's acquisition of its external manager to create an integrated company is expected to generate over $100 million in cash savings by 2026 and cumulative savings of more than $1.6 billion over 10 years, enhancing net margins.

- The company has a strong pipeline, including royalties on 8 new therapies added in 2024, with some having blockbuster potential, which could significantly drive future revenue growth.

- Royalty Pharma's growing engagement in synthetic royalties as a funding solution is expected to expand their total addressable market and offer higher return opportunities, positively impacting future earnings.

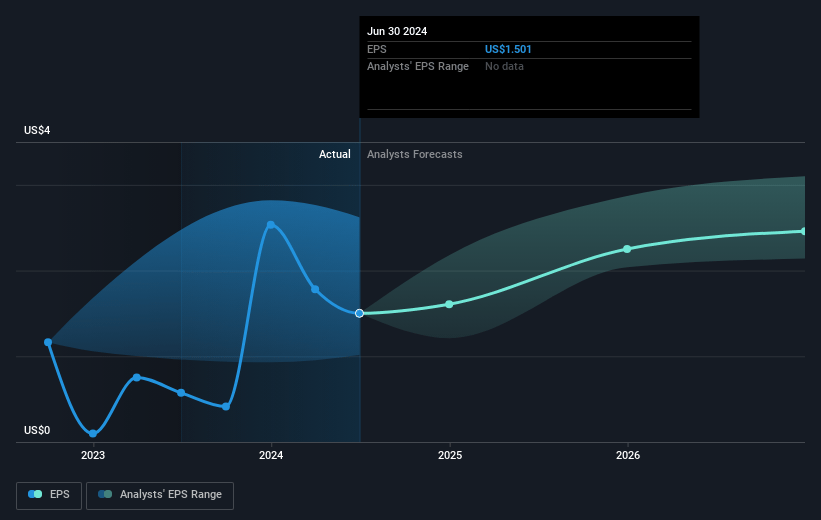

- The planned $2 billion share repurchase in 2025 will likely enhance EPS and indicate confidence in undervaluation.

- The internalization transaction will remove the management fee, thus increasing net returns on royalty investments which will positively impact net margins and long-term shareholder value.

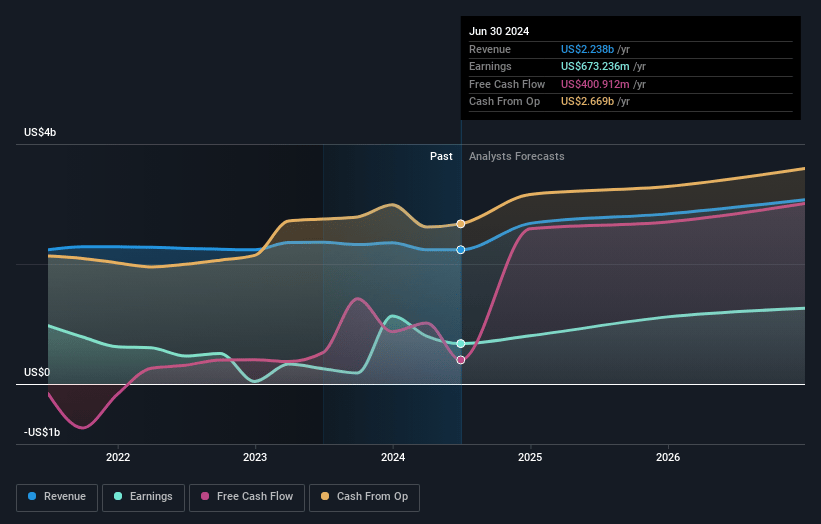

Royalty Pharma Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Royalty Pharma's revenue will grow by 12.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 37.9% today to 28.6% in 3 years time.

- Analysts expect earnings to reach $922.0 million (and earnings per share of $2.6) by about March 2028, up from $859.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 27.2x on those 2028 earnings, up from 16.9x today. This future PE is greater than the current PE for the US Pharmaceuticals industry at 16.3x.

- Analysts expect the number of shares outstanding to decline by 3.92% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.21%, as per the Simply Wall St company report.

Royalty Pharma Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The financial performance of Royalty Pharma in 2024 was positively influenced by onetime milestone payments from Biohaven, suggesting that consistent revenue growth could be challenging without similar large-scale, one-off contributions, impacting future revenue stability.

- Portfolio Receipts guidance for 2025 was based on existing assets without accounting for potential future royalty acquisitions, which can lead to investor skepticism if future acquisitions do not occur or underperform, potentially impacting long-term revenue and earnings.

- The significant cash deployment for share repurchases, contingent on the share discount to intrinsic value, introduces risk if market conditions change or the intrinsic value estimation proves inaccurate, affecting cash flow management and net earnings.

- The company's reliance on synthetic royalties as a non-dilutive funding solution, while innovative, represents a small portion of the industry’s funding and its future scalability is uncertain, posing a risk to future revenue growth and net margins if adoption does not expand as expected.

- The planned internalization transaction, while expected to produce long-term savings, carries execution risk. Integrating employees, transferring intellectual capital, and realizing anticipated cash savings of $100 million by 2026 may not proceed smoothly, potentially impacting operational costs and net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $40.92 for Royalty Pharma based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $48.0, and the most bearish reporting a price target of just $30.14.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.2 billion, earnings will come to $922.0 million, and it would be trading on a PE ratio of 27.2x, assuming you use a discount rate of 6.2%.

- Given the current share price of $33.41, the analyst price target of $40.92 is 18.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.