Key Takeaways

- Regeneron's strategic focus on expanding its robust pipeline and regulatory approvals aims to drive long-term revenue growth across various significant disease areas.

- Collaborations and technology investments in personalized medicine and analytics enhance competitive advantage, while shareholder strategies aim to boost earnings per share.

- Competitive pressures, rising expenses, and strategic investments pose risks to Regeneron's revenue growth, market share, and financial sustainability.

Catalysts

About Regeneron Pharmaceuticals- Regeneron Pharmaceuticals, Inc. discovers, invents, develops, manufactures, and commercializes medicines for treating various diseases worldwide.

- Regeneron's emphasis on its robust pipeline, with 40 product candidates targeting a market opportunity of over $220 billion, is expected to drive long-term revenue growth. Significant potential lies in diseases such as COPD, multiple myeloma, and chronic spontaneous urticaria, which could considerably boost revenue when these therapies come to market.

- The anticipated regulatory approvals and potential label expansions for key products like EYLEA HD and Libtayo could enhance market penetration and support revenue growth. For instance, extending dosing flexibility and adding disease indications can strengthen the profile of these therapies, sustaining and potentially increasing their market share.

- Investment in technology platforms and big data, such as Regeneron’s world-class DNA sequence-linked database and new strategic collaborations, aims to maintain their competitive edge in healthcare analytics and personalized medicine. This could translate to enhanced efficiency and innovative product development, positively impacting net margins.

- The initiation of a quarterly dividend and an expanded share repurchase program, with a total current buyback capacity of approximately $4.5 billion, reflects strong confidence in future cash flows. These shareholder return strategies are likely to drive earnings per share upwards, making the stock more attractive.

- Strategic alliances with partners like Sanofi ensure broader market penetration and optimized commercialization of key products like Dupixent, which continues to see robust growth across multiple indications. This partnership facilitates synergistic marketing and R&D efforts, potentially boosting net profit margins through shared costs and revenue.

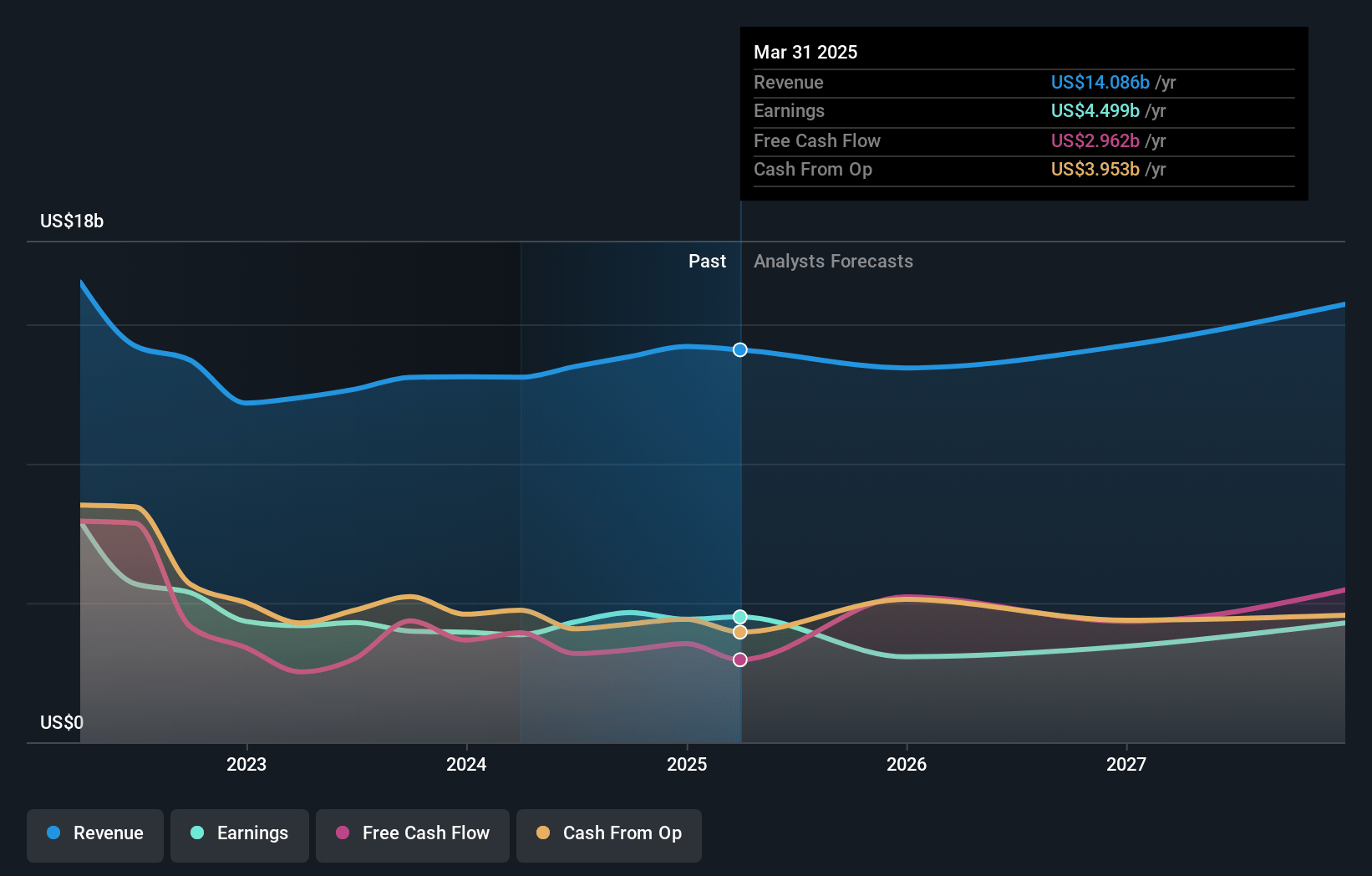

Regeneron Pharmaceuticals Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Regeneron Pharmaceuticals compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Regeneron Pharmaceuticals's revenue will grow by 11.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 31.1% today to 33.8% in 3 years time.

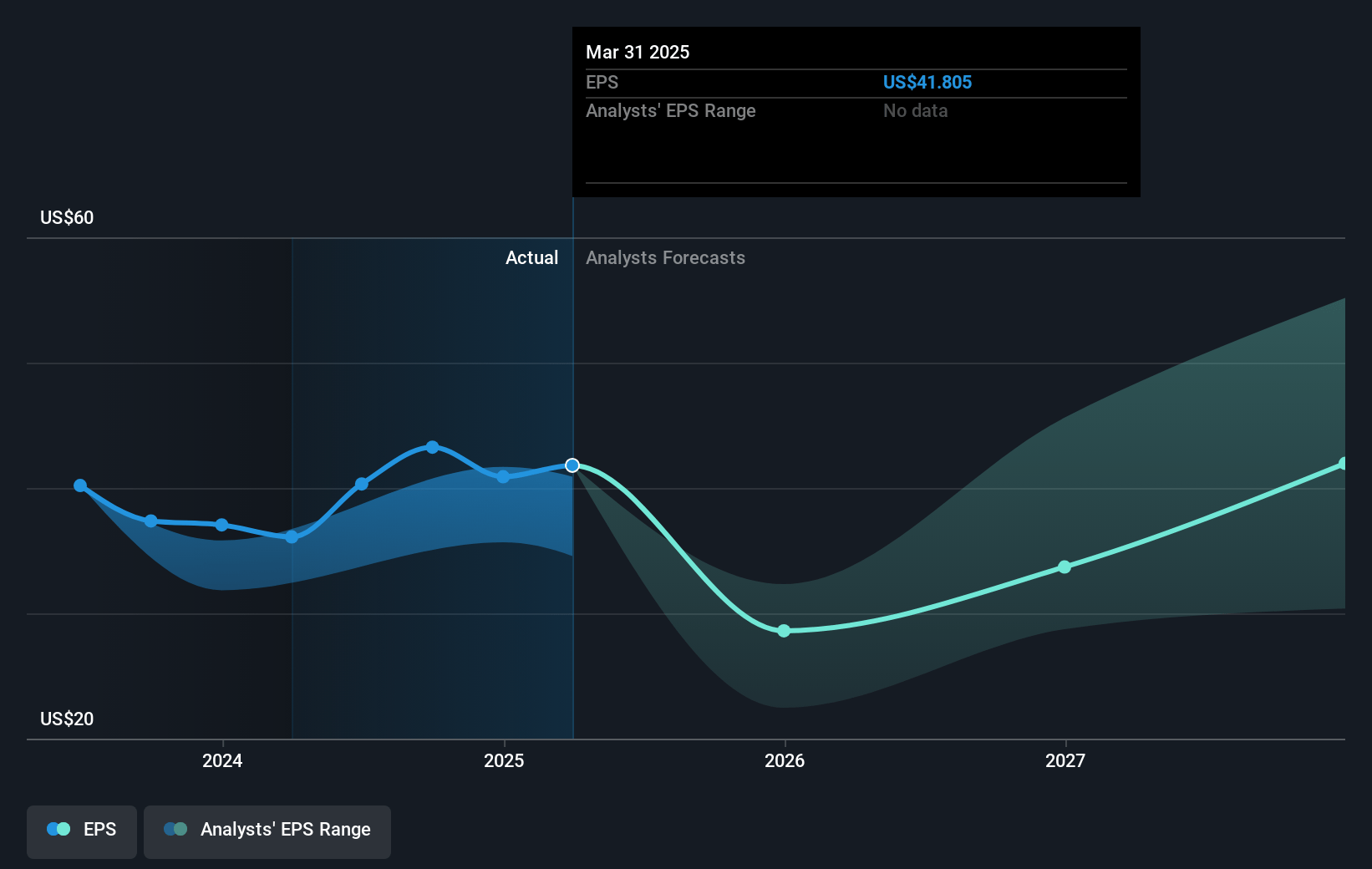

- The bullish analysts expect earnings to reach $6.7 billion (and earnings per share of $66.1) by about April 2028, up from $4.4 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 20.2x on those 2028 earnings, up from 14.2x today. This future PE is greater than the current PE for the US Biotechs industry at 19.6x.

- Analysts expect the number of shares outstanding to decline by 0.8% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.45%, as per the Simply Wall St company report.

Regeneron Pharmaceuticals Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company faces substantial competitive pressure in the anti-VEGF category, especially from biosimilars like Amgen's product, which could impact EYLEA's revenue and market share.

- The anticipated decrease in annual sales for the EYLEA franchise, at an expected rate of 7%, could adversely affect overall revenue and earnings if competitive pressures persist.

- Increased R&D and SG&A expenses related to expanding its pipeline and commercial operations, including in international markets, may compress net margins if top-line growth does not keep pace.

- Regeneron’s plans to maintain strong R&D investment alongside new ventures, like obesity trials, present financial risks if these projects do not yield the expected return on investment, potentially impacting future earnings.

- The introduction of a quarterly cash dividend and an expanded share repurchase authorization might strain cash flow if revenue growth does not meet expectations, affecting long-term financial sustainability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Regeneron Pharmaceuticals is $1081.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Regeneron Pharmaceuticals's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $1081.0, and the most bearish reporting a price target of just $547.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $19.8 billion, earnings will come to $6.7 billion, and it would be trading on a PE ratio of 20.2x, assuming you use a discount rate of 6.4%.

- Given the current share price of $585.49, the bullish analyst price target of $1081.0 is 45.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NasdaqGS:REGN. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.