Key Takeaways

- Strategic partnerships and anticipated regulatory approvals are poised to significantly expand OncoCyte's market reach, boosting revenue and supporting scalability.

- Fiscal discipline and funding increase operational sustainability, with reduced cash burn and a year-long financial runway enhancing long-term growth potential.

- Regulatory hurdles, competitive pressures, and financial risks could delay market entry and impact OncoCyte’s revenue growth, margins, and operational scalability.

Catalysts

About OncoCyte- A precision diagnostics company in the United States and internationally.

- OncoCyte is progressing towards regulatory submissions for their GraftAssure assay in both the U.S. and Europe, with mid-2026 as the target for an approved product in the market. This regulatory approval is expected to expand their addressable market, directly impacting future revenue growth.

- They anticipate significant market expansion due to their assay's ability to detect organ rejection much earlier than standard protocols, alongside recently expanded Medicare claims. This could lead to a 20% increase in their total addressable market, affecting both revenue and net margins positively.

- The partnership with Bio-Rad Laboratories has been strategically beneficial, not only as a repeat investor in their funding rounds but also projecting support for clinical trial and commercialization efforts. This enhances scalability and strengthens financial backing, positively impacting earnings and cash flow.

- The company expects to secure 20 transplant centers by the end of 2025, translating into approximately $20 million in recurring annual revenue post-regulatory approvals, subject to increased adoption. This represents substantial projected revenue growth.

- OncoCyte's reduced cash burn rate and successful capital raise provide a financial runway for over a year, indicating strong fiscal discipline which is essential for operational sustainability and improving net margins over time.

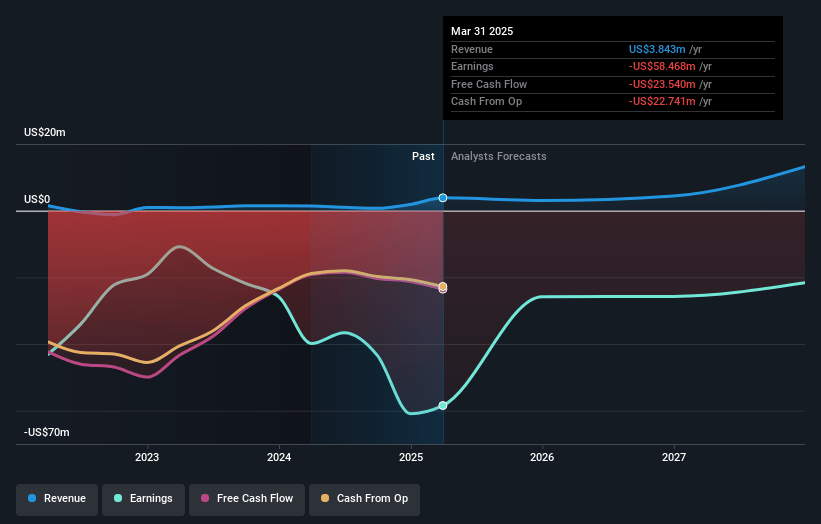

OncoCyte Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming OncoCyte's revenue will grow by 91.5% annually over the next 3 years.

- Analysts are not forecasting that OncoCyte will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate OncoCyte's profit margin will increase from -3239.0% to the average US Biotechs industry of 17.3% in 3 years.

- If OncoCyte's profit margin were to converge on the industry average, you could expect earnings to reach $2.3 million (and earnings per share of $0.07) by about April 2028, up from $-60.9 million today.

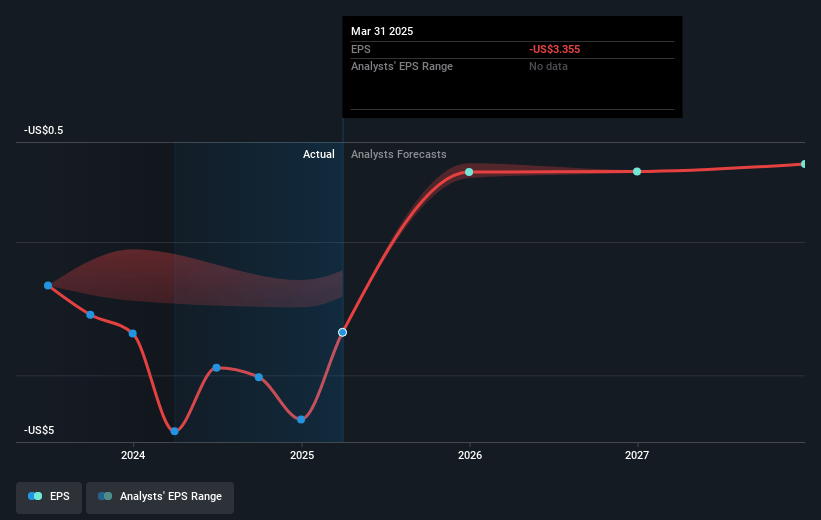

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 81.6x on those 2028 earnings, up from -1.3x today. This future PE is greater than the current PE for the US Biotechs industry at 20.2x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.44%, as per the Simply Wall St company report.

OncoCyte Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Regulatory hurdles, including the uncertainty around the FDA's approval process and potential delays due to staffing and budget issues, could impact the timeline to market and delay expected revenues from the new assay.

- The clinical trial required for FDA approval involves significant resource allocation, with uncertainties in enrollment and execution potentially impacting the projected timeline and increasing costs, affecting net margins.

- Dependence on a few strategic partners, like Bio-Rad Laboratories, introduces risk; if these partnerships falter or do not meet expectations, it could impede the company's ability to scale operations, negatively impacting earnings.

- Competitive market pressures from established lab-based providers who have longstanding customer relationships could hinder OncoCyte's market penetration, affecting revenue growth and market share.

- Financial risks due to heavy upfront investments in product development and ongoing cash burn, which might pressure liquidity despite capital raises, thereby impacting future earnings and operational flexibility.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $4.417 for OncoCyte based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $5.0, and the most bearish reporting a price target of just $4.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $13.2 million, earnings will come to $2.3 million, and it would be trading on a PE ratio of 81.6x, assuming you use a discount rate of 6.4%.

- Given the current share price of $2.83, the analyst price target of $4.42 is 35.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.