Key Takeaways

- Heavy reliance on faster-burning studies and pass-through revenue may lead to unsustainable growth and margin pressures as project mix normalizes.

- Declining backlog, increased competition, and rising operational costs threaten future revenue visibility, profitability, and long-term market share.

- Strong industry demand, disciplined capital allocation, and operational excellence position Medpace for sustained, margin-supportive growth despite short-term client and funding challenges.

Catalysts

About Medpace Holdings- Provides clinical research-based drug and medical device development services in North America, Europe, and Asia.

- The rapid revenue acceleration in 2025 is heavily influenced by a therapeutic mix shift toward faster-burning studies (such as metabolic trials) with higher reimbursable costs, increasing "pass-through" revenue that is less margin-accretive, which could result in lower underlying revenue and EBITDA growth once this project mix normalizes.

- Funding for many clients, especially small biotech, remains fragile, with low cancellations having driven recent upside; should the improved funding or lower cancellations reverse (as seen in previous quarters), revenue and earnings growth could sharply decelerate, indicating that the current growth levels may not be sustainable.

- Despite strong topline growth, win rates for new business were down and backlog is declining (-1.8% year-over-year), suggesting competitive pressures and a lack of large contract wins may negatively impact future bookings and limit revenue and earnings visibility beyond 2025.

- The company is guiding for accelerated hiring in the back half of 2025 to support the faster pace of trials, which-combined with higher investigator and salary costs-could increase operating expenses faster than underlying EBITDA if productivity gains plateau or reverse, exerting pressure on net margins.

- Biopharma sponsors are increasingly adopting tech-enabled and decentralized trial models, which could enable more internalization of clinical research activities and erode Medpace's market share and pricing power over time, ultimately reducing long-term revenue and margin expansion prospects.

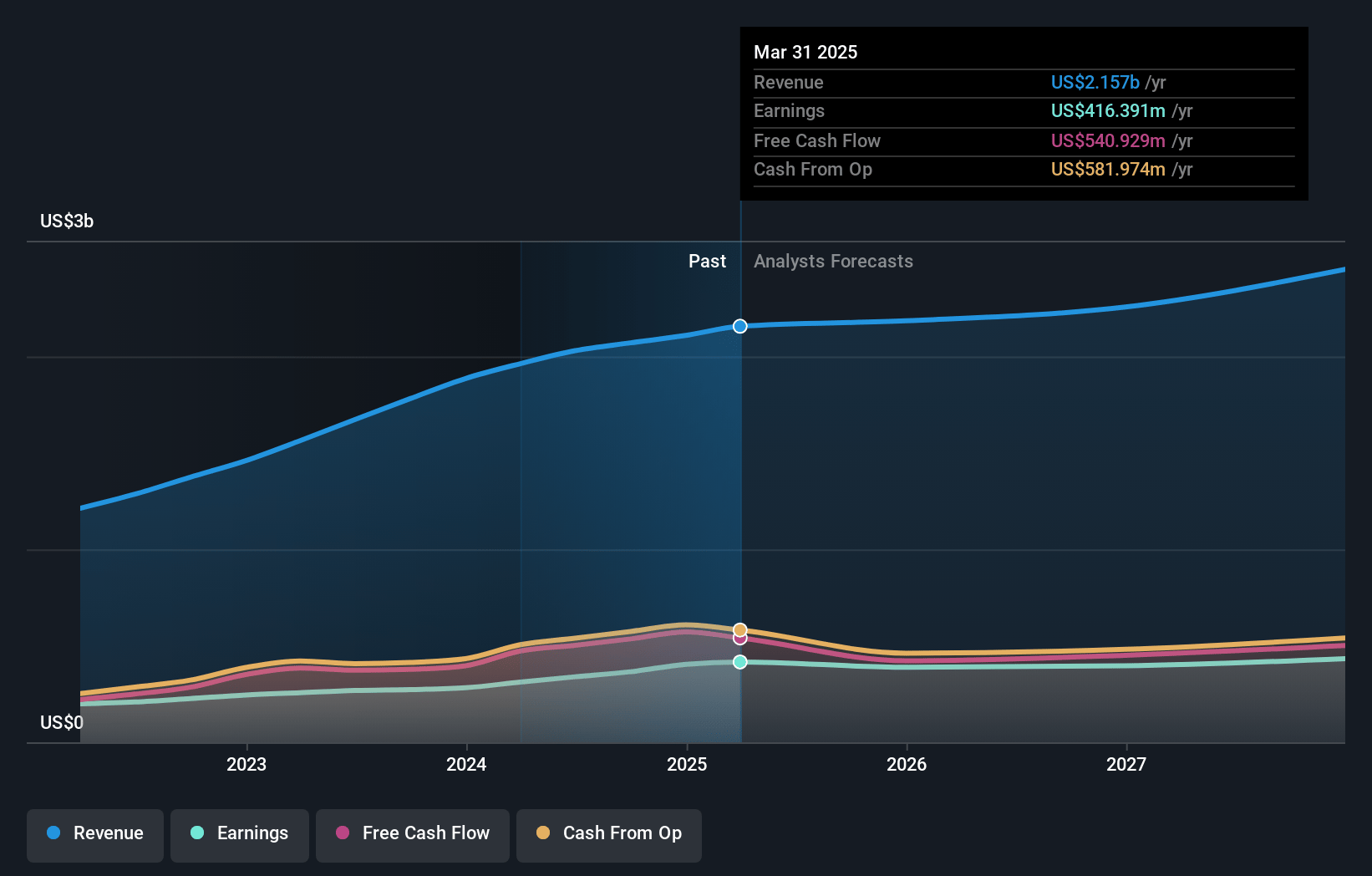

Medpace Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Medpace Holdings's revenue will grow by 6.2% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 18.7% today to 17.9% in 3 years time.

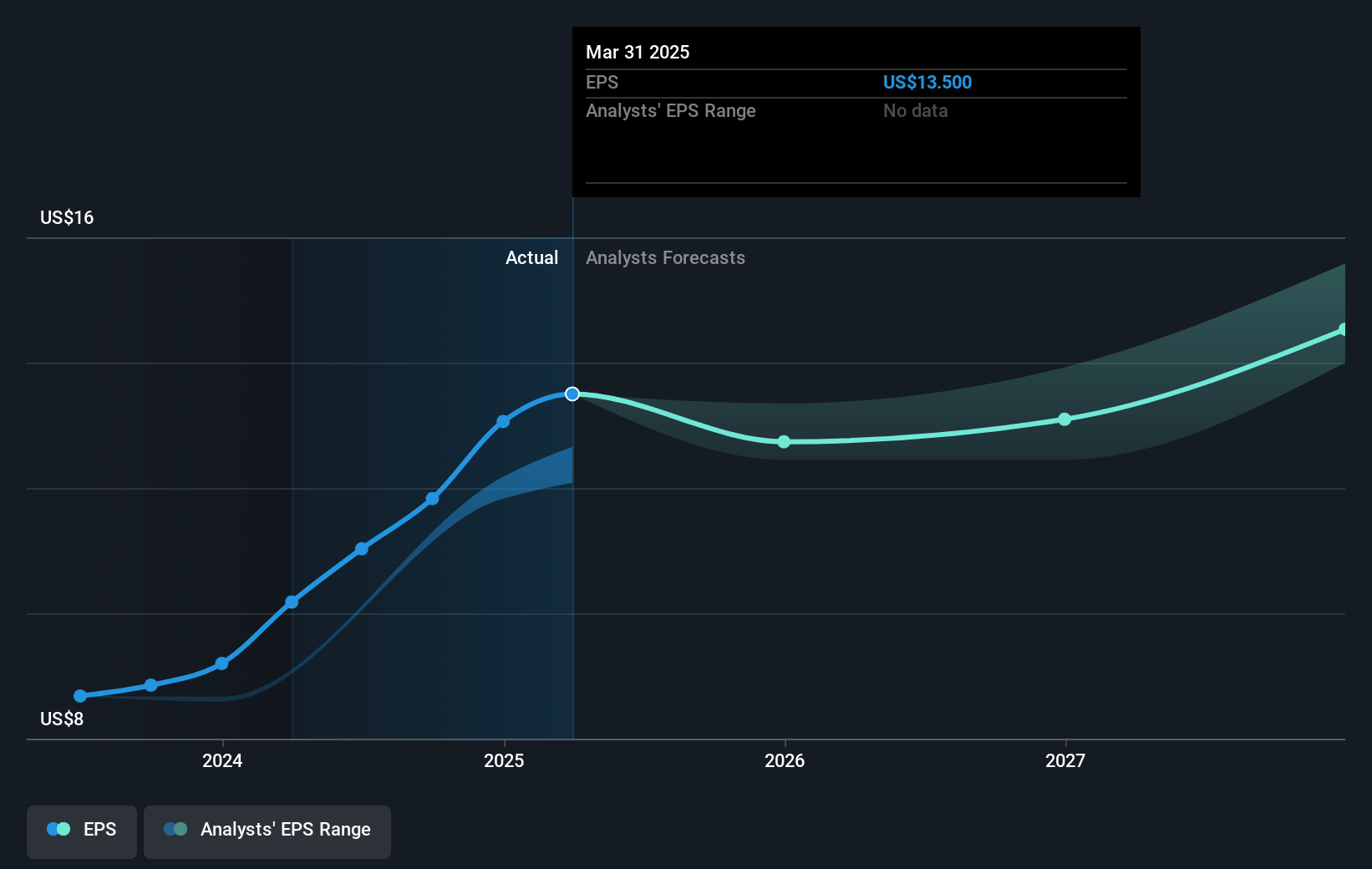

- Analysts expect earnings to reach $477.9 million (and earnings per share of $15.96) by about July 2028, up from $418.3 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $533.4 million in earnings, and the most bearish expecting $389.2 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.6x on those 2028 earnings, down from 32.0x today. This future PE is lower than the current PE for the US Life Sciences industry at 36.0x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.81%, as per the Simply Wall St company report.

Medpace Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent and robust demand for clinical trials-evidenced by strong RFP (Request for Proposal) flow, accelerating backlog conversion, and management's expectations for bookings to return to or exceed historical levels-suggests secular biopharma R&D outsourcing trends remain solid, supporting revenue growth.

- Medpace's disciplined capital allocation, demonstrated by significant share repurchases and a large remaining buyback authorization, offers flexibility to enhance earnings per share even in periods of fluctuating business activity, supporting long-term EPS growth potential.

- Integrated, full-service operational model and ongoing investment in specialized therapeutic expertise and technology infrastructure are allowing the company to achieve rising productivity, maintain attractiveness for clients, and manage cost efficiency, thereby supporting margins and recurring revenue.

- Despite short-term headwinds like cancellations and funding challenges for smaller clients, Medpace's broad backlog, increasing involvement in faster-growing therapeutic areas (such as metabolic studies), and scalable staffing strategy provide resilience and adaptability that favor sustained revenues and margins.

- Industry-wide movement towards more complex, tech-enabled, and globalized clinical trials increases demand for CROs with Medpace's capabilities; if these long-term trends continue, Medpace could see continued growth in bookings, revenue, and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $313.945 for Medpace Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $455.0, and the most bearish reporting a price target of just $270.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.7 billion, earnings will come to $477.9 million, and it would be trading on a PE ratio of 17.6x, assuming you use a discount rate of 6.8%.

- Given the current share price of $477.73, the analyst price target of $313.94 is 52.2% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.