Key Takeaways

- Medpace's hiring plans aim to support project growth and revenue, but may pressure margins if costs outweigh productivity gains.

- Reducing project cancellations and improving book-to-bill ratios are expected to stabilize and potentially increase revenue flow.

- Backlog cancellations, competitive pressures, and a challenging business environment threaten Medpace's revenue growth and earnings stability.

Catalysts

About Medpace Holdings- Provides clinical research-based drug and medical device development services in North America, Europe, and Asia.

- Medpace is targeting headcount growth in the mid

- to upper mid-single-digit level for 2025, which should enable the company to support more projects and potentially increase revenue. However, increased hiring could negatively impact EBITDA margins.

- The company anticipates improving book-to-bill ratios in the second half of 2025, ideally reaching above 1.15x, which would indicate stronger future revenue from project bookings.

- Medpace is beginning to accelerate its hiring efforts after a period of flat headcount, aiming to capitalize on anticipated growth opportunities, which may lead to a boost in revenue if the business environment improves.

- With the expectation of decelerated cancellations as compared to 2024, Medpace could stabilize or possibly increase its revenue flow, assuming fewer project cancellations lead to higher overall earnings and revenue.

- The company saw increased productivity from its existing staff, suggesting potential for maintaining or even expanding net margins if operating costs from expansion initiatives like offshoring dose not offset these productivity gains.

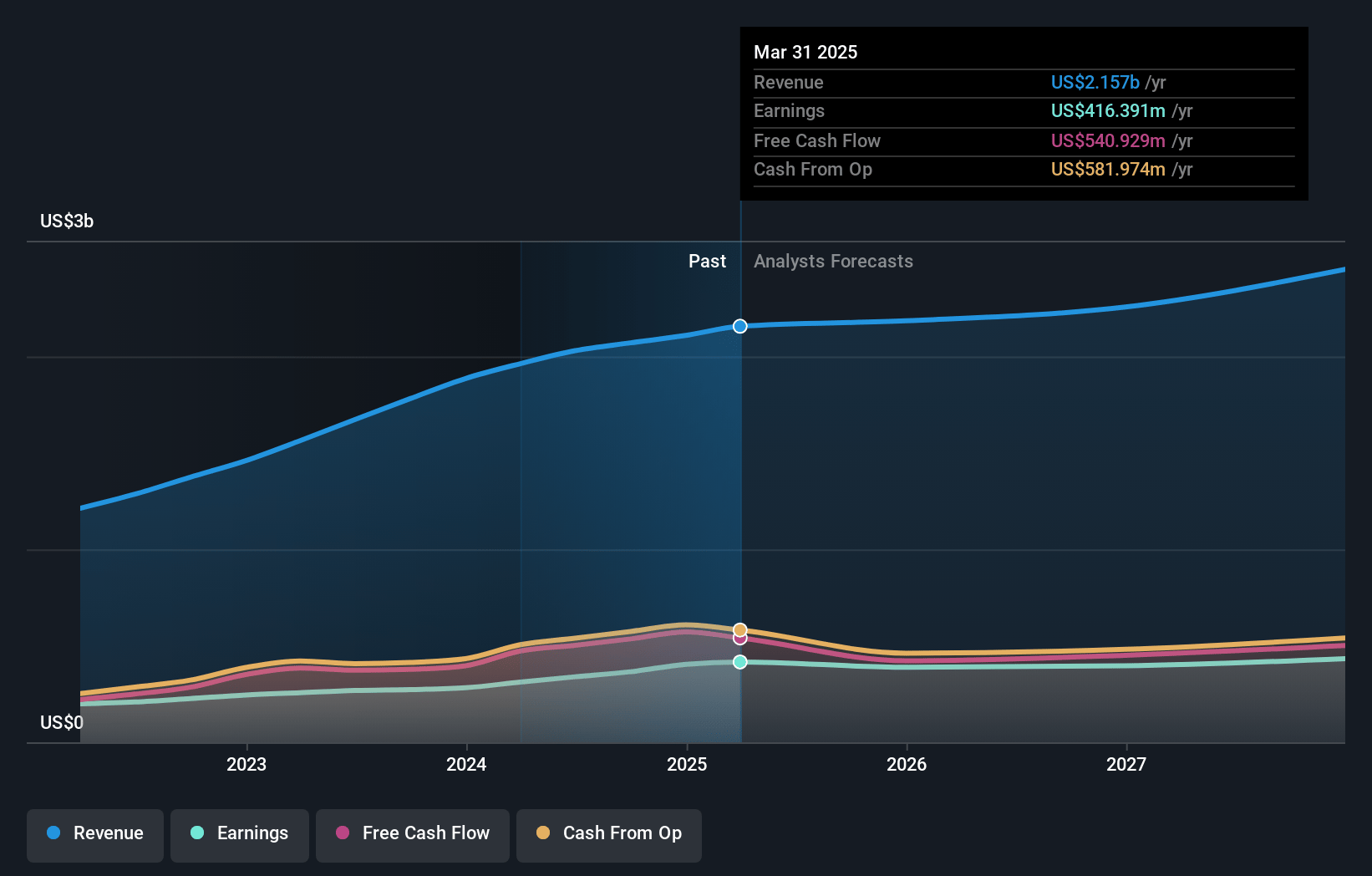

Medpace Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Medpace Holdings's revenue will grow by 8.1% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 19.2% today to 18.2% in 3 years time.

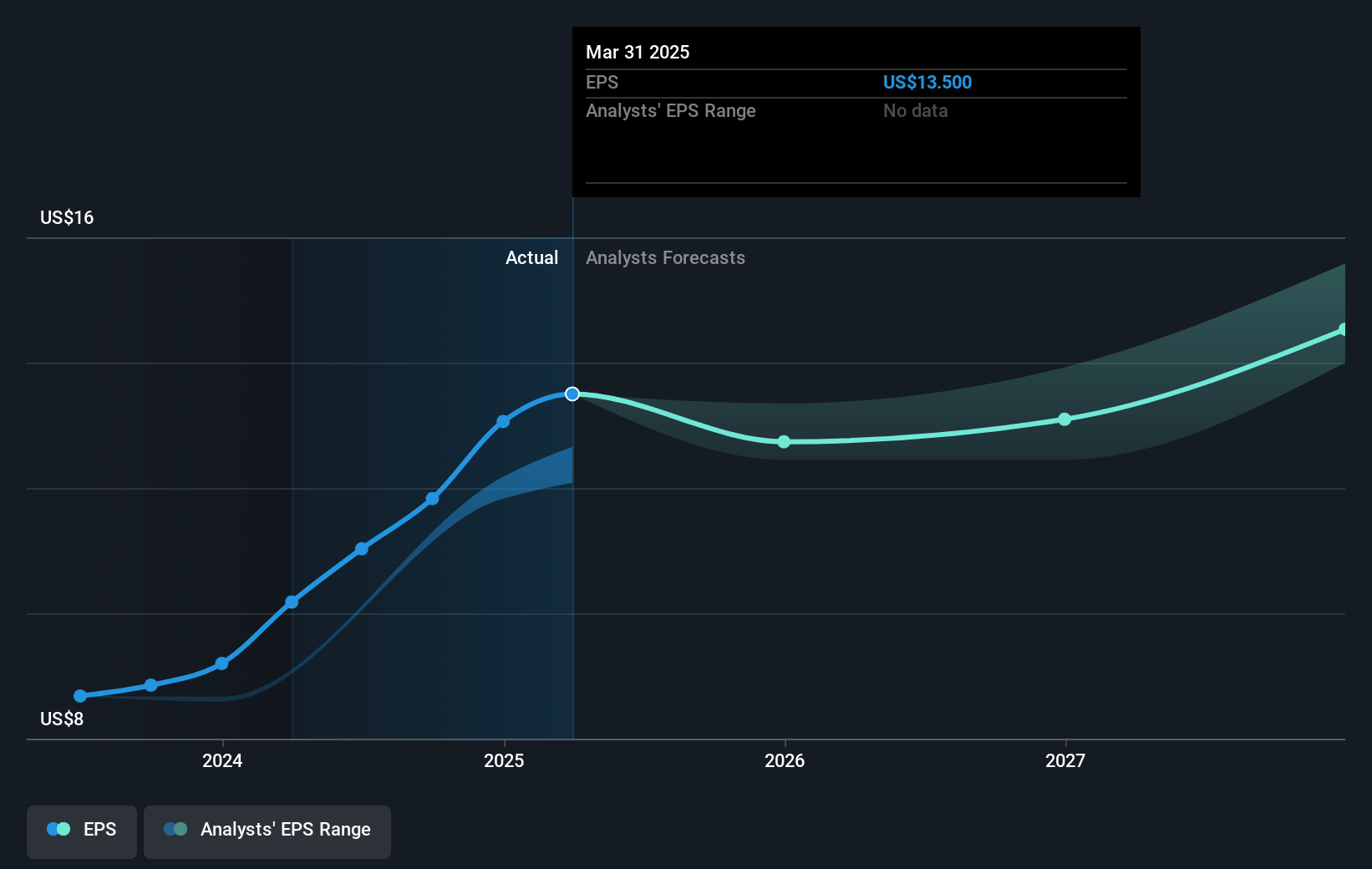

- Analysts expect earnings to reach $486.2 million (and earnings per share of $15.93) by about March 2028, up from $404.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 25.0x on those 2028 earnings, down from 25.1x today. This future PE is lower than the current PE for the US Life Sciences industry at 42.5x.

- Analysts expect the number of shares outstanding to decline by 1.44% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.7%, as per the Simply Wall St company report.

Medpace Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Backlog cancellations and lower-than-expected pipeline conversions pose a challenge to revenue growth, highlighting potential weakness in future earnings.

- The business environment has shown signs of deterioration and could impact revenue streams if it persists, presenting risks to revenue and earnings.

- Revenue guidance for 2025 indicates flat to low single-digit growth, which may not inspire confidence in robust earnings growth.

- Elevated historical cancellations and uncertainties about future cancellations pose a risk to maintaining stable revenue and order volumes.

- Competitive pressure and potential customer concentration could strain margins and affect earnings if Medpace cannot defend its pricing or maintain client diversity.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $344.831 for Medpace Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $404.0, and the most bearish reporting a price target of just $296.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.7 billion, earnings will come to $486.2 million, and it would be trading on a PE ratio of 25.0x, assuming you use a discount rate of 6.7%.

- Given the current share price of $332.81, the analyst price target of $344.83 is 3.5% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives