Key Takeaways

- MiMedx anticipates increased revenue and market share through the implementation of pending LCDs and product innovation in HELIOGEN.

- International expansion and innovations like EpiFix and MiMedx Connect are crucial for enhancing revenue, margins, and customer relationships.

- Uncertainty in Medicare changes, sales challenges, legal issues, and competitor responses could disrupt MiMedx's growth and impact revenue, margins, and earnings.

Catalysts

About MiMedx Group- Develops and distributes placental tissue allografts for various sectors of healthcare.

- MiMedx is poised to capitalize on the implementation of pending LCDs, which is expected to bolster its business and potentially increase revenue through market share gains as it is well-positioned compared to competitors.

- The company is continuing to innovate and diversify its product portfolio with recent introductions like HELIOGEN gaining traction, which should support top-line growth.

- Significant growth in the EpiFix product sales in Japan, which has tripled in 2024, provides an international expansion opportunity that could enhance revenue and margins.

- MiMedx is investing in clinical research and developing programs to increase its presence in the surgical market, expecting that reduced scarring and improved healing outcomes could lead to long-term revenue growth.

- The adoption of MiMedx Connect, a customer portal aimed at improving customer relationships, is expected to improve lifetime customer value and net margins by strengthening bonds with existing customers.

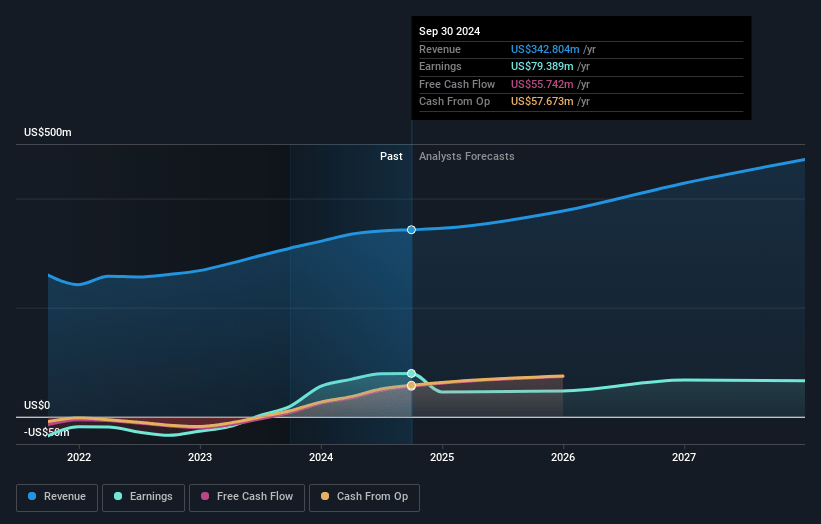

MiMedx Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming MiMedx Group's revenue will grow by 9.6% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 12.0% today to 11.7% in 3 years time.

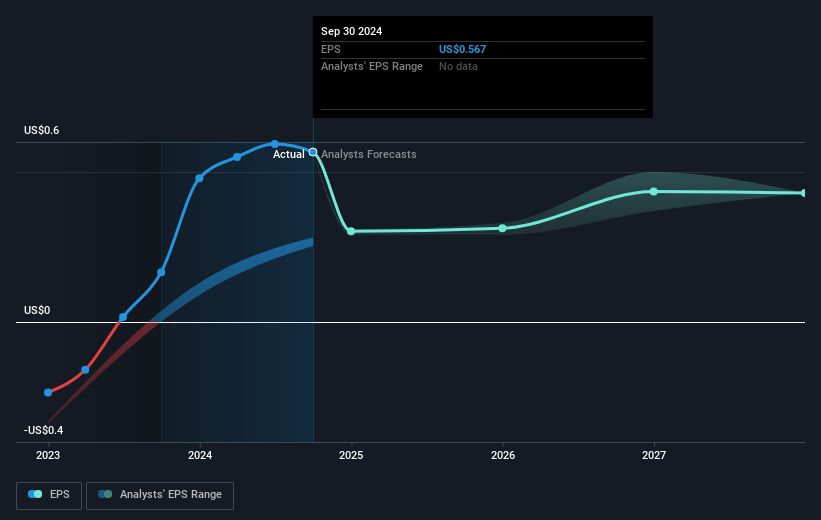

- Analysts expect earnings to reach $53.8 million (and earnings per share of $0.35) by about May 2028, up from $42.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 42.5x on those 2028 earnings, up from 24.3x today. This future PE is greater than the current PE for the US Biotechs industry at 20.4x.

- Analysts expect the number of shares outstanding to decline by 0.16% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.44%, as per the Simply Wall St company report.

MiMedx Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- There is ongoing uncertainty regarding the implementation of changes to the Medicare reimbursement system, which could lead to short-term market disruption and impact revenues if not resolved as expected.

- Above-average sales force turnover and market implementation challenges with new products like HELIOGEN might hinder MiMedx's growth execution, potentially affecting future revenues and net margins.

- Legal matters, including the AXIOFIL issue with the FDA and the Surgenex suit, could consume resources and create financial liabilities, impacting net earnings.

- Competitors' responses to regulatory changes, particularly in skin substitutes, could influence market dynamics and MiMedx’s ability to maintain its gross profit margins.

- The company's reliance on new product introductions and international market growth, such as in Japan, involves risks related to market adoption and reimbursement, impacting the long-term revenue outlook if expectations are not met.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $13.0 for MiMedx Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $15.0, and the most bearish reporting a price target of just $12.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $459.8 million, earnings will come to $53.8 million, and it would be trading on a PE ratio of 42.5x, assuming you use a discount rate of 6.4%.

- Given the current share price of $6.92, the analyst price target of $13.0 is 46.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.