Key Takeaways

- Advancements in certepetide and regulatory achievements could expedite market entry, fostering revenue growth and enhancing treatment standards.

- Strategic partnerships and diversified applications beyond oncology offer new revenue streams and market expansion opportunities, potentially improving margins.

- Heavy reliance on future approvals and funding poses risks to financial stability amidst high expenses, potential liquidity issues, and investor uncertainty.

Catalysts

About Lisata Therapeutics- A clinical-stage pharmaceutical company, engages in the discovery, development, and commercialization of therapies for the treatment of solid tumors and other diseases.

- Advancements in the development of certepetide, particularly in treating advanced solid tumors, show potential to create a new standard of care, likely enhancing future revenue through new treatment regimens.

- Regulatory achievements such as orphan drug designations and Fast Track status reflect a strong regulatory strategy that could expedite certepetide's market entry, impacting revenue and earnings positively by reaching patients sooner.

- The diversification of certepetide's application beyond oncology into areas like endometriosis presents new revenue streams, potentially improving net margins as the company taps into markets with unmet needs.

- Strategic partnerships and collaborations, such as those with Kuva Labs for diagnostic enhancements and with AstraZeneca for clinical trials, are expected to enhance research data credibility and expansion opportunities, thereby supporting revenue growth.

- Cost-efficient trial modifications, including alternative approaches like imaging techniques for the FORTIFIDE trial, suggest effective expense management, potentially improving net margins and extending cash runway for ongoing operations and further expansions.

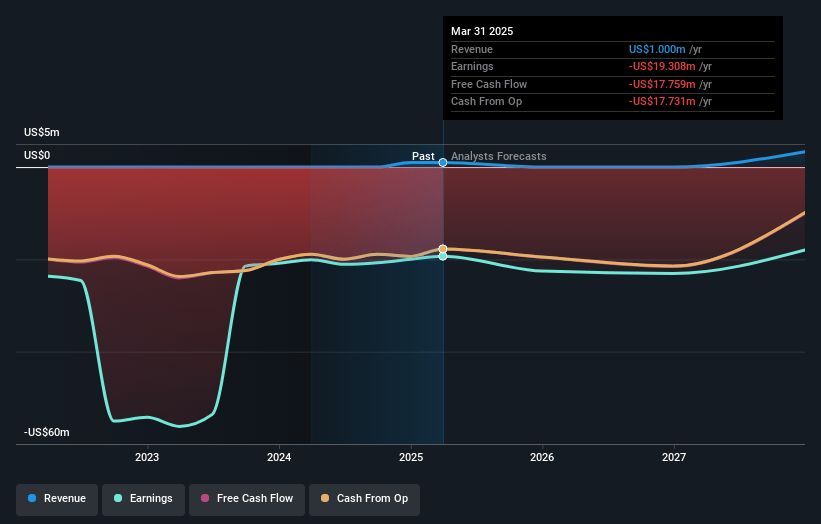

Lisata Therapeutics Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Lisata Therapeutics's revenue will grow by 49.4% annually over the next 3 years.

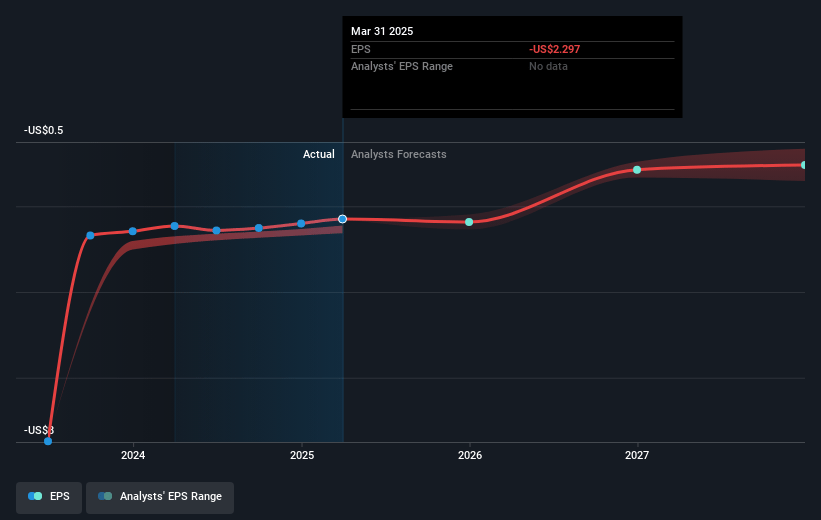

- Analysts are not forecasting that Lisata Therapeutics will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Lisata Therapeutics's profit margin will increase from -1998.5% to the average US Biotechs industry of 15.9% in 3 years.

- If Lisata Therapeutics's profit margin were to converge on the industry average, you could expect earnings to reach $528.9 thousand (and earnings per share of $0.05) by about May 2028, up from $-20.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 387.3x on those 2028 earnings, up from -1.0x today. This future PE is greater than the current PE for the US Biotechs industry at 20.4x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.41%, as per the Simply Wall St company report.

Lisata Therapeutics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's revenue for 2024 was only $1 million, solely derived from a one-off upfront license fee, indicating a significant reliance on potential future product approvals for revenue growth. This lack of current diversified revenue streams poses a risk to its future financial stability.

- Operating expenses in 2024 totaled $23.4 million, resulting in a net loss of $20 million. Continued high expenses relative to minimal revenue could adversely impact net margins and profitability if not managed effectively.

- The company's cash and marketable securities are expected to support operations only until the second quarter of 2026. This indicates a potential liquidity risk if additional funding is not secured, which could affect operational continuity and financial solvency.

- The ASCEND trial results led to a negative reaction in the stock market, suggesting the possibility that future trial outcomes might not meet investor expectations, directly affecting market perception and investor confidence, thus impacting stock price performance.

- Many of the ongoing and planned clinical studies are investigator-initiated with limited company control, posing risks of delays or inconsistencies in outcomes that could affect the timelines for regulatory approval and the resultant revenue streams.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $17.0 for Lisata Therapeutics based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $21.0, and the most bearish reporting a price target of just $15.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.3 million, earnings will come to $528.9 thousand, and it would be trading on a PE ratio of 387.3x, assuming you use a discount rate of 6.4%.

- Given the current share price of $2.45, the analyst price target of $17.0 is 85.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.