Key Takeaways

- Successful trial enrollment and regulatory designations could accelerate Longeveron's market entry and future revenue growth through streamlined FDA pathways and partnerships.

- Cost-management strategies in 2024 are set to improve margins and support key clinical trials, enhancing long-term earnings prospects.

- Delays and regulatory uncertainties, coupled with financial constraints and competitive pressures, pose risks to Longeveron's revenue, financial stability, and market positioning.

Catalysts

About Longeveron- A clinical stage biotechnology company, develops cellular therapies for aging-related and life-threatening conditions in the United States.

- Longeveron is nearing full enrollment in its Phase IIb ELPIS II trial for HLHS, with 90% enrolled and the expectation of completing enrollment in Q2. Successful completion and positive results could lead to a rolling BLA submission with the FDA in 2026, potentially accelerating the product's regulatory path and future revenue generation.

- The company's Alzheimer's program has garnered significant regulatory designations, including RMAT and fast track status. These designations could allow for a streamlined and accelerated clinical and regulatory pathway, ultimately speeding up time to market and impacting future revenue growth.

- Longeveron is exploring strategic partnerships especially for its Alzheimer's program. A potential accelerated regulatory pathway in the U.S. could make the company an attractive partner, bringing in collaborative revenue streams and potentially increasing earnings.

- Cost-management initiatives in 2024 led to reduced operating expenses, freeing up resources to focus on core clinical trials and potential partnership opportunities. This prudent financial management could improve net margins in the short term while positioning the company for long-term earnings growth.

- The company's engagement with regulatory authorities on key clinical programs like HLHS and Alzheimer's, coupled with strategic hiring for regulatory affairs, will bolster its readiness for commercial success and impact revenue through smoother BLA submissions and potential market entries.

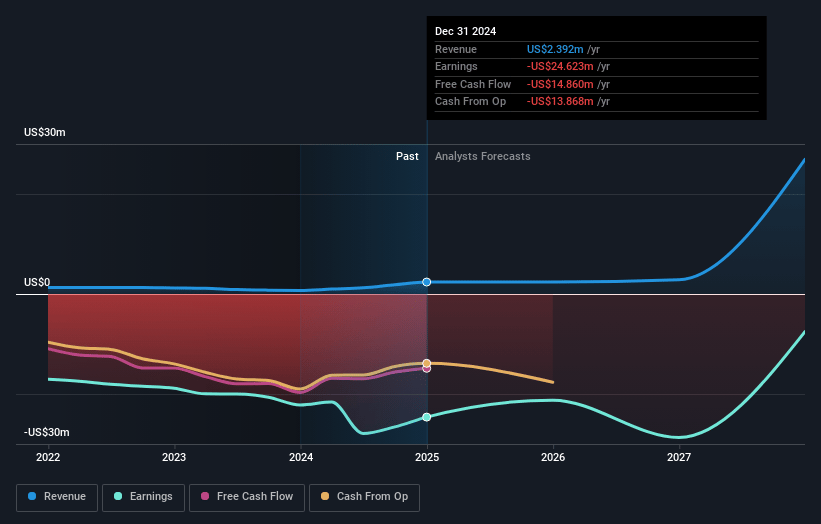

Longeveron Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Longeveron's revenue will grow by 124.1% annually over the next 3 years.

- Analysts are not forecasting that Longeveron will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Longeveron's profit margin will increase from -1029.4% to the average US Biotechs industry of 15.9% in 3 years.

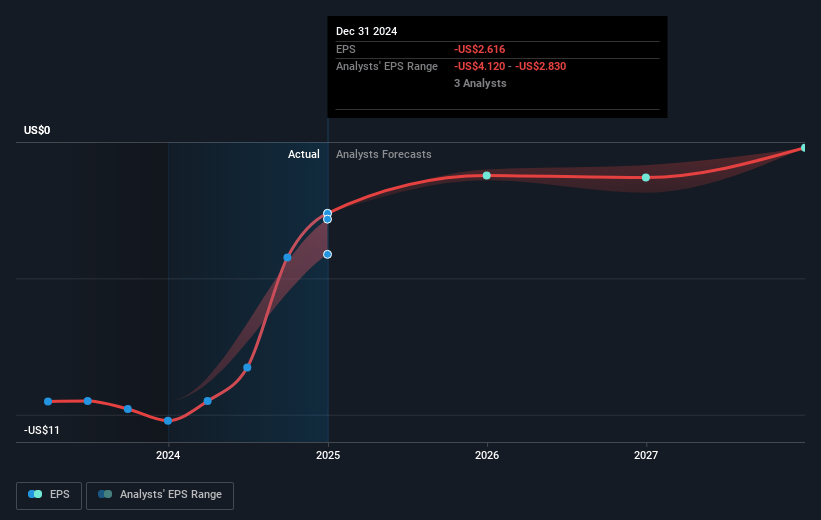

- If Longeveron's profit margin were to converge on the industry average, you could expect earnings to reach $4.3 million (and earnings per share of $0.24) by about May 2028, up from $-24.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 45.1x on those 2028 earnings, up from -1.0x today. This future PE is greater than the current PE for the US Biotechs industry at 20.4x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.5%, as per the Simply Wall St company report.

Longeveron Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The enrollment delays in the ELPIS II study for HLHS, attributed to complexities in scheduling surgeries and determining patient eligibility, could prolong development timelines, impacting the projected revenue stream from early commercialization of Lomecel-B in this indication.

- The dependency on regulatory approval paths and uncertainties related to accelerated approval processes for Alzheimer’s disease and rare pediatric diseases could jeopardize the timing and scale of future earnings if not successfully navigated.

- Financial constraints and the need for additional financing, particularly given the predicted increase in operating expenses and capital expenditure requirements for BLA-related activities, pose a risk to the company’s financial stability and net margin.

- The requirement for extensive CMC and manufacturing readiness preparations could lead to increased costs and operational challenges, affecting net income if not managed efficiently and if expected economies of scale are not realized.

- The competitive landscape with over 140 clinical development programs in Alzheimer's and the necessity to secure partnerships for Phase III trials could dilute future revenue potential and impact long-term market positioning.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $8.875 for Longeveron based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $10.0, and the most bearish reporting a price target of just $6.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $26.9 million, earnings will come to $4.3 million, and it would be trading on a PE ratio of 45.1x, assuming you use a discount rate of 6.5%.

- Given the current share price of $1.6, the analyst price target of $8.88 is 82.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.