Key Takeaways

- Strategic focus on royalty-generating models and key commercial launches is poised to significantly boost royalty revenue and profitability.

- Investments in late-stage development assets and a strong business development pipeline drive future revenue growth and diversification.

- The company's dependence on key product royalties and high noncash expenses could affect earnings, while investments in high-risk areas pose potential long-term uncertainties.

Catalysts

About Ligand Pharmaceuticals- A biopharmaceutical company, develops and licenses biopharmaceutical assets worldwide.

- Ligand's strategic shift towards a low-operating-expense, royalty-generating business model has reduced cash operating expenses by over 50% and increased royalty revenue by nearly 50%. This streamlined approach is expected to positively impact net margins and drive long-term profitability.

- Key commercial launches like Verona Pharma's Ohtuvayre and Merck's Capvaxive, with blockbuster sales potential, are forecasted to substantially contribute to Ligand's royalty revenue growth in the coming years.

- The company's investment in Travere's Filspari, which has received FDA approval and has plans for further label expansion into untreated rare kidney diseases, is expected to drive significant royalty revenue growth, doubling in 2025.

- Ligand's recent investment in Castle Creek's D-Fi, a promising Phase III therapy for a rare skin disease, illustrates its focus on high-value, late-stage development assets. Successful approval and launch could enhance future earnings through new royalty streams.

- The robust pipeline of business development opportunities suggests that Ligand will continue to diversify and grow its royalty assets, enabling consistent revenue growth and potential EPS expansion over the coming years.

Ligand Pharmaceuticals Future Earnings and Revenue Growth

Assumptions

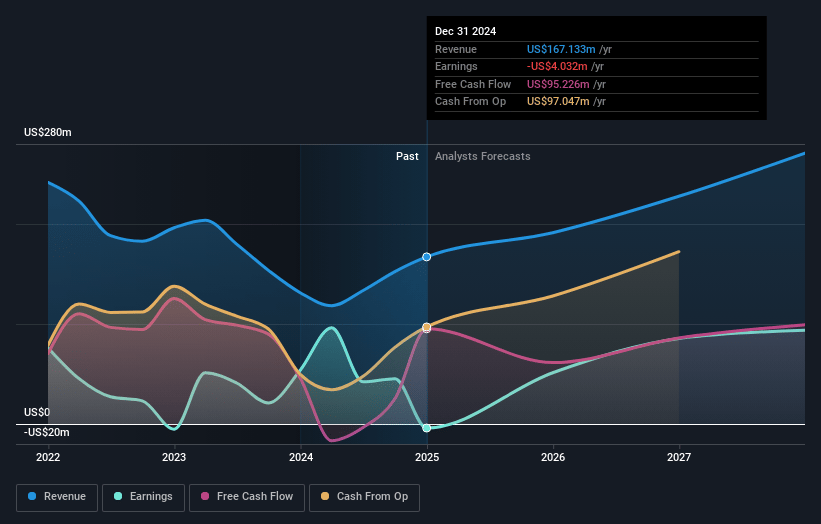

How have these above catalysts been quantified?- Analysts are assuming Ligand Pharmaceuticals's revenue will grow by 17.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from -2.4% today to 34.6% in 3 years time.

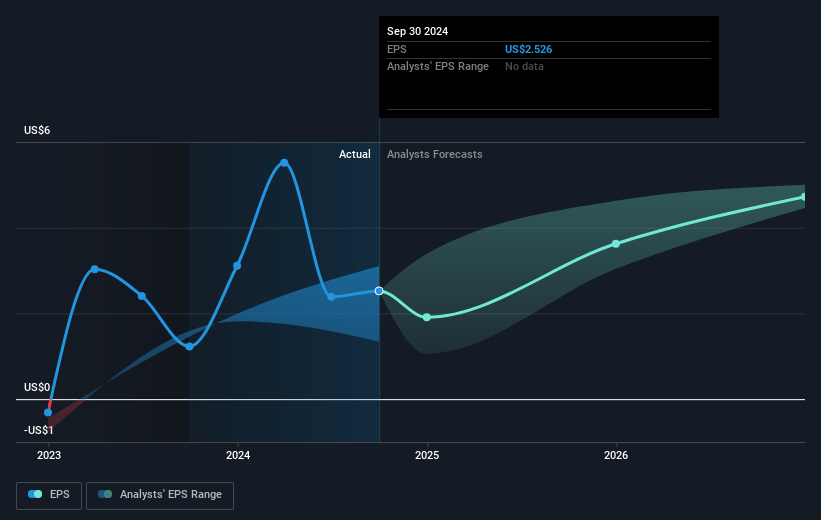

- Analysts expect earnings to reach $93.8 million (and earnings per share of $4.54) by about April 2028, up from $-4.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $109.9 million in earnings, and the most bearish expecting $77.6 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 42.2x on those 2028 earnings, up from -532.6x today. This future PE is greater than the current PE for the US Pharmaceuticals industry at 17.2x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.21%, as per the Simply Wall St company report.

Ligand Pharmaceuticals Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company has faced higher noncash stock-based compensation expenses and costs related to incubating the new Pelthos business, which have increased operating expenses. This could impact net margins if not managed carefully.

- Ligand's royalty revenue growth is heavily reliant on a few key products, such as Filspari and Ohtuvayre. If these products underperform or face market or regulatory challenges, expected revenue and earnings could be negatively impacted.

- The company saw a decline in GAAP net income, driven by noncash items, including a financial royalty asset impairment and losses from equity method investments. This could affect overall earnings and investor sentiment.

- The recent financial performance benefits significantly from milestones and royalties from new product launches, which can be unpredictable and may not sustain current growth rates if future launches are delayed or fail to materialize as expected, impacting revenue.

- Ligand's strategy involves significant investments in high-risk areas such as orphan drugs and novel therapeutics, which can have uncertain outcomes and might not yield the expected returns, potentially affecting long-term revenue and earnings forecasts.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $143.5 for Ligand Pharmaceuticals based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $270.9 million, earnings will come to $93.8 million, and it would be trading on a PE ratio of 42.2x, assuming you use a discount rate of 6.2%.

- Given the current share price of $111.38, the analyst price target of $143.5 is 22.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.