Key Takeaways

- Expanding partnerships, operational enhancements, and regulatory credibility are driving Lifecore's momentum in biopharma manufacturing, supporting stronger contract wins and profitability.

- Rising demand for injectable and HA-based drugs, along with new market entries, is broadening Lifecore's addressable market and cementing a foundation for sustained growth.

- Heavy reliance on key customers, margin compression, and sector risks challenge profitability and growth, while macroeconomic pressures threaten long-term financial stability and flexibility.

Catalysts

About Lifecore Biomedical- Operates as an integrated contract development and manufacturing organization in the United States.

- The company is benefiting from increased development agreements and partnerships with both new and existing customers, including high-value programs in late-stage development (such as the GLP-1 and ophthalmic programs), positioning Lifecore to capitalize on growing biopharma R&D spending-this should support future top-line growth and provide greater revenue visibility as pipeline products reach commercialization.

- Growing demand for injectable and HA-based pharmaceuticals, driven by aging demographics and a rise in chronic illnesses like osteoarthritis and ophthalmic disorders, is expanding Lifecore's target market; recent volume increases and take-or-pay commitments from major customers, including upcoming expansions into new regions (notably Asia Pacific), suggest a foundation for sustained revenue and earnings growth.

- Lifecore has executed significant operational improvements-rightsizing the workforce, implementing manufacturing automation, and introducing an enterprise resource planning (ERP) system-all of which are likely to increase operating leverage, improve margins, and reduce SG&A as a percent of revenue, thus contributing to higher future profitability.

- The shift toward pharmaceutical manufacturing onshoring and greater regulatory focus on supply chain security is driving increased outsourcing to specialized CDMOs in the US like Lifecore-management commentary and customer pipeline activity indicate that these industry dynamics can support continued contract wins, boosting long-term volume growth and recurring revenues.

- The company's strong quality management systems, recent positive FDA audit, and investment in business development talent have upgraded capabilities and customer perception, enhancing Lifecore's ability to win new contracts and sustain its reputation; this operational credibility is expected to translate into a higher win rate for projects and improved long-term revenue growth.

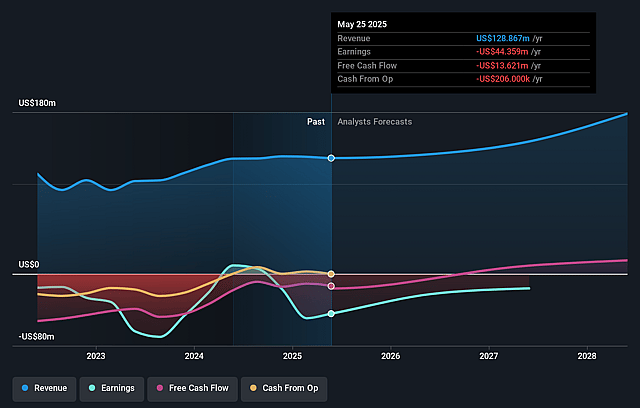

Lifecore Biomedical Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Lifecore Biomedical's revenue will grow by 11.5% annually over the next 3 years.

- Analysts are not forecasting that Lifecore Biomedical will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Lifecore Biomedical's profit margin will increase from -34.4% to the average US Life Sciences industry of 14.2% in 3 years.

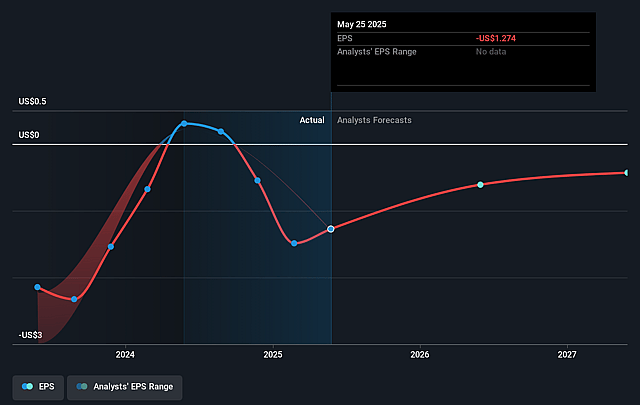

- If Lifecore Biomedical's profit margin were to converge on the industry average, you could expect earnings to reach $25.4 million (and earnings per share of $0.56) by about August 2028, up from $-44.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 22.4x on those 2028 earnings, up from -6.5x today. This future PE is lower than the current PE for the US Life Sciences industry at 29.7x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.03%, as per the Simply Wall St company report.

Lifecore Biomedical Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Lifecore remains highly dependent on a small number of large customers, with growth in HA manufacturing and revenue heavily concentrated in a single partner's supply chain shift; this customer concentration exposes the company to sudden revenue declines and earnings volatility if relationships change, contracts are lost, or terms are renegotiated, directly impacting future revenue visibility and profit stability.

- The company's recent financials reflect a net loss of $38.7 million for FY2025 versus net income the prior year, with declining gross profits in CDMO business segments and only marginal total revenue growth (0.5% YoY); these trends suggest persistent challenges in scaling profitability and improving net margins, raising questions about Lifecore's ability to deliver sustained earnings growth.

- Industry-wide margin compression and pricing pressure are foreseeable as competition intensifies in the injectable and hyaluronic acid contract manufacturing market; Lifecore's midterm margin expansion targets could be undermined if competitive or regulatory forces drive down pricing or increase cost of compliance, negatively affecting EBITDA and net margins.

- Advances in alternative drug delivery technologies or synthetic/biosynthetic substitutes for hyaluronic acid could erode demand for Lifecore's core offerings; such secular shifts in the biotechnology sector would hurt long-term top-line growth and threaten the relevance of the current product portfolio, putting revenues at risk.

- Lifecore's recently strengthened balance sheet is partly due to noncore asset sales, but the company remains exposed to broader macro risks such as rising interest rates, capital market volatility, and elevated compliance costs; these factors can increase operational overhead, borrowing costs, and refinancing risk, further squeezing net income and limiting the financial flexibility needed for long-term expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $10.0 for Lifecore Biomedical based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $178.8 million, earnings will come to $25.4 million, and it would be trading on a PE ratio of 22.4x, assuming you use a discount rate of 8.0%.

- Given the current share price of $7.74, the analyst price target of $10.0 is 22.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.