Narratives are currently in beta

Key Takeaways

- Strong LINZESS demand and apraglutide's market potential could drive future revenue, contingent on stable pricing and regulatory success.

- Reduced R&D spending and strategic focus on high-potential assets may enhance financial stability and boost future earnings.

- LINZESS faces revenue and margin pressures from Medicaid, while stalled pipeline projects and commercialization challenges limit future growth avenues.

Catalysts

About Ironwood Pharmaceuticals- A healthcare company, focuses on the development and commercialization of gastrointestinal (GI) products.

- The ongoing robust prescription demand growth for LINZESS, despite pricing pressures, suggests potential for increased revenues if pricing strategies stabilize or improve.

- The upcoming apraglutide NDA submission and potential market entry could drive significant future revenue growth, assuming regulatory approval and successful commercialization.

- The strategic focus on maximizing LINZESS profits and cash flow, coupled with debt repayments and financial restructuring efforts, may enhance net margins and overall financial stability.

- Significant reductions in R&D expenditures and the discontinuation of less promising projects allow the company to allocate resources towards high-potential assets like apraglutide, potentially boosting future earnings.

- The possibility of LINZESS transitioning to an over-the-counter product presents a long-term revenue opportunity by extending the product's lifecycle beyond its current prescription-only status.

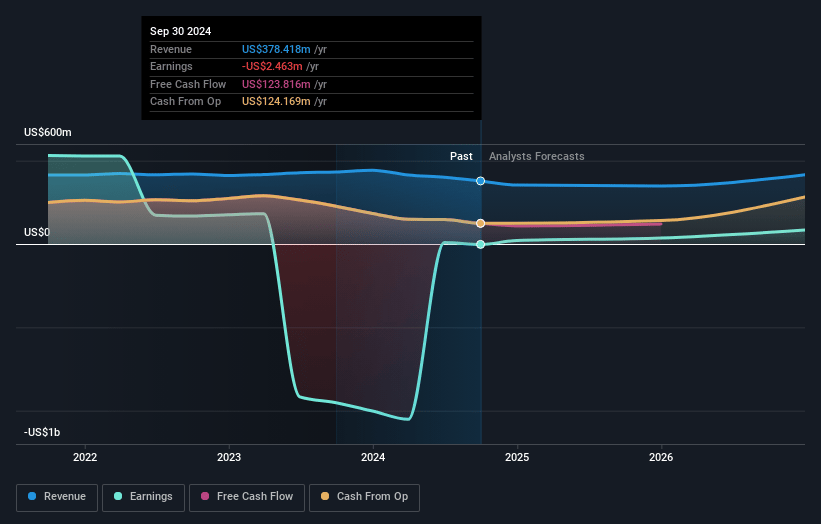

Ironwood Pharmaceuticals Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Ironwood Pharmaceuticals's revenue will grow by 10.0% annually over the next 3 years.

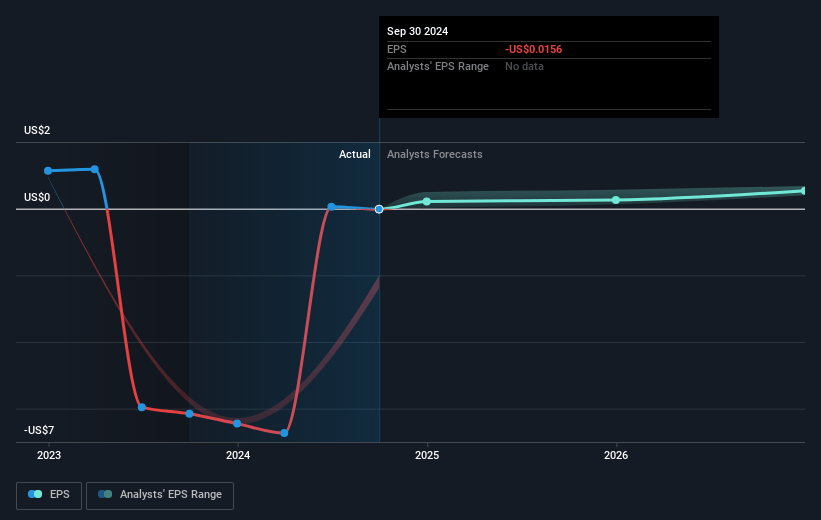

- Analysts assume that profit margins will increase from -0.7% today to 24.2% in 3 years time.

- Analysts expect earnings to reach $122.0 million (and earnings per share of $0.82) by about November 2027, up from $-2.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.0x on those 2027 earnings, up from -247.5x today. This future PE is greater than the current PE for the US Biotechs industry at 17.2x.

- Analysts expect the number of shares outstanding to decline by 2.56% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.81%, as per the Simply Wall St company report.

Ironwood Pharmaceuticals Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- LINZESS is experiencing pricing headwinds due to an increase in Medicaid prescriptions, which could negatively affect the company's revenue and net margins.

- The decision not to pursue some pipeline projects, such as CNP-104 and the IW-3300 study, may limit future revenue growth avenues and could affect earnings if alternative projects do not compensate for these lost opportunities.

- Ironwood's revenues from LINZESS decreased by 19% year-over-year in the third quarter, which indicates challenges in maintaining current revenue levels and could impact future profitability.

- Continued legislative changes, such as the 2025 Medicare Part D redesign, might further impact LINZESS pricing dynamics and pressure net revenues.

- The company faces potential commercialization challenges for apraglutide, with ongoing pre-launch costs impacting short-term net margins, and uncertainties around market acceptance affecting long-term revenue potential.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $12.5 for Ironwood Pharmaceuticals based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $23.0, and the most bearish reporting a price target of just $5.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $503.6 million, earnings will come to $122.0 million, and it would be trading on a PE ratio of 19.0x, assuming you use a discount rate of 7.8%.

- Given the current share price of $3.81, the analyst's price target of $12.5 is 69.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives