Key Takeaways

- Intense competition and market saturation may hinder anticipated revenue growth from new product launches, impacting overall revenue projections.

- Increased R&D investments may not lead to adequate pipeline progression, affecting future earnings and profitability.

- Incyte's strong revenue growth, financial flexibility, and ongoing R&D efforts support sustainable earnings increases and shareholder value through product diversification and strategic initiatives.

Catalysts

About Incyte- A biopharmaceutical company, engages in the discovery, development, and commercialization of therapeutics in the United States, Europe, Canada, and Japan.

- The anticipated growth in revenue from new product launches such as Niktimvo, ruxolitinib cream for pediatric atopic dermatitis, tafasitamab, and retifanlimab might not meet expectations due to the high level of competition in the market, potentially impacting projected revenues.

- The company's plan to significantly increase investment in R&D, with expenses projected to hit up to $1.96 billion, might not yield the expected pipeline progression, which could negatively affect future earning potential and profitability margins.

- With Medicare Part D changes and expected lower net pricing due to price increase caps, Jakafi’s revenue could be pressured, potentially resulting in less robust revenue growth than anticipated if the company cannot offset these factors with volume growth.

- Despite expectations for robust revenue contributions from Opzelura, the healthcare sector's uncertainty might lead to slower international market penetration and reimbursement challenges, which would affect revenue growth from non-U.S. segments.

- The relatively high guidance for net products like Opzelura, projecting full-year sales growth of 24% to 32%, may not materialize if demand growth doesn't meet expectations due to market saturation or evolving treatment standards, thus impacting the company's overall revenue targets.

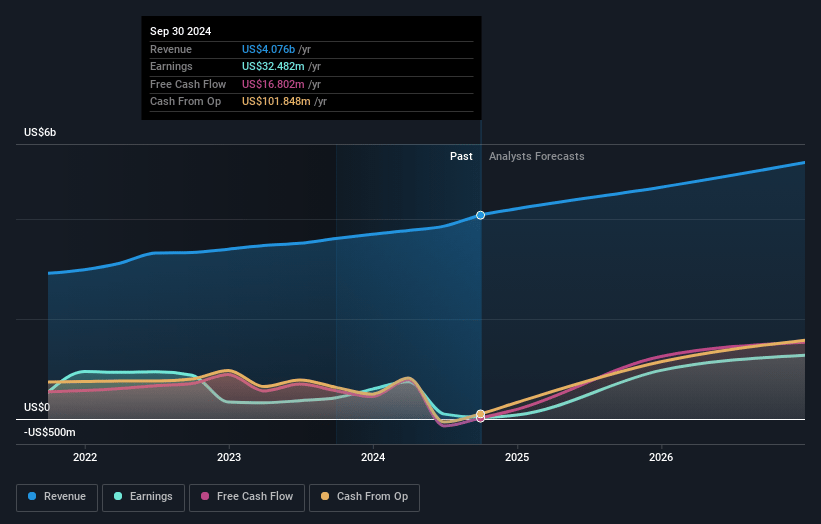

Incyte Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Incyte compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Incyte's revenue will grow by 7.0% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 0.8% today to 21.3% in 3 years time.

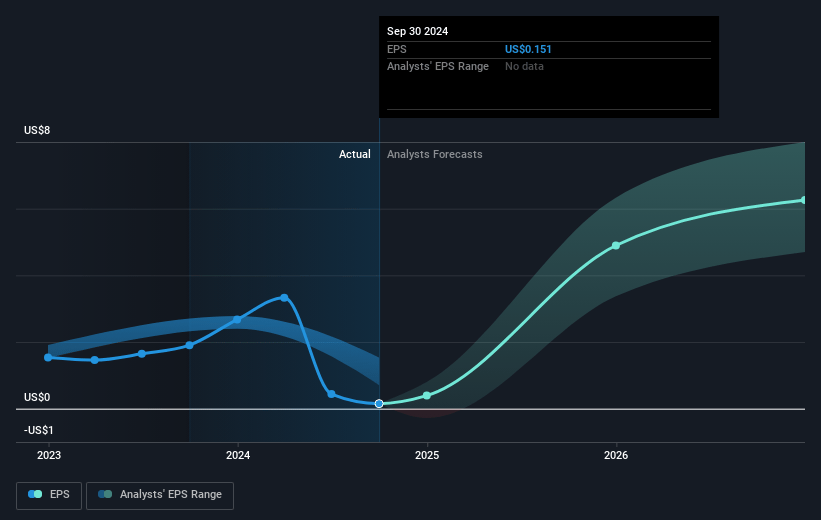

- The bearish analysts expect earnings to reach $1.1 billion (and earnings per share of $5.58) by about April 2028, up from $32.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 10.6x on those 2028 earnings, down from 340.5x today. This future PE is lower than the current PE for the US Biotechs industry at 19.1x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.37%, as per the Simply Wall St company report.

Incyte Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Incyte experienced strong revenue growth in 2024, with total revenues increasing by 15% to $4.2 billion. The growth encompassed both Jakafi and non-Jakafi products like Opzelura, demonstrating a successful diversification strategy that could positively impact future revenue streams.

- The company's robust financial position, characterized by $2.2 billion in cash and no debt, provides financial flexibility. This stability supports potential investments in growth initiatives and could lead to improved profit margins through strategic resource allocation.

- With anticipated approvals and commercial launches of several new products, including Niktimvo and ruxolitinib cream for pediatric atopic dermatitis, Incyte is positioned for significant revenue growth. These launches are projected to contribute $1 billion in incremental revenues by 2029, enhancing overall earnings potential.

- Incyte's ongoing R&D activities, reflected in over 10 expected high-impact product launches by 2030, indicate sustainable revenue growth. The company's commitment to developing new therapies can lead to increased market share and competitive positioning, positively impacting future earnings.

- Successful share repurchase activities in 2024, totaling $2 billion, reflect strong cash flow and commitment to returning value to shareholders. This financial action, coupled with a strategic vision, may lead to enhanced shareholder value and stable net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Incyte is $62.86, which represents one standard deviation below the consensus price target of $73.31. This valuation is based on what can be assumed as the expectations of Incyte's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $92.0, and the most bearish reporting a price target of just $52.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $5.2 billion, earnings will come to $1.1 billion, and it would be trading on a PE ratio of 10.6x, assuming you use a discount rate of 6.4%.

- Given the current share price of $57.38, the bearish analyst price target of $62.86 is 8.7% higher. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystLowTarget holds no position in NasdaqGS:INCY. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.