Last Update07 May 25Fair value Decreased 2.29%

AnalystHighTarget has decreased profit margin from 18.3% to 16.2%.

Read more...Key Takeaways

- New product innovations and adoption of advanced sequencing solutions are expanding addressable markets and driving growth in research, clinical, and diagnostic applications.

- Operational efficiencies, strong demand, and disciplined financial management are supporting improved margins, earnings growth, and greater revenue predictability.

- Rising regulatory barriers, funding constraints, and increasing competition are pressuring Illumina’s revenue growth, margins, and long-term earnings prospects amid industry commoditization.

Catalysts

About Illumina- Provides sequencing- and array-based solutions for genetic and genomic analysis in the Americas, Europe, Greater China, the Asia Pacific, the Middle East, and Africa.

- Illumina’s new product launches in advanced sequencing and multiomics—including innovations like the upcoming spatial biology solution, new single cell CRISPR offerings for oncology and immunology, and the proteomics platform—are expected to unlock new research and clinical applications that were previously unattainable, directly expanding Illumina’s addressable market and supporting future revenue growth.

- Strong global trends in personalized medicine, population health, and chronic disease management are driving sustained demand for high-throughput sequencing and variant analysis solutions, positioning Illumina to benefit from the accelerating adoption of genomics in both clinical settings and national genomics initiatives, supporting higher long-term instrument placements and consumables growth.

- The transition of Illumina’s installed base to the NovaSeq X platform is well underway, with high-throughput sequencing activity up over 30% year-over-year and a growing proportion of clinical customers adopting the platform; as price effects normalize and more sequencing runs migrate to NovaSeq X, revenue growth and gross margins are expected to accelerate due to increased recurring consumable sales and premium platform adoption.

- Operational catalysts such as Illumina’s successful $100 million cost reduction program, ongoing supply chain optimization, and disciplined pricing actions to offset tariffs and macroeconomic headwinds are expected to yield $225 million of run-rate expense reductions over the next four years, directly contributing to higher operating leverage, margin expansion, and earnings growth.

- The growing installed base of Illumina sequencers, strong customer uptake of new contract commitments, and the company’s commitment to continued bolt-on M&A and share repurchases are positioned to improve revenue predictability, deliver meaningful EPS growth, and provide additional upside as both secular and company-specific trends drive further penetration into thriving markets like oncology and clinical diagnostics.

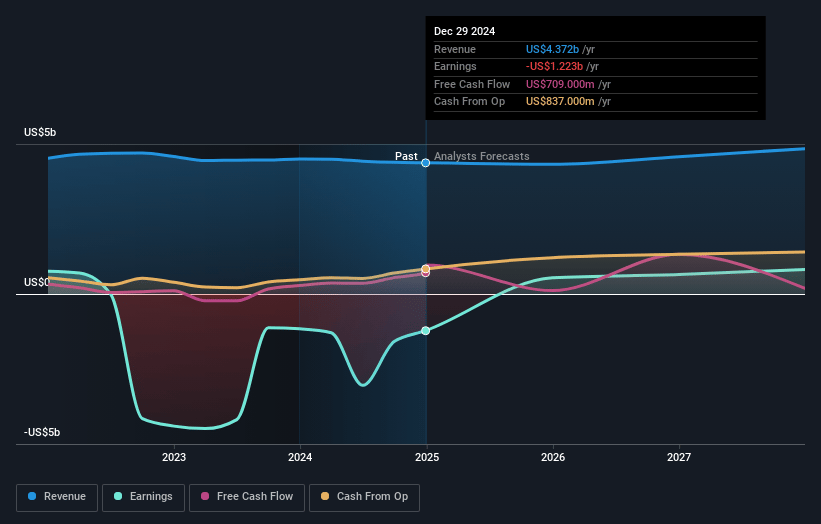

Illumina Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Illumina compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Illumina's revenue will grow by 5.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -22.3% today to 16.2% in 3 years time.

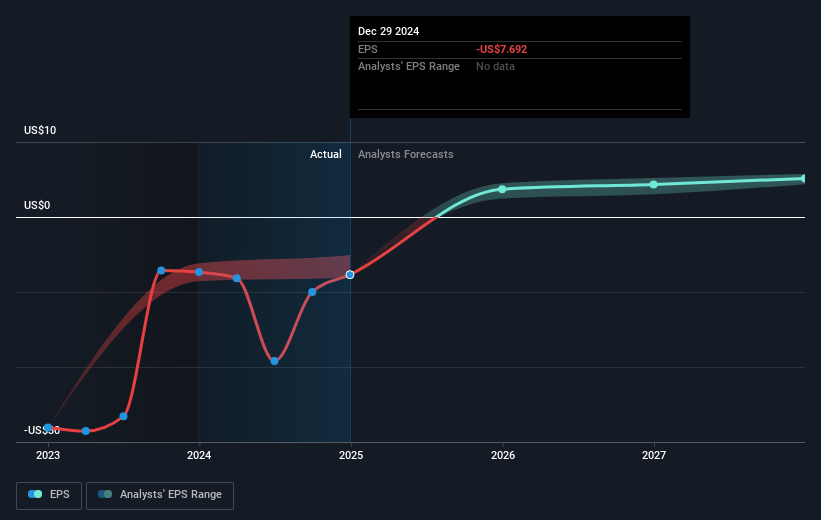

- The bullish analysts expect earnings to reach $819.3 million (and earnings per share of $5.51) by about May 2028, up from $-966.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 39.0x on those 2028 earnings, up from -13.2x today. This future PE is greater than the current PE for the US Life Sciences industry at 35.3x.

- Analysts expect the number of shares outstanding to decline by 0.63% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.1%, as per the Simply Wall St company report.

Illumina Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Illumina faces mounting challenges from rising global protectionism and regulatory scrutiny, exemplified by ongoing export restrictions and limited sales in China, which are significantly reducing its addressable market and will negatively impact future revenue growth.

- Heightened cost pressures and constrained research funding, particularly in the U.S. academic and government sectors, are causing double-digit declines in research-related revenue, restricting demand for sequencing instruments and consumables, and thereby posing a long-term threat to the company’s revenue and earnings trajectory.

- Rapid emergence of low-cost competitors, especially from China, is intensifying pricing pressure in the sequencing industry, increasing the risk of further gross and net margin erosion that would dampen profitability.

- Illumina continues to allocate substantial resources to R&D and operational innovation, but if these investments do not result in transformative breakthroughs or significant market expansion, return on investment could diminish, constraining future earnings and cash flow generation.

- The DNA sequencing market is showing early signs of commoditization, with industry-wide declines in hardware prices and shifts in research priorities toward other ‘omics’ technologies, both of which threaten to cap long-term revenue growth and exert downward pressure on margins as Illumina’s pricing power erodes.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Illumina is $167.63, which represents two standard deviations above the consensus price target of $109.1. This valuation is based on what can be assumed as the expectations of Illumina's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $190.0, and the most bearish reporting a price target of just $70.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $5.0 billion, earnings will come to $819.3 million, and it would be trading on a PE ratio of 39.0x, assuming you use a discount rate of 7.1%.

- Given the current share price of $80.3, the bullish analyst price target of $167.63 is 52.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives