Narratives are currently in beta

Key Takeaways

- Enhanced customer collaboration and continuous innovation drive product adoption, boosting revenue and aligning developments with customer needs for advanced sequencing.

- Operational excellence, capital allocation, and NovaSeq X transition aim to improve profitability, offset pricing pressure, and drive shareholder value.

- Competitive pressures, economic headwinds, and shifting consumer patterns pose risks to Illumina's revenue growth, margins, and market expansion efforts.

Catalysts

About Illumina- Offers sequencing- and array-based solutions for genetic and genomic analysis in the United States, Singapore, the United Kingdom, and internationally.

- Illumina is focusing on deeper customer collaboration, which involves shifting how they interact and collaborate with customers, allowing for early input on innovations. This could enhance revenue by ensuring that product developments align closely with customer needs, leading to higher adoption and sales.

- Continuous innovation is a core priority, with launches such as the MiSeq i100 and advancements like comprehensive whole genome sequencing and 5-based genome technology. These innovations could drive revenue and earnings growth as they meet customer demand for advanced sequencing capabilities.

- Operational excellence is being prioritized to enhance productivity and optimize investment spend. This focus aims to expand operating margins by 500 basis points by 2027, directly impacting the company's net margins and overall profitability.

- Illumina's transition to the NovaSeq X series is progressing well, with increased clinical volumes and consumable revenue from these instruments. This transition is expected to offset some of the pricing pressure and contribute to revenue growth as more customers adopt the newer platform.

- The company's capital allocation strategy, including repurchasing shares and strategic acquisitions, aims to drive shareholder value and boost earnings per share. This strategic use of capital is expected to support future revenue growth and improve earnings.

Illumina Future Earnings and Revenue Growth

Assumptions

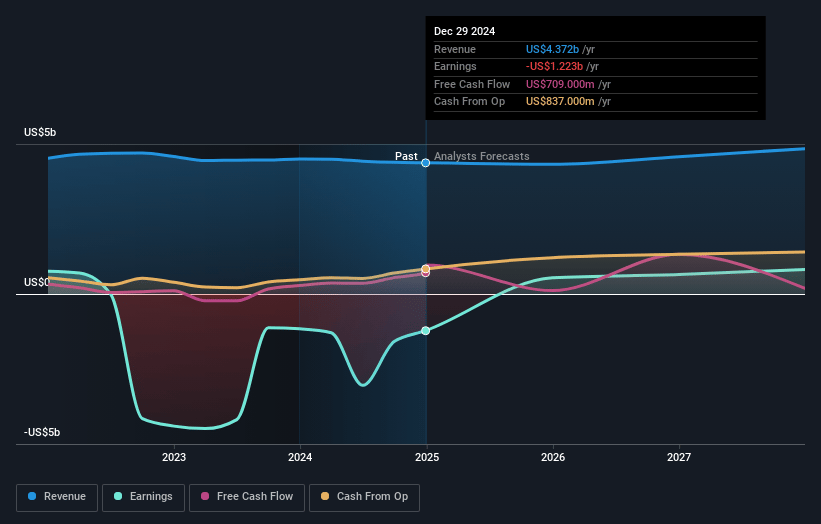

How have these above catalysts been quantified?- Analysts are assuming Illumina's revenue will grow by 4.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from -36.1% today to 15.4% in 3 years time.

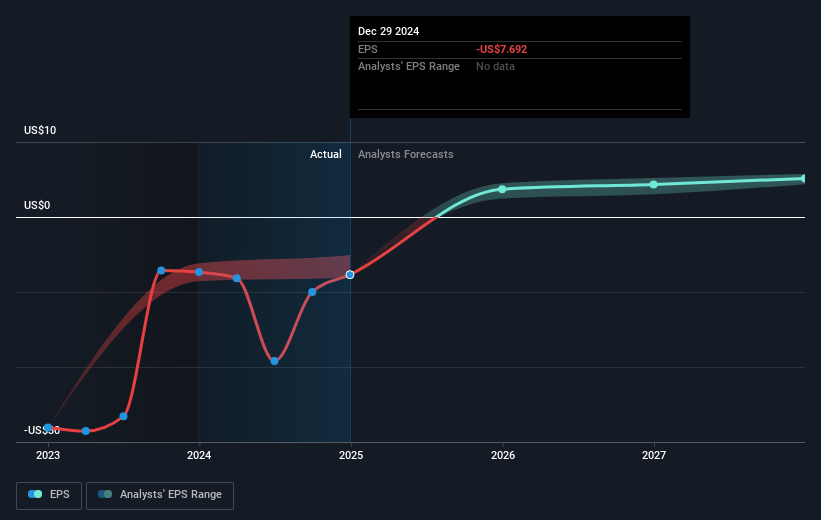

- Analysts expect earnings to reach $771.4 million (and earnings per share of $4.69) by about November 2027, up from $-1.6 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $475.2 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 42.4x on those 2027 earnings, up from -13.5x today. This future PE is greater than the current PE for the US Life Sciences industry at 41.6x.

- Analysts expect the number of shares outstanding to grow by 1.21% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.59%, as per the Simply Wall St company report.

Illumina Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The decline in Illumina's sequencing instrument revenue by 42% year-over-year, driven by lower NovaSeq X placements and mid-throughput shipments, could hinder future revenue growth as capital and cash flow constraints continue to impact purchasing behavior.

- The revision of 2024 revenue growth guidance to slightly lower than prior estimates due to constrained macroeconomic conditions suggests a potential risk to revenue growth and market expansion efforts.

- The continued macroeconomic headwinds, including variability in consumer purchasing patterns and reduced end-of-year business activity, could pressure financial performance, impacting both revenue and net margins.

- Competitive pressures, particularly in the mid-throughput segment, and ongoing price reductions for sequencing services could limit revenue growth and compress margins as Illumina attempts to maintain its market position.

- Seasonal declines and consumption patterns with respect to sequencing consumables, particularly in the fourth quarter, could result in revenue contractions at critical fiscal periods, impacting the overall financial outcomes for the company.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $164.6 for Illumina based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $254.0, and the most bearish reporting a price target of just $120.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $5.0 billion, earnings will come to $771.4 million, and it would be trading on a PE ratio of 42.4x, assuming you use a discount rate of 6.6%.

- Given the current share price of $135.0, the analyst's price target of $164.6 is 18.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives