Key Takeaways

- Rapid growth in eye care prescriptions, product innovation, and successful market access initiatives are driving higher revenues, margins, and expanding customer reach.

- Investments in sales infrastructure and digital health, along with strong industry relationships, support sustainable earnings and position the company for scalable long-term growth.

- Heavy dependence on key products, margin pressures, regulatory and refinancing risks, and rising operating costs threaten profitability and strategic flexibility.

Catalysts

About Harrow- An eyecare pharmaceutical company, engages in the discovery, development, and commercialization of ophthalmic pharmaceutical products.

- The rapid adoption and strong early results of the VEVYE Access for All program have led to a quadrupling of new prescriptions and prescribers, positioning VEVYE to capture significant share in the large and growing dry eye market, which is structurally supported by increasing prevalence of chronic eye diseases—this is poised to drive substantial quarterly revenue growth and overall top-line acceleration.

- Harrow’s portfolio expansion, both from the ongoing successful transition of compounded products (e.g., Klarity-C) to higher-margin branded pharmaceuticals (e.g., VEVYE) and further pipeline development from compounding relationships, leverages the long-term trend of brand preference in ophthalmology, improving both net margins and creating cross-selling opportunities that bolster sustainable earnings growth.

- Recent completion of market access and reimbursement initiatives for TRIESENCE has unlocked previously inaccessible segments (ASCs, hospital outpatient departments), immediately doubling the number of ordering accounts and increasing market confidence—these improvements are expected to lead to accelerating unit demand and increased recurring revenues in upcoming quarters.

- Harrow’s ongoing investments in commercial infrastructure, which include a sizable and expanding salesforce, enhance reach and market penetration while capitalizing on greater adoption of telemedicine and digital health platforms in vision care—these actions support future revenue scalability and could drive improved sales efficiency and net margin expansion over time.

- As the aging population fuels ongoing demand for advanced ophthalmic medications and surgical solutions, Harrow’s vertically integrated operations, deep relationships with over 10,000 U.S. eye care professionals, and robust recurring compounding business provide operational leverage and predictable revenue streams—setting the stage for long-term top-line growth and improved operating margins as market size and patient pool continue to expand.

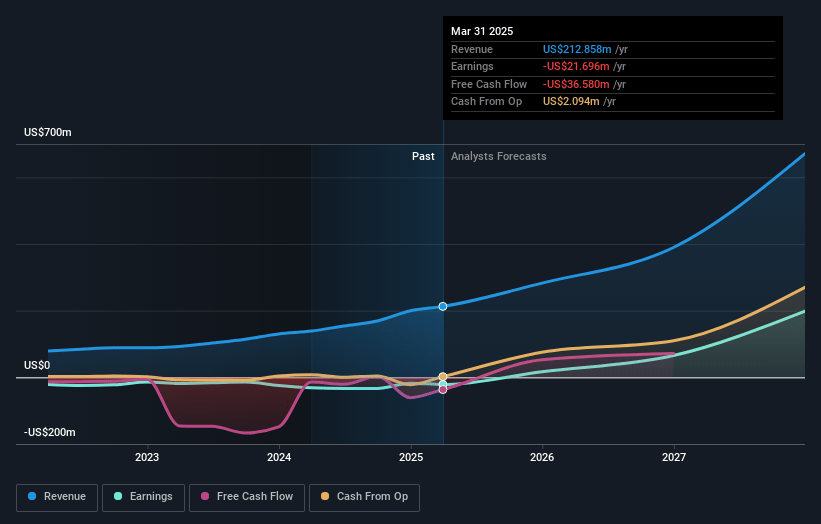

Harrow Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Harrow's revenue will grow by 41.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from -10.2% today to 29.5% in 3 years time.

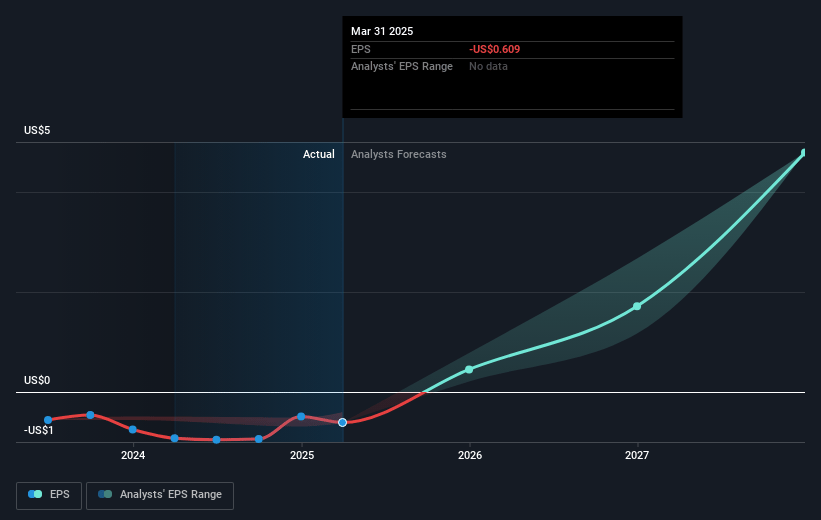

- Analysts expect earnings to reach $179.5 million (and earnings per share of $3.97) by about July 2028, up from $-21.7 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $210.4 million in earnings, and the most bearish expecting $99.1 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.8x on those 2028 earnings, up from -58.1x today. This future PE is lower than the current PE for the US Pharmaceuticals industry at 17.6x.

- Analysts expect the number of shares outstanding to grow by 3.43% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.4%, as per the Simply Wall St company report.

Harrow Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy reliance on a small number of branded specialty products, especially VEVYE as a “company maker,” exposes Harrow to significant product concentration risk; loss of momentum, competitive launches, or market access/reimbursement changes for these products could materially depress revenue and earnings.

- Volatility in gross-to-net estimates and average selling prices (ASPs), plus the use of price reduction strategies to maintain/increase market share, could compress margins, making sustainable net margin expansion more difficult in a value-based and price-conscious healthcare environment.

- Ongoing and increasing investment in commercial infrastructure, sales, and marketing – while supporting growth – also raises fixed operating expenses; if new launches or transitions (like Project Eagle) underperform, this could create negative operating leverage and deteriorate profitability.

- The compounding pharmacy segment, while providing a base of recurring revenue and market access credibility, is exposed to heightened regulatory scrutiny and risk from evolving FDA guidelines for compounding, which could increase compliance costs or limit product offerings, affecting both topline and margins.

- Upcoming debt refinancing needs create financial overhang; if Harrow cannot secure favorable refinancing terms or delever as planned, increased interest expense or constrained access to capital may negatively impact net income and limit strategic flexibility for reinvestment or growth initiatives.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $59.025 for Harrow based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $76.0, and the most bearish reporting a price target of just $42.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $607.6 million, earnings will come to $179.5 million, and it would be trading on a PE ratio of 15.8x, assuming you use a discount rate of 6.4%.

- Given the current share price of $34.37, the analyst price target of $59.02 is 41.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.