Key Takeaways

- Broadening global access and new treatment guidelines are expected to boost demand and strengthen market position for lipid-lowering therapies.

- Strategic partnerships, product innovation, and enhanced cost controls are set to improve profitability and support long-term growth.

- Heavy reliance on a narrow product line, persistent financial losses, and industry pressures threaten future growth, profitability, and international market contributions.

Catalysts

About Esperion Therapeutics- A pharmaceutical company, develops and commercializes medicines for the treatment of patients with elevated low density lipoprotein cholesterol (LDL-C) in the United States.

- Growing global prevalence of cardiovascular and metabolic disease, combined with an aging patient population, is expected to drive increasing long-term demand for lipid-lowering therapies like bempedoic acid, supporting revenue growth and improved market share for Esperion.

- Expanded international partnerships and successful regulatory filings/approvals in major markets (Japan, Canada, Australia, New Zealand, Israel, and Europe) are set to unlock new revenue streams and diversify top-line growth, enhancing both revenues and long-term profitability.

- Inclusion of NEXLETOL and NEXLIZET in new ACC/AHA guidelines, coupled with strong clinical outcomes and increasing payer/formulary access, is likely to accelerate physician adoption and prescription volumes, which can meaningfully boost near

- and mid-term revenues.

- Development of the triple combination therapy (aiming for 2027 commercialization) and label expansion into new indications (such as PSC) could grow the addressable patient pool and fortify Esperion’s market position, supporting future revenue and earnings visibility.

- Ongoing improvements in operating leverage, such as increasing gross margin through tech transfer to partners and disciplined cost control of R&D and SG&A, are expected to drive long-term improvements in net margins and overall profitability.

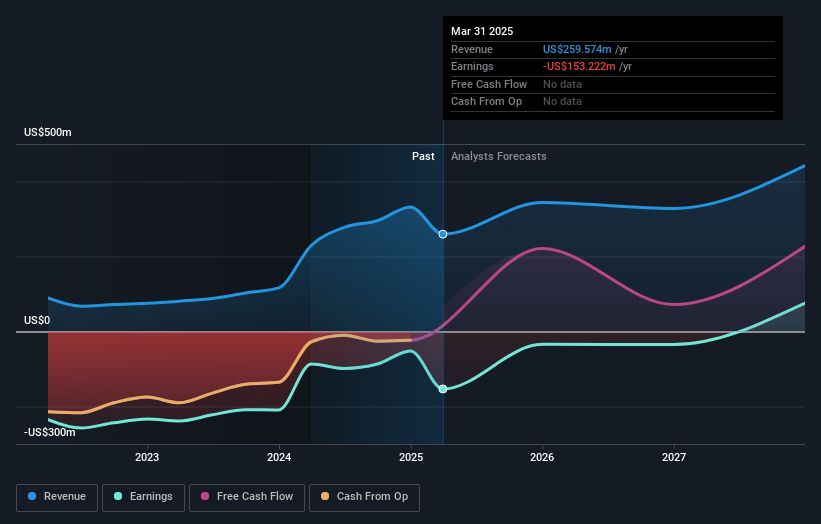

Esperion Therapeutics Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Esperion Therapeutics's revenue will grow by 21.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from -59.0% today to 15.6% in 3 years time.

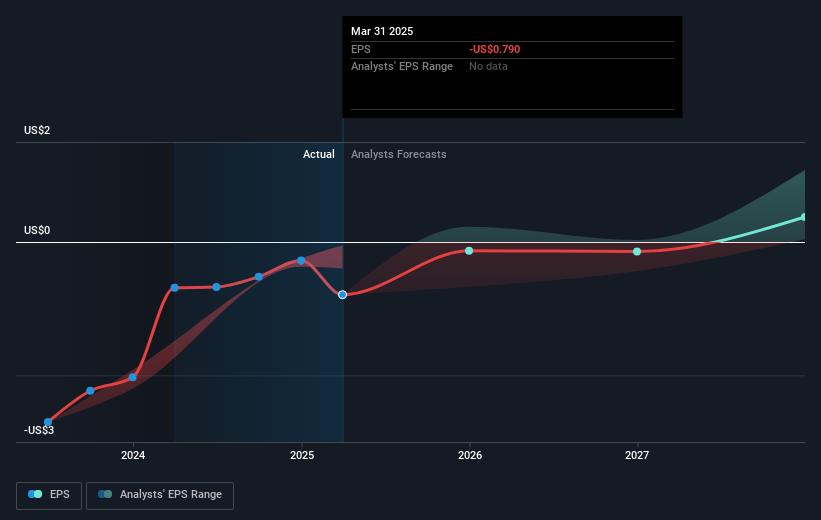

- Analysts expect earnings to reach $73.1 million (and earnings per share of $0.44) by about May 2028, up from $-153.2 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $212.1 million in earnings, and the most bearish expecting $-28.3 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.0x on those 2028 earnings, up from -1.1x today. This future PE is greater than the current PE for the US Pharmaceuticals industry at 17.2x.

- Analysts expect the number of shares outstanding to grow by 1.01% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.25%, as per the Simply Wall St company report.

Esperion Therapeutics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Esperion remains heavily dependent on a narrow portfolio—primarily bempedoic acid and its related products—and faces the risk that emerging alternatives (such as obicetrapib or therapies addressing lipoprotein(a)) or future generics could erode its competitive position, potentially reducing future revenue growth and earnings.

- Persistent net losses, high marketing and R&D investments, and continued reliance on expensive commercial initiatives to drive sales penetration (including an expanded field reimbursement team and ongoing educational programs) could compress net margins and delay the company’s path to sustained profitability.

- Changes in U.S. healthcare reimbursement and insurance dynamics—including confusion and negative impact from the Inflation Reduction Act (IRA), Medicare Part D changes, and higher patient out-of-pocket costs—have resulted in more pronounced seasonal revenue headwinds; ongoing or worsening pressures could impede net product revenue growth and affect earnings reliability.

- Esperion’s international royalties, particularly in Europe and Japan, are subject to variable margins and long approval/tech transfer cycles; flat-to-negative margins on partner tablet sales and risks around realization of Japanese market approval may limit the anticipated contribution to long-term net margins and cash flow.

- Ongoing industry-wide pressures—such as increasing scrutiny of drug pricing, potential for generic or biosimilar competitors, and the rise of digital and non-pharmaceutical interventions for cardiovascular risk reduction—could reduce the addressable market and limit Esperion’s ability to sustain premium pricing, ultimately constraining long-term revenue, gross margin, and overall profits.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $5.786 for Esperion Therapeutics based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $16.0, and the most bearish reporting a price target of just $1.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $469.7 million, earnings will come to $73.1 million, and it would be trading on a PE ratio of 21.0x, assuming you use a discount rate of 9.2%.

- Given the current share price of $0.86, the analyst price target of $5.79 is 85.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.