Narratives are currently in beta

Key Takeaways

- Successful Phase III studies suggest significant future revenue growth by expanding the treatment market and raising physician awareness.

- Promising trials in new therapeutic areas could diversify revenue streams and increase long-term earnings stability.

- Corcept's revenue growth faces risks from legal disputes, reliance on Korlym, regulatory challenges, and assumptions about hypercortisolism prevalence impacting future market penetration.

Catalysts

About Corcept Therapeutics- Engages in discovery and development of drugs for the treatment of severe endocrinologic, oncologic, metabolic, and neurologic disorders in the United States.

- The successful results from the GRACE and GRADIENT Phase III studies for relacorilant in treating Cushing syndrome suggest a positive path for regulatory approval, which is expected to drive future revenue growth significantly by expanding the treatment market.

- Increasing physician awareness and recognition of the prevalence of hypercortisolism could lead to more patients diagnosed and treated, thereby potentially boosting revenue from Corcept’s existing product, Korlym, and the forthcoming relacorilant.

- The ongoing and future studies in cancer treatments, including the pivotal ROSELLA study in ovarian cancer, hold the potential to expand the therapeutic uses of relacorilant, opening new high-value markets and positively impacting future earnings.

- The CATALYST study indicating a higher-than-expected prevalence of hypercortisolism in patients with diabetes and cardiovascular diseases could lead to a substantial increase in the market size for Corcept’s products, driving up revenue and earnings.

- Entering new therapeutic areas with promising trials in ALS and potential treatments for MASH (metabolic dysfunction-associated steatohepatitis) could provide new growth avenues and diversify revenue streams, increasing long-term earnings stability.

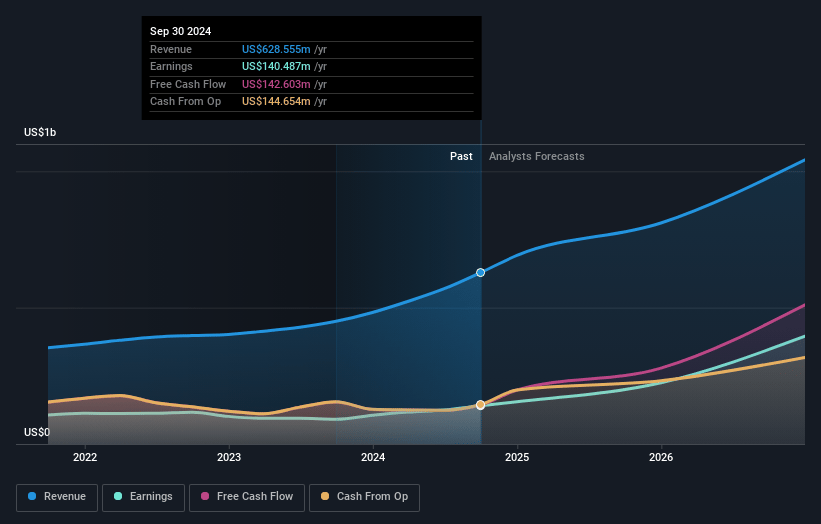

Corcept Therapeutics Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Corcept Therapeutics's revenue will grow by 25.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 22.4% today to 44.0% in 3 years time.

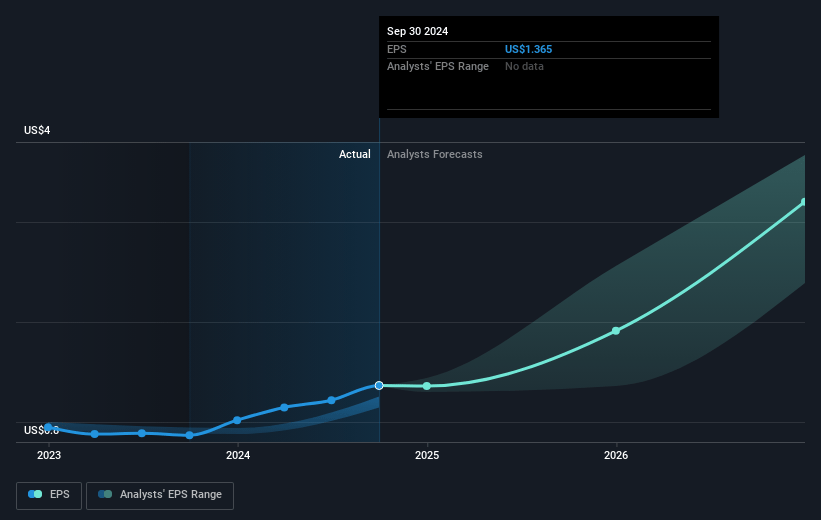

- Analysts expect earnings to reach $551.3 million (and earnings per share of $4.43) by about November 2027, up from $140.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.0x on those 2027 earnings, down from 40.5x today. This future PE is greater than the current PE for the US Pharmaceuticals industry at 19.9x.

- Analysts expect the number of shares outstanding to grow by 5.86% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.92%, as per the Simply Wall St company report.

Corcept Therapeutics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing legal dispute with Teva Pharmaceuticals over patent rights for Korlym poses a risk. If Corcept loses the appeal, Teva could market a generic version, potentially reducing Corcept's revenue from Korlym.

- The GRADIENT study results showed a non-statistically significant difference in blood pressure improvement between relacorilant and placebo, which might jeopardize regulatory approval expectations, impacting future earnings assumptions tied to this drug.

- The company's revenue heavily relies on Korlym, and while there is optimism about relacorilant's potential, regulatory and market acceptance remain uncertain, creating risk for sustained revenue growth.

- Corcept is aggressively pursuing multiple research and development projects, which typically require significant investment. If these projects do not translate into successful products, net margins could be adversely impacted to due increased R&D costs.

- The assumption that hypercortisolism is more prevalent than previously thought is driving projections for future growth. However, this assumption carries risks, such as slower uptake or screening rates, which could impact anticipated revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $74.9 for Corcept Therapeutics based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $80.0, and the most bearish reporting a price target of just $67.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $1.3 billion, earnings will come to $551.3 million, and it would be trading on a PE ratio of 20.0x, assuming you use a discount rate of 5.9%.

- Given the current share price of $54.3, the analyst's price target of $74.9 is 27.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives