Key Takeaways

- Successful clinical studies and expanding hypercortisolism awareness are expected to drive revenue growth through increased prescriptions and potential FDA approvals.

- The oncology division and relacorilant's FDA acceptance could significantly expand market potential and improve profitability through higher revenue streams.

- Ongoing litigation, operational challenges, trial uncertainties, and R&D costs pose risks to revenue growth and operational efficiency for Corcept Therapeutics.

Catalysts

About Corcept Therapeutics- Engages in discovery and development of medication for the treatment of severe endocrinologic, oncologic, metabolic, and neurologic disorders in the United States.

- Successful data from pivotal studies such as the GRACE, GRADIENT, and ROSELLA, along with advances in relacorilant therapy, are expected to drive revenue growth due to increased prescription rates and potential FDA approval expansion.

- Expanded awareness of hypercortisolism among physicians and successful results from studies like CATALYST and MOMENTUM suggest a higher than previously assumed prevalence, which will likely increase future revenues as more patients undergo screening and treatment.

- Continued growth in the Cushing's syndrome treatment market, with potential revenues projected to reach $3 billion to $5 billion in 3-5 years, driven by increased market penetration and physician uptake of cortisol modulators, is expected to significantly boost earnings.

- The launch of an oncology division and ongoing clinical trials evaluating relacorilant's application in cancer therapy (e.g., the ROSELLA study) offer significant upside potential to future revenue streams, expanding Corcept's addressable market.

- Anticipated upcoming FDA NDA acceptance for relacorilant, given the compelling clinical data and established safety profile, is expected to enhance product offerings and revenue, improving profitability.

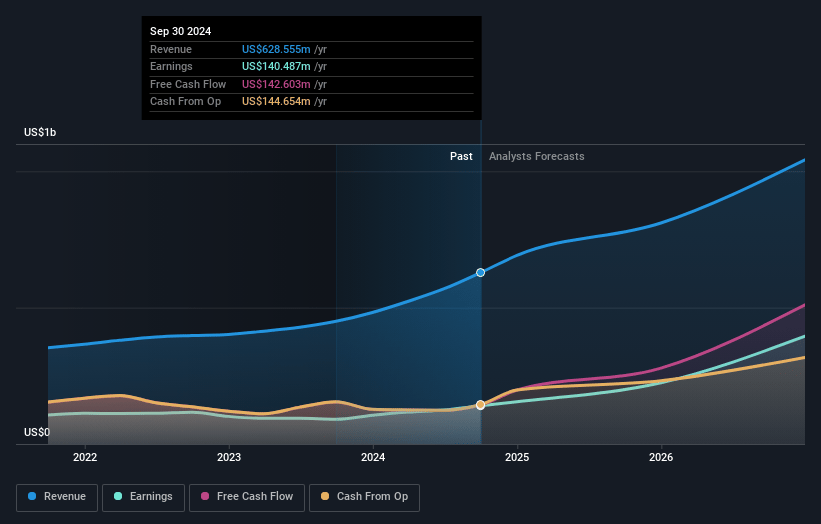

Corcept Therapeutics Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Corcept Therapeutics's revenue will grow by 35.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 20.7% today to 45.7% in 3 years time.

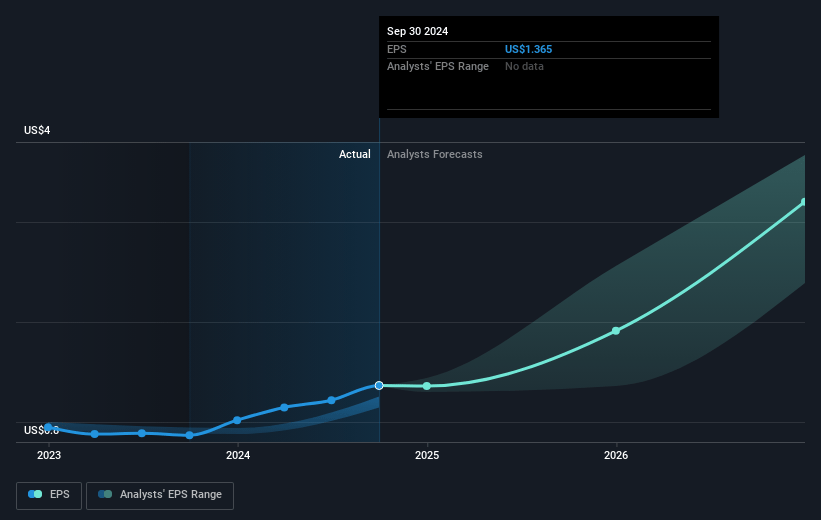

- Analysts expect earnings to reach $774.3 million (and earnings per share of $6.1) by about April 2028, up from $139.7 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $1.0 billion in earnings, and the most bearish expecting $432.6 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 24.2x on those 2028 earnings, down from 48.8x today. This future PE is greater than the current PE for the US Pharmaceuticals industry at 16.1x.

- Analysts expect the number of shares outstanding to grow by 1.34% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.21%, as per the Simply Wall St company report.

Corcept Therapeutics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing litigation with Teva regarding the Korlym patent might result in a negative decision, allowing Teva to enter the market and potentially reduce Corcept's revenue from Korlym sales.

- The FDA approval process for relacorilant and the uncertainty of an AdCom could delay market entry, impacting future revenue projections.

- Operational challenges with their pharmacy partner affected Q4 revenue, indicating potential issues with scaling operations effectively in response to increased demand.

- The ROSSELLA trial results carry risks, as failure to meet primary endpoints could jeopardize approval and anticipated revenue from treating ovarian cancer.

- The ALS trial for dazucorilant did not meet its primary efficacy endpoint, suggesting possible financial risks in other exploratory therapeutic areas and necessitating future R&D investment that could impact net earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $143.25 for Corcept Therapeutics based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.7 billion, earnings will come to $774.3 million, and it would be trading on a PE ratio of 24.2x, assuming you use a discount rate of 6.2%.

- Given the current share price of $64.68, the analyst price target of $143.25 is 54.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.