Last Update 24 Nov 25

COLL: Increased Revenue Guidance And Margin Shifts Will Shape Measured Future Returns

Collegium Pharmaceutical’s analyst price target remains unchanged at $46.80, as analysts point to a balanced outlook where revisions to profit margin and future P/E estimates offset each other.

What's in the News

- Collegium Pharmaceutical raised its 2025 net product revenue guidance and now expects a range of $775 to $785 million, up from the previous range of $745 million to $760 million (Key Developments).

- The company reported no share repurchases from July 1, 2025 to September 30, 2025. The completed buyback resulted in 0 shares repurchased and $0 million spent during this period (Key Developments).

Valuation Changes

- Consensus Analyst Price Target remains unchanged at $46.80.

- Discount Rate is virtually flat, declining marginally from 6.96% to 6.96%.

- Revenue Growth expectations are steady, moving from -3.37% to -3.37%.

- Net Profit Margin has fallen significantly, from 32.60% down to 25.58%.

- Future P/E has risen moderately, increasing from 7.46x to 10.16x.

Key Takeaways

- Broadening demand for specialty pharmaceuticals and innovative pain products positions the company for sustained revenue growth and margin expansion.

- Disciplined acquisitions and targeted investments in ADHD therapies diversify the portfolio and reduce risk, supporting stable long-term earnings.

- Heavy reliance on a maturing pain portfolio and rising fixed costs, amid regulatory, competitive, and pricing pressures, threatens long-term growth and profit sustainability.

Catalysts

About Collegium Pharmaceutical- A specialty pharmaceutical company, engages in the development and commercialization of medicines for pain management.

- Collegium is positioned to benefit from broadening demand for specialty pharmaceuticals addressing chronic medical conditions, as seen in the successful integration and rapid growth trajectory of Jornay PM-a product with expanding use among both adult and pediatric patient populations. This underappreciated expansion directly supports revenue and total earnings growth.

- The company's differentiated pain portfolio, notably with products featuring proprietary abuse-deterrent and extended-release technologies (e.g., Xtampza ER's DETERx platform), is supported by industry and regulatory trends that increasingly favor safer opioid options, likely enhancing market share, pricing power, and sustaining net margins as regulatory emphasis on abuse deterrence grows.

- Collegium's disciplined capital allocation and ongoing business development (M&A) strategy, including pursuing synergistic pain/CNS assets, is expected to drive portfolio diversification and inorganic growth, further reducing revenue concentration risk and providing additional sources of EBITDA and earnings stability.

- Targeted investments in sales force expansion and marketing for Jornay PM, coupled with high prescriber intent and broadening awareness, are designed to capitalize on a sizable and still underpenetrated ADHD market-creating significant momentum for above-market revenue acceleration over the next several years.

- Proactive life-cycle management, continued product innovation, and extended exclusivity (with limited immediate generic competition for its core products) position the company for durable cash flow generation and sustained margins, supporting a robust forward earnings outlook and reducing near

- to mid-term risks to its revenue base.

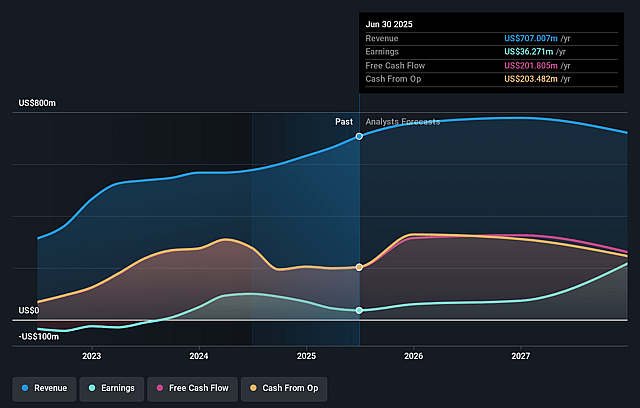

Collegium Pharmaceutical Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Collegium Pharmaceutical's revenue will decrease by 0.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.1% today to 18.9% in 3 years time.

- Analysts expect earnings to reach $131.4 million (and earnings per share of $2.78) by about September 2028, up from $36.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.0x on those 2028 earnings, down from 33.0x today. This future PE is lower than the current PE for the US Pharmaceuticals industry at 19.0x.

- Analysts expect the number of shares outstanding to decline by 2.32% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.79%, as per the Simply Wall St company report.

Collegium Pharmaceutical Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Collegium remains heavily reliant on its pain portfolio (especially Belbuca, Xtampza ER, and Nucynta), which faces impending patent expirations and potential generic competition starting as early as 2027; erosion of exclusivity and increased competition would likely pressure both revenue and net margins.

- Non-GAAP adjusted operating expenses jumped significantly (104% year-over-year), largely due to ongoing commercialization costs for Jornay and sales force expansion; if expected revenue growth does not materialize, these fixed costs could compress net income and reduce earnings quality.

- Opioid products remain under heightened regulatory scrutiny and societal pressure, and future changes in prescribing guidelines or reimbursement restrictions could further suppress prescription volumes and directly impact total revenues.

- Collegium's M&A and portfolio diversification strategy is described as disciplined, but the company is not currently investing in pipeline or development-stage assets, limiting its long-term revenue growth potential and increasing vulnerability to future product concentration risk.

- Industry-wide payer demands for higher rebates and discounts, combined with the threat of further commoditization as more alternatives (including non-opioid and digital therapies) emerge, could exert significant downward pressure on pricing power, limiting revenue growth and compressing margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $44.6 for Collegium Pharmaceutical based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $48.0, and the most bearish reporting a price target of just $40.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $695.3 million, earnings will come to $131.4 million, and it would be trading on a PE ratio of 12.0x, assuming you use a discount rate of 6.8%.

- Given the current share price of $37.97, the analyst price target of $44.6 is 14.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.