Key Takeaways

- Strategic collaborations with major pharmaceutical companies could significantly boost Compugen’s future revenue through milestone payments and potential royalties.

- Developing innovative treatments like COM701 and COM902 could open lucrative market opportunities and enhance revenue if they prove clinically successful.

- Limited cash runway and declining revenue could impair research funding and undermine financial stability, with reliance on partnerships adding revenue uncertainty.

Catalysts

About Compugen- A clinical-stage therapeutic discovery and development company, engages in the research, development, and commercialization of therapeutics and product candidates in Israel, the United States, and Europe.

- Compugen's advancement of COM701 as a maintenance treatment for platinum-sensitive ovarian cancer could open new market opportunities, potentially boosting future revenues if it demonstrates clinically meaningful benefits over current treatments.

- The initiation of an adaptive platform trial for COM701 in 2025, with an anticipated interim analysis by the second half of 2026, could accelerate regulatory discussions and future growth, impacting potential earnings positively.

- The favorable positioning of Compugen's COM902 within a less competitive landscape for Fc inactive TIGIT antibodies might lead to broader adoption if upcoming Phase III trials validate their benefits, which could enhance Compugen's revenue streams.

- Strategic partnerships with AstraZeneca and Gilead, indicated by milestone payments and potential future royalties, represent significant financial catalysts that could increase Compugen’s revenue in the upcoming years.

- Compugen's cash runway projected into 2027 provides the financial stability to continue investing in their clinical and research pipelines, potentially improving long-term margins and earnings with successful program advancements.

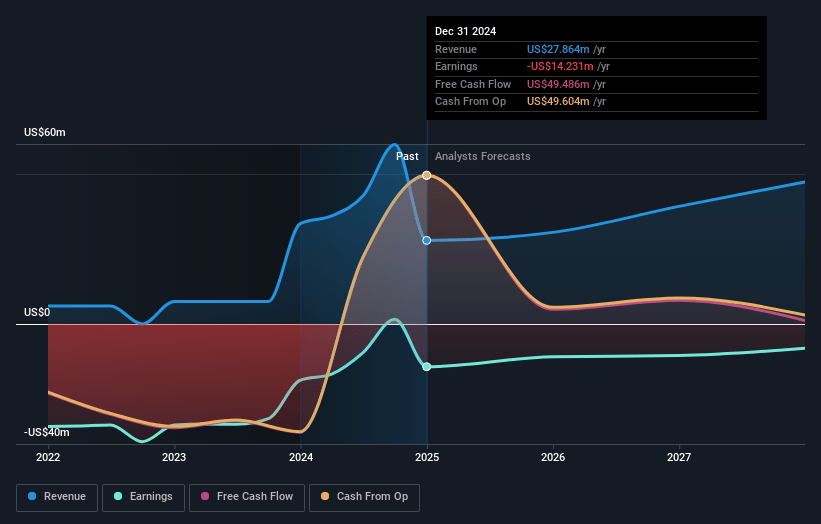

Compugen Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Compugen's revenue will grow by 19.4% annually over the next 3 years.

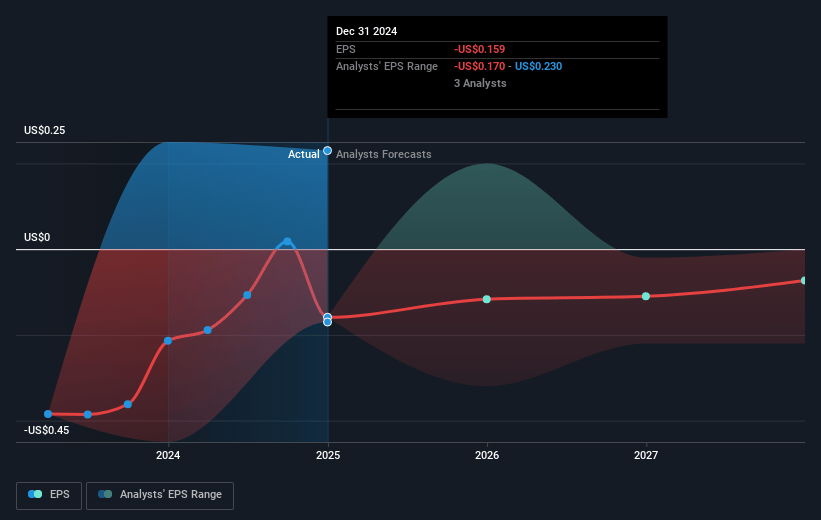

- Analysts are not forecasting that Compugen will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Compugen's profit margin will increase from -51.1% to the average US Biotechs industry of 15.9% in 3 years.

- If Compugen's profit margin were to converge on the industry average, you could expect earnings to reach $7.5 million (and earnings per share of $0.07) by about May 2028, up from $-14.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 71.5x on those 2028 earnings, up from -9.2x today. This future PE is greater than the current PE for the US Biotechs industry at 20.4x.

- Analysts expect the number of shares outstanding to grow by 4.48% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.25%, as per the Simply Wall St company report.

Compugen Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's cash runway is only expected to last into 2027, assuming no further cash inflows, which could limit its ability to finance ongoing and new research initiatives, potentially affecting future revenue and earnings.

- Revenues for 2024 were lower compared to the previous year ($27.9 million versus $33.5 million in 2023), indicating a decline in revenue generation which could impact net margins and financial stability.

- The skepticism surrounding the TIGIT antibody class following several setbacks, study, or program discontinuations could impact investor confidence and future revenue from related projects.

- The adaptive platform trial for COM701 in a relatively small patient population with a stratified randomization approach carries a risk of not demonstrating significant results, thus affecting the drug's potential market approval and subsequent revenue.

- Dependency on milestone payments and royalties from partners like AstraZeneca and Gilead introduces uncertainty in revenue predictions, especially if partnered products don't meet success expectations, impacting overall earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $4.0 for Compugen based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $47.4 million, earnings will come to $7.5 million, and it would be trading on a PE ratio of 71.5x, assuming you use a discount rate of 8.2%.

- Given the current share price of $1.4, the analyst price target of $4.0 is 65.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.