Narratives are currently in beta

Key Takeaways

- Expansion into new markets and software enhancement are poised to increase patient base and procedure volumes, driving revenue growth.

- Integration with Asteria Health and improved supply chain efficiencies are expected to enhance cost efficiencies and net margins.

- Temporary disruptions, small BioteRx contributions, external factors, and regulatory uncertainties pose risks to Biote's revenue and financial growth projections.

Catalysts

About biote- Operates in practice-building business within the hormone optimization space.

- Biote's enhancements to its Clinical Decision Support software and expansion in treatment options are expected to drive future growth by increasing procedure volumes and patient base, thus positively impacting revenue.

- The integration of Asteria Health is expected to improve cost efficiencies through vertical integration and supply chain management, leading to better net margins.

- BioteRx's expansion into more states and its comprehensive product offerings, including competitive GLP-1 weight loss products, are set to enhance long-term market opportunity, potentially driving revenue growth.

- The QuickStart program for practitioners aims to rapidly boost clinic performance, providing a path for more clinics to become top-tier, which is expected to support revenue and earnings growth.

- Continued improvements in the Amazon channel are anticipated to boost sales of dietary supplements, which should support revenue growth.

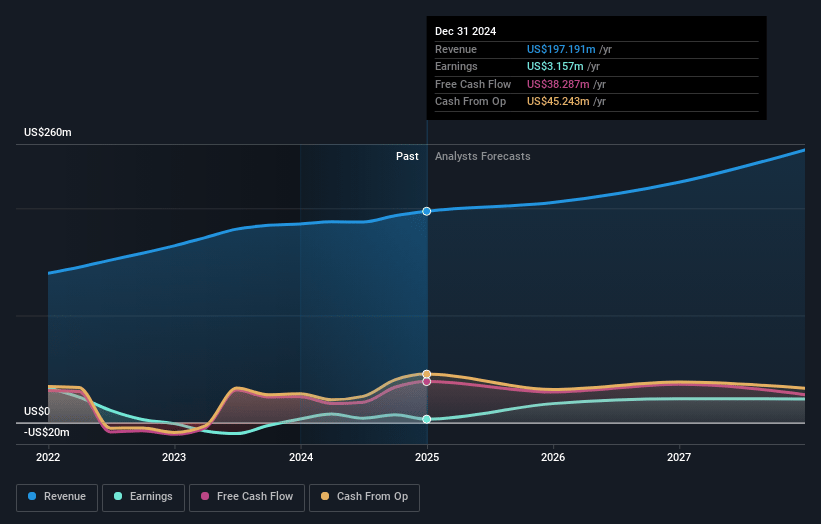

biote Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming biote's revenue will grow by 18.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.7% today to 11.4% in 3 years time.

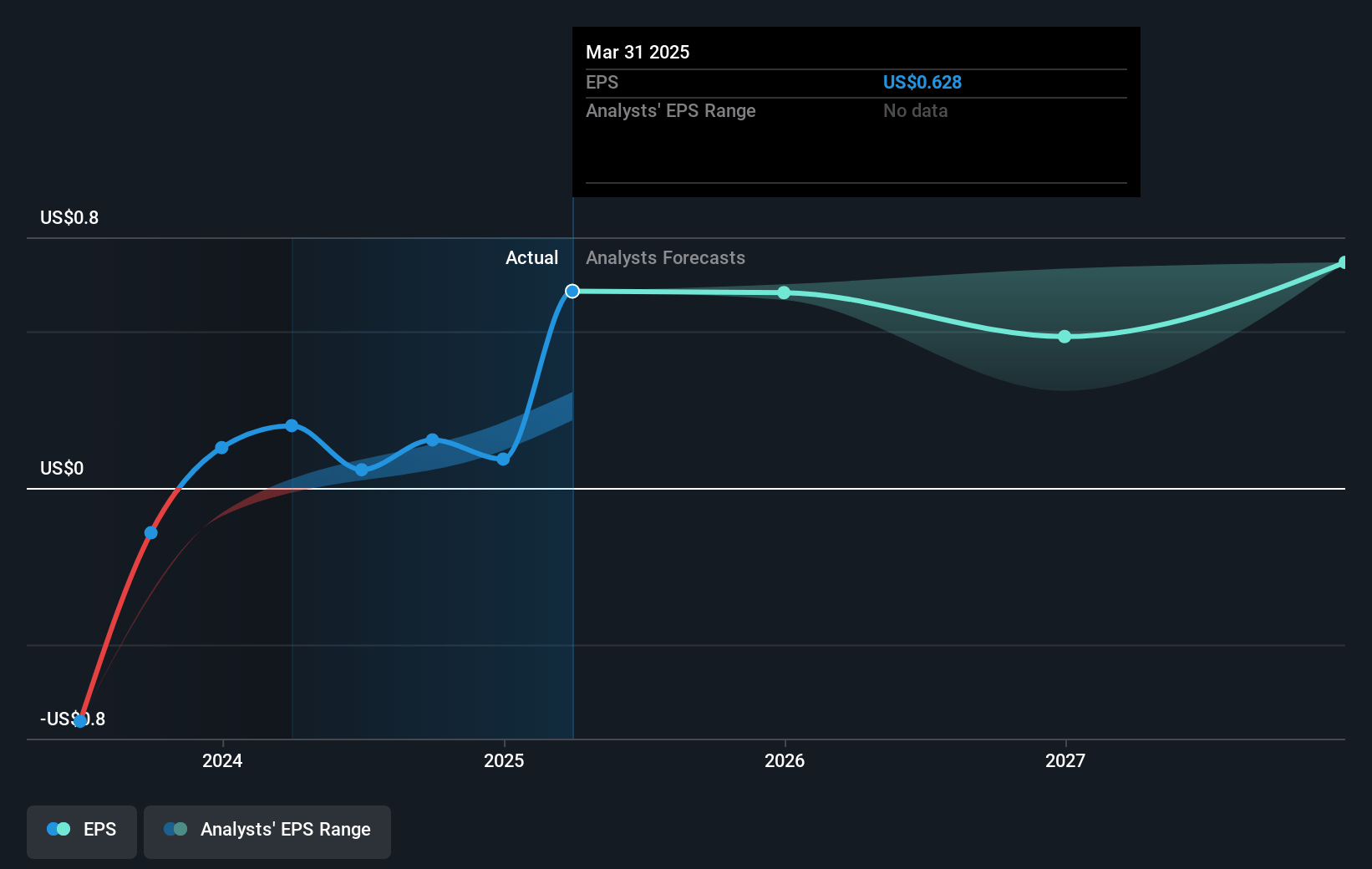

- Analysts expect earnings to reach $36.9 million (and earnings per share of $1.06) by about November 2027, up from $7.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.4x on those 2027 earnings, down from 26.2x today. This future PE is lower than the current PE for the US Pharmaceuticals industry at 19.9x.

- Analysts expect the number of shares outstanding to decline by 1.32% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.92%, as per the Simply Wall St company report.

biote Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Temporary disruptions in procedure volume due to adjustments needed for enhanced Clinical Decision Support software may impact revenue growth, as practitioners adapt to the workflow changes.

- The BioteRx program currently provides a relatively small contribution to direct revenue, which may affect overall revenue growth projections if the program does not scale as anticipated.

- External factors such as clinic closures caused by Hurricane Helene and other natural disasters can lead to shifts in procedure timing, potentially impacting short-term revenue and earnings.

- The company's reliance on expanding in regulated markets, such as obtaining additional state licenses for Asteria Health, creates uncertainty that could hinder expected revenue from vertical integration improvements.

- Adjusted financial guidance reflecting unexpected obstacles in the fourth quarter suggests potential risks to achieving prior revenue and EBITDA targets, impacting overall financial performance expectations.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $9.54 for biote based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $11.0, and the most bearish reporting a price target of just $8.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $324.2 million, earnings will come to $36.9 million, and it would be trading on a PE ratio of 10.4x, assuming you use a discount rate of 5.9%.

- Given the current share price of $6.06, the analyst's price target of $9.54 is 36.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives