Key Takeaways

- Expanded regulatory approvals and commercialization in 49 markets support future revenue growth, particularly through focused expansion in Europe and worldwide.

- Strong intellectual property and financial stability underpin strategic marketing, expected to enhance revenue and profitability, especially for VASCEPA in high-risk cardiovascular populations.

- Increased competition from generics and international challenges pressure Amarin's revenue and profitability, affecting market valuation and investor perception.

Catalysts

About Amarin- A pharmaceutical company, engages in the development and commercialization of therapeutics for the treatment of cardiovascular diseases in the United States, European countries, Canada, Lebanon, and the United Arab Emirates.

- Expanded global regulatory approvals and early stages of commercialization and reimbursement agreements in 49 markets set the stage for future revenue growth, particularly in Europe and the rest of the world, where the company is focused on accelerating its presence.

- Strong intellectual property position in Europe, extended through 2039, provides a longer runway for exclusivity, enhancing potential net margins and overall revenue from the VAZKEPA brand in the region.

- Strategic focus on launching VASCEPA in high-risk cardiovascular patient populations and securing public and private access is expected to significantly augment revenue in the European and emerging markets.

- Robust cash reserves and no debt provide a stable financial foundation to support strategic marketing and expansion initiatives, potentially improving operational efficiency and future profitability.

- Medical and scientific advocacy through continuous research and publications on the benefits and mechanisms of VASCEPA are expected to bolster demand and support pricing strategies, positively impacting future revenue growth and earnings.

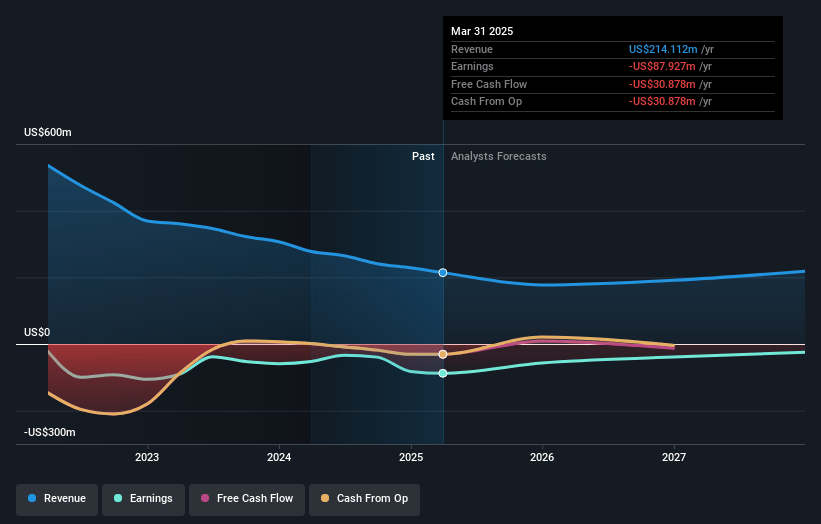

Amarin Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Amarin's revenue will decrease by 1.9% annually over the next 3 years.

- Analysts are not forecasting that Amarin will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Amarin's profit margin will increase from -35.9% to the average US Biotechs industry of 15.9% in 3 years.

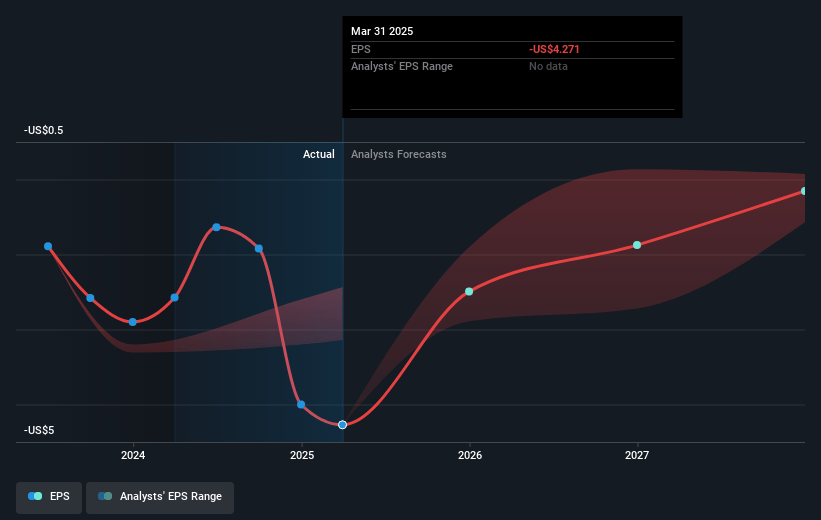

- If Amarin's profit margin were to converge on the industry average, you could expect earnings to reach $34.2 million (and earnings per share of $1.63) by about May 2028, up from $-82.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.2x on those 2028 earnings, up from -2.6x today. This future PE is lower than the current PE for the US Biotechs industry at 20.4x.

- Analysts expect the number of shares outstanding to grow by 0.81% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.17%, as per the Simply Wall St company report.

Amarin Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company faces increased competition and pricing pressure in the U.S. market due to generic VASCEPA, impacting net margins and revenue stability.

- Despite achieving revenues of over $200 million and maintaining a cash position of $300 million, the decline in U.S. product revenue reflects an ongoing challenge from generic competitors, which could further erode earnings.

- Amarin's financial results show a GAAP net loss of $48.6 million in Q4 2024 due to the introduction of generics, indicating ongoing pressure on profitability.

- While international partnerships are a focal point, the company faces challenges with public reimbursement and regulatory approval timelines outside the U.S., potentially limiting revenue growth in these markets.

- Maintaining its NASDAQ listing through an ADS ratio change implies challenges related to market valuation, which could affect investor perception and pressure financial performance.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $13.5 for Amarin based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $20.0, and the most bearish reporting a price target of just $7.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $215.6 million, earnings will come to $34.2 million, and it would be trading on a PE ratio of 10.2x, assuming you use a discount rate of 7.2%.

- Given the current share price of $10.33, the analyst price target of $13.5 is 23.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.