Key Takeaways

- Declining net prices and loss of exclusivity may reduce revenue and net margins despite anticipated volume increases.

- Increased R&D investment and acquisitions could weigh on earnings growth, offsetting short-term revenue gains.

- Amgen's growth in product sales, international market expansion, promising pipeline, and biosimilar introduction enhances revenue and profit prospects.

Catalysts

About Amgen- Amgen Inc. discovers, develops, manufactures, and delivers human therapeutics worldwide.

- Amgen anticipates challenges related to declining net prices and losses of exclusivity in the coming years, which can negatively impact revenue and place downward pressure on net margins as pricing pressures continue.

- The expected mid-single-digit decline in net price for Repatha in 2025 suggests potential stagnation in revenue growth, despite anticipated volume increases, which could compress net margins.

- Amgen's extensive investments in research and development, which increased 25% year-over-year, and the integration of acquired programs, may weigh on earnings growth, as increased expenditure could offset short-term revenue gains.

- The upcoming denosumab patent expiration poses a significant risk of market share loss to biosimilars, potentially leading to a notable reduction in revenue from this product line post-2025.

- Anticipated price declines across the portfolio during 2025, along with competitive pressures in various therapeutic areas, might limit revenue growth and negatively impact the company's ability to sustain high operating margins.

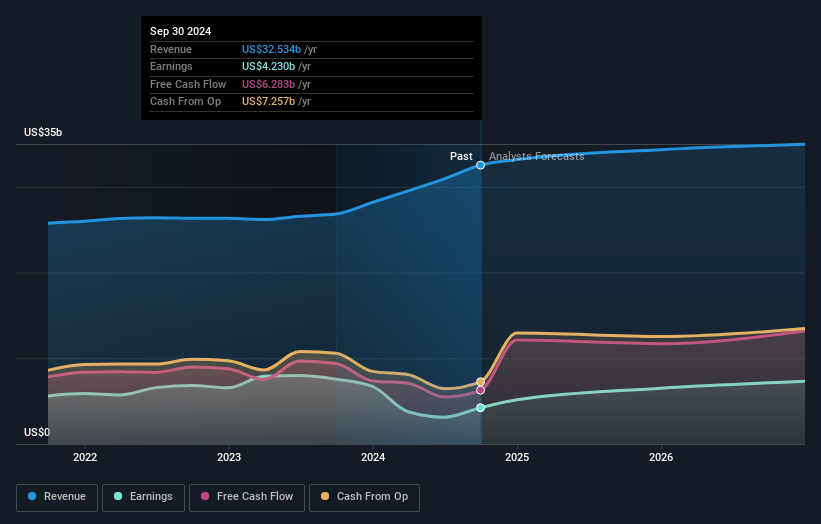

Amgen Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Amgen compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Amgen's revenue will decrease by 0.7% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 12.2% today to 21.8% in 3 years time.

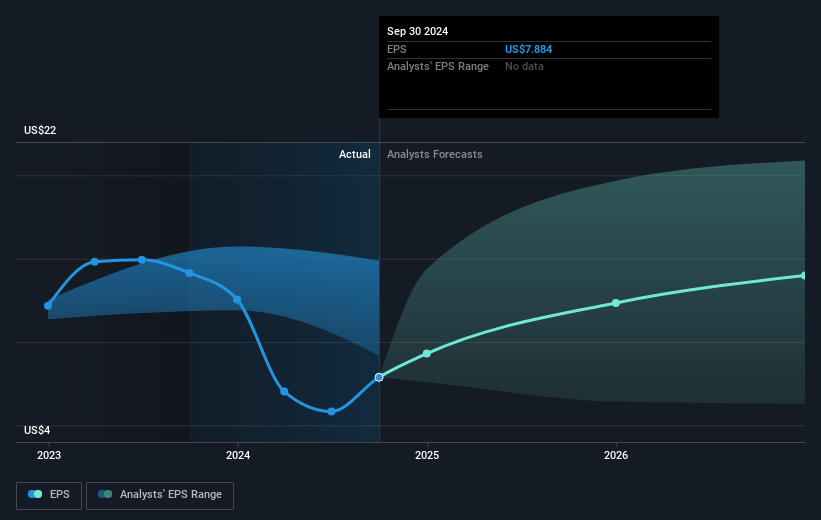

- The bearish analysts expect earnings to reach $7.4 billion (and earnings per share of $10.09) by about April 2028, up from $4.1 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 23.7x on those 2028 earnings, down from 38.2x today. This future PE is greater than the current PE for the US Biotechs industry at 19.3x.

- Analysts expect the number of shares outstanding to grow by 0.14% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.99%, as per the Simply Wall St company report.

Amgen Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Amgen's strong growth trajectory is evident in the 11% year-over-year increase in Q4 product sales and a full-year growth of 19%. This robust performance may signal continued strong revenue prospects.

- The company's focus on expanding its global reach, especially in growing markets with high unmet needs like Japan and China, enhances their potential to drive revenue growth internationally.

- Amgen is well-positioned with several medicines across key therapeutics areas, notably with Repatha and EVENITY demonstrating significant sales increases, which could maintain high net margins and robust earnings.

- The advancing pipeline with promising Phase III trials and the powerful development of AI-enabled efficiencies across their operations bode well for long-term earnings growth potential.

- Introduction of biosimilars such as PAVBLU and WEZLANA further solidifies the company’s position in the biosimilar segment with expectations of attractive returns, potentially boosting both revenue and profit margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Amgen is $266.95, which represents one standard deviation below the consensus price target of $317.64. This valuation is based on what can be assumed as the expectations of Amgen's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $408.0, and the most bearish reporting a price target of just $185.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $34.2 billion, earnings will come to $7.4 billion, and it would be trading on a PE ratio of 23.7x, assuming you use a discount rate of 7.0%.

- Given the current share price of $291.09, the bearish analyst price target of $266.95 is 9.0% lower. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystLowTarget holds no position in NasdaqGS:AMGN. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.