Last Update07 May 25Fair value Decreased 19%

AnalystLowTarget has decreased revenue growth from 19.7% to 15.3%, decreased profit margin from 8.7% to 2.9% and increased future PE multiple from 129.6x to 346.4x.

Read more...Key Takeaways

- Reliance on premium pricing, constrained reimbursement, and pipeline concentration exposes Alnylam to growth and earnings volatility amid evolving policy and competitive pressures.

- Elevated innovation and regulatory costs, plus intensified global market competition, may restrict profitability and challenge expansion outside core regions.

- Strong commercial execution, expanding pipeline, high market penetration, and disciplined management position Alnylam for sustained growth, diversification, and improving profitability.

Catalysts

About Alnylam Pharmaceuticals- Alnylam Pharmaceuticals, Inc. discovers, develops, and commercializes therapeutics based on ribonucleic acid interference.

- Projected revenue growth relies heavily on high pricing and broad reimbursement for therapies addressing rare diseases and newly expanded indications, but rising government cost-control measures, increased drug pricing scrutiny, and shifting health policy agendas could significantly cap top-line growth over the long term, especially as global payers prioritize affordability and limit premium price adoption.

- Alnylam remains exposed to pipeline concentration risk, with the majority of near-term and mid-term revenues dependent on its TTR franchise. Any adverse clinical developments, regulatory delays, or failures in securing new indications for key programs could lead to abrupt and lasting shortfalls in expected earnings and overall business stability.

- Even as the company seeks international geographic expansion, patient access to novel, high-cost drugs may become increasingly constrained by global socioeconomic factors and growing disparities in health insurance coverage. This could translate to muted worldwide demand and slow future revenue expansion, especially outside of core North American and Western European markets.

- Industry competition is evolving rapidly: increasing adoption of next-generation gene editing and oligonucleotide-based therapies from new and existing entrants will likely erode Alnylam’s competitive differentiation, limiting longer-term market share and putting downward pressure on net margins as price competition intensifies.

- Sustained high R&D expenses driven by an expanding and ambitious development pipeline, ongoing investment in novel RNAi delivery technologies, and mounting regulatory requirements may compress net earnings, restrict margin expansion, and challenge Alnylam’s ability to maintain its current trajectory of operating profit growth.

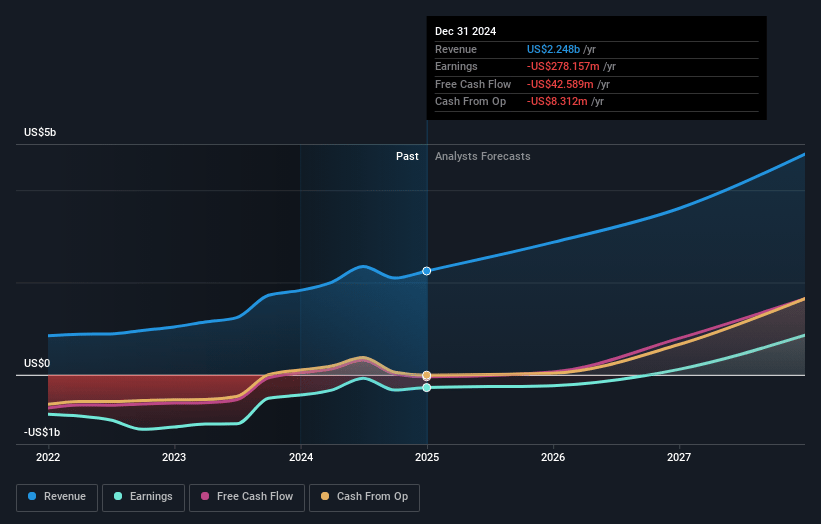

Alnylam Pharmaceuticals Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Alnylam Pharmaceuticals compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Alnylam Pharmaceuticals's revenue will grow by 15.3% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -11.5% today to 2.9% in 3 years time.

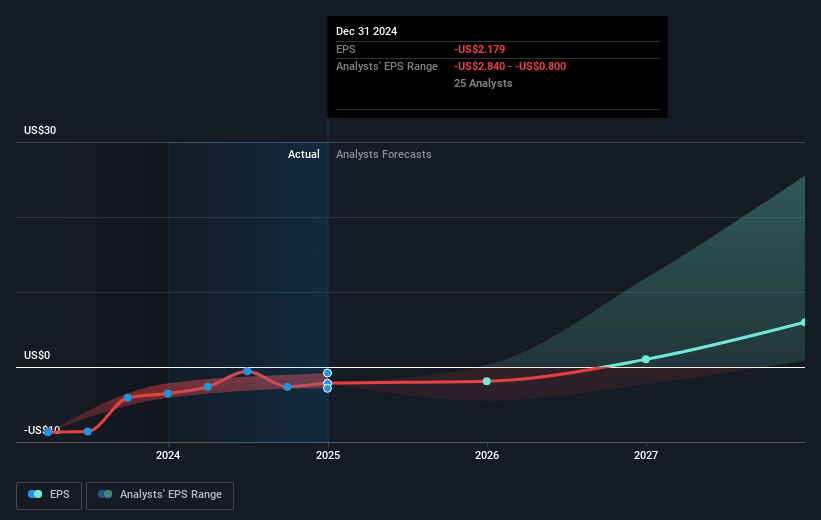

- The bearish analysts expect earnings to reach $104.4 million (and earnings per share of $0.74) by about May 2028, up from $-269.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 346.4x on those 2028 earnings, up from -129.3x today. This future PE is greater than the current PE for the US Biotechs industry at 17.1x.

- Analysts expect the number of shares outstanding to grow by 3.08% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.23%, as per the Simply Wall St company report.

Alnylam Pharmaceuticals Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Robust year-over-year revenue growth driven by Alnylam’s TTR franchise, with a reported 28% overall product revenue growth and 36% TTR franchise revenue growth, suggests significant ongoing commercial momentum and points to continued top-line revenue expansion.

- Early but strong uptake of AMVUTTRA for cardiomyopathy, rapid formulary inclusion across key health systems, and broad payer access, including high coverage with patients frequently paying zero copay, support accelerated adoption and improved future net revenues.

- The pipeline continues to expand with late-stage, high-value RNAi therapies addressing large markets such as type 2 diabetes and additional indications for ATTR, increasing the probability of further regulatory approvals, future diversification, and long-term earnings growth.

- Management expresses confidence in attaining sustainable non-GAAP profitability in 2025, underpinned by disciplined capital allocation and high gross margins, indicating the potential for sustained improvement in earnings and net margins moving forward.

- Accelerating category growth due to improved disease awareness, multiple drug approvals, and the untapped global addressable market (with around 80% of patients still untreated) creates a secular tailwind for Alnylam’s RNAi portfolio, supporting lasting expansion in revenue and profits.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Alnylam Pharmaceuticals is $212.45, which represents two standard deviations below the consensus price target of $320.56. This valuation is based on what can be assumed as the expectations of Alnylam Pharmaceuticals's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $500.0, and the most bearish reporting a price target of just $212.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $3.6 billion, earnings will come to $104.4 million, and it would be trading on a PE ratio of 346.4x, assuming you use a discount rate of 6.2%.

- Given the current share price of $267.55, the bearish analyst price target of $212.45 is 25.9% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.